Colliers International WA, LLC

11225 SE 6th St, Suite 240

Bellevue, WA 98004

Phone: 425-453-4545

Fax: 425-453-4540

© Commercial Brokers

Association

ALL RIGHTS RESERVED

Form: SUB_LS

Sublease Agreement

Rev. 9/2020

Page 1 of 20

Exhibit 10.16

|

Colliers International WA, LLC 11225 SE 6th St, Suite 240 Bellevue, WA 98004 Phone: 425-453-4545 Fax: 425-453-4540 |

© Commercial Brokers Association ALL RIGHTS RESERVED

Form: SUB_LS Sublease Agreement Rev. 9/2020 Page 1 of 20 |

|

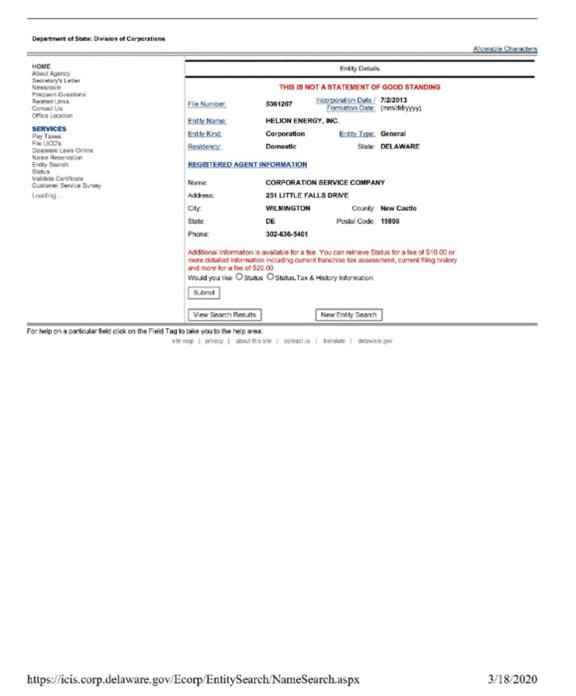

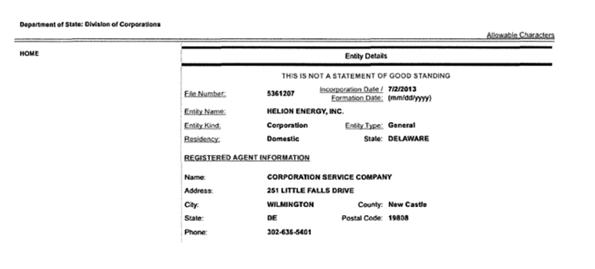

SUBLEASE AGREEMENT

THIS SUBLEASE AGREEMENT (“Sublease”) is entered and effective this 13 day of July, 20 23, by Helion Energy, Inc. __________, a(n) Delaware corporation (“Tenant”), and JDL Digital Systems, Inc., a(n) Washington corporation (“Subtenant”). Tenant entered into that certain lease agreement dated March 17, 2015, AND FURTHER AMENDED MAY 18, 2020 (FIRST AMENDMENT), APRIL 13, 2021 (SECOND AMENDMENT), JULY 28, 2021 (LANDLORD LETTER), AND APRIL 21, 2022 (THIRD AMENDMENT) COLLECTIVELY THE (“Master Lease”) with Kore Westpark LLC, a(n) Delaware limited liability company as landlord (“Landlord”), for the leased premises legally described in the attached Exhibit 1 (the “Master Premises”). The Master Premises is located in that certain building commonly known as 8210 154th Ave NE, Redmond, Washington 98052, located in Building A (the “Building”), and situated on real property legally described in the Master Lease (the “Property”). A copy of the Master Lease, including all amendments and addenda thereto, is attached as Exhibit 2.

Tenant and Subtenant agree as follows:

1. SUBLEASE SUMMARY.

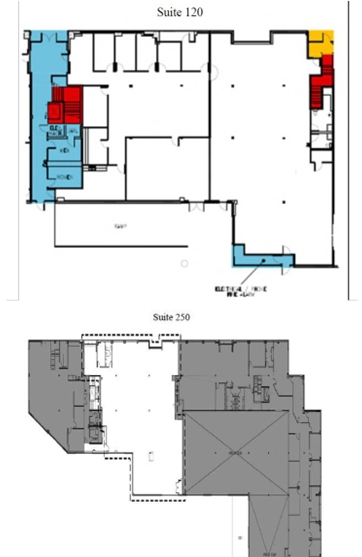

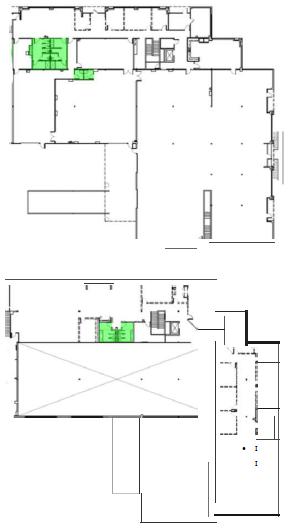

| a. | Subleased Premises. Tenant leases to Subtenant and Subtenant leases from Tenant that portion of the Master Premises (the “Subleased Premises”) consisting of an agreed area of 15,567 rentable square feet on the 1st and 2nd floor(s) of the Master Premises, as outlined on the floor plan attached as Exhibit 3 and commonly known as 8210 154th Ave NE 120 & 250, Redmond, WA 98052. |

| b. | Sublease Commencement Date. The term of this Sublease shall commence upon (check one): | |

☐ Substantial completion of (choose one) ☐ Tenant’s Work, or ☐ Subtenant’s Work as further described in the attached Exhibit 4 (“Work Letter”), but in no event later than________, 20 __

☒

SEE ADDENDUM/AMENDMENT TO CBA SUBLEASE ___________

(the “Sublease Commencement Date”). |

| c. | Sublease Termination Date. The term of this Sublease shall terminate at midnight on the last day of the July 31, 2024 full month following the Sublease Commencement Date, or one (1) day prior to the termination date of the Master Lease, whichever is earlier, unless sooner terminated in accordance with the terms of this Sublease (the “Sublease Termination Date”). Subtenant shall have no right or option to extend this Sublease. |

| d. | Base Rent. Subtenant shall pay to Tenant monthly base rent (check one): ☒ $ 25,000.00, or ☐ according to the Rent Rider attached hereto (“Base Rent). Rent shall be payable at Tenant’s address shown in Section 1(h) below, or such other place designated in writing by Tenant. | |

| e. | Prepaid Rent. Upon

execution of this Sublease, Subtenant shall deliver to Tenant the sum of $ 25,000.00 as prepaid rent to be applied to Rent

due for |

| f. | Security Deposit. Upon execution of this Sublease, Subtenant shall deliver to Tenant the sum of $ $25,000.00 to be held as a security deposit pursuant to Section 5 below. The security deposit shall be in the form of (check one): ☒ cash, check or wire transfer, or ☐ letter of credit according to the Letter of Credit Rider (CBA Form LCR) attached hereto. |

| g. | Permitted Use. The Subleased Premises shall be used only for Executive, general, administrative offices and warehousing, and any legally permissible use, subject to the Master Lease, applicable zoning, and other laws, and for no other purpose without the prior written consent of Tenant (the “Permitted Use”). |

| h. | Notice and Payment Addresses: Tenant: |

|

Colliers International WA, LLC 11225 SE 6th St, Suite 240 Bellevue, WA 98004 Phone: 425-453-4545 Fax: 425-453-4540 |

© Commercial Brokers Association ALL RIGHTS RESERVED

Form: SUB_LS Sublease Agreement Rev. 9/2020 Page 2 of 20 |

|

SUBLEASE AGREEMENT

Helion Energy, Inc.

1415 75th Street SW, Everett, WA 98203

Email:

Subtenant:

JDL Digital Systems, Inc.

Email:

| i. | Subtenant’s Sublease Share. Subtenant’s Sublease Share of any operating costs, common area charges, additional rent, or other amounts payable by Tenant under the Master Lease is 0 % of such amounts, based upon the ratio of the rentable area of the Subleased Premises to the rentable area of the Master Premises. |

| 2. | PREMISES. |

| a. | Lease of Premises. Tenant leases to Subtenant, and Subtenant leases from Tenant the Subleased Premises upon the terms specified in this Sublease. |

| b. | Acceptance of Premises. Except as specified elsewhere in this Sublease, Tenant makes no representations or warranties to Subtenant regarding the Subleased Premises, including the structural condition of the Subleased Premises or the condition of all mechanical, electrical, and other systems on the Subleased Premises. Except for any subtenant improvements to be completed by Tenant as described in the Work Letter attached as Exhibit 4 (“Tenant’s Work”), Subtenant shall accept the Subleased Premises and its appurtenances in their respective AS-IS, WHERE-IS condition, and shall further be responsible for performing any work necessary to bring the Subleased Premises into a condition satisfactory to Subtenant. By signing this Sublease, Subtenant acknowledges that it has had adequate opportunity to investigate the Subleased Premises, acknowledges responsibility for making any corrections, alterations and repairs to the Subleased Premises (other than Tenant’s Work), and acknowledges that the time needed to complete any such items shall not delay the Sublease Commencement Date. |

| c. | Subtenant Improvements. The Work Letter attached as Exhibit 4 sets forth all of Tenant’s Work, if any, and all improvements to be completed by Subtenant ( “Subtenant’s Work”), if any, that will be performed on the Subleased Premises. Responsibility for design, payment and performance of all such work shall be as set forth in the Work Letter. |

| 3. | TERM. The term of this Sublease shall commence on the Commencement Date and shall end on the Termination Date (the “Term”). |

| a. | Early Possession. Subtenant acknowledges that Tenant may need to obtain Landlord’s consent to this Sublease as provided in Sections 21 and 24 of this Sublease prior to Subtenant occupying the Subleased Premises, and that Subtenant shall not occupy the Subleased Premises without the prior written consent of Tenant. In the event Tenant gives Subtenant access to the Premises preceding the Sublease Commencement Date for the purpose of installing Subtenant’s furniture, telecommunications, fixtures, telephone systems and computer cabling and the performance of Subtenant’s Work, if any, such access shall be fully coordinated with Tenant in advance and Subtenant shall not interfere with Tenant’s Work. All of the terms and conditions of this Sublease, including Subtenant’s insurance and indemnification obligations, shall apply during such time, except for payment of Base Rent. If Subtenant occupies the Subleased Premises before the Sublease Commencement Date specified in Section 1, then such date of occupancy shall not advance the Sublease Commencement Date or Sublease Termination Date set forth above. |

|

Colliers International WA, LLC 11225 SE 6th St, Suite 240 Bellevue, WA 98004 Phone: 425-453-4545 Fax: 425-453-4540 |

© Commercial Brokers Association ALL RIGHTS RESERVED

Form: SUB_LS Sublease Agreement Rev. 9/2020 Page 3 of 20 |

|

SUBLEASE AGREEMENT

| b. | Delayed Possession. Tenant shall act diligently to make the Subleased Premises available to Subtenant, provided, however, that neither Tenant nor any agent or employee of Tenant shall be liable for any damage or loss due to Tenant’s inability or failure to deliver possession of the Premises to Subtenant as provided in this Sublease. If possession is delayed, the Sublease Commencement Date set forth in Section 1 shall also be delayed, but the Sublease Termination Date shall not be extended by such delay. If Tenant has not delivered possession of the Subleased Premises to Subtenant within___________days ((60) days if not filled in) after the Sublease Commencement Date specified in Section 1 (check one): ☐ Subtenant may elect to cancel this Sublease by giving written notice to Tenant no later than__________((10) days if not filled in) after such time period ends, or ☒ then all Base Rent and Additional Rent (as defined below) shall be abated for each one (1) day after the Sublease Commencement Date during which possession of the Subleased Premises has not been delivered to Subtenant. If Subtenant gives notice of cancellation, as Subtenant’s sole and exclusive remedy, this Sublease shall be cancelled, all prepaid rent and security deposits shall be refunded to Subtenant, and neither Tenant nor Subtenant shall have any further obligations to the other. |

Notwithstanding anything in this Section 3 to the contrary, to the extent that any portions of the Tenant’s Work or the Subtenant’s Work have not been completed in time for the Subtenant to occupy or take possession of the Subleased Premises on the Sublease Commencement Date due to the failure of Subtenant to fulfill any of its obligations under this Sublease (“Subtenant Delays”), the Sublease shall nevertheless commence on the Sublease Commencement Date, including without limitation, Subtenant’s obligation to pay Base Rent and Additional Rent, as set forth in Section 1, or upon the date that the Sublease Commencement Date would have occurred but for the Subtenant Delays.

| 4. | RENT. |

| a. | Payment of Rent. Subtenant shall pay Tenant without notice, demand, deduction or offset, in lawful money of the United States, the monthly Base Rent stated in Section 1 in advance on or before the first day of each month during the Sublease Term beginning on (check one): ☒ the Sublease Commencement Date, or ☐ ______ (if no date specified, then on the Sublease Commencement Date), and any other additional payments due to Tenant (“Additional Rent”, and together with Base Rent, the “Rent”) when required under this Sublease. Payments for any partial month during the Term shall be prorated. All payments due to Tenant under this Sublease, including late fees and interest, shall also constitute Additional Rent, and upon Subtenant’s failure to pay any such costs, charges or expenses, Tenant shall have the same rights and remedies as otherwise provided in this Sublease for the failure of Subtenant to pay Rent. | |

| b. | Late Charges; Default Interest. If any sums payable by Subtenant to Tenant under this Sublease are not received within five (5) days of their due date, Subtenant shall pay Tenant an amount equal to the sum which would be payable by Tenant to the Landlord for an equivalent default under the Master Lease or 5% of the delinquent amount for the cost of collecting and handling such late payment in addition to the amount due and as Additional Rent, whichever is greater. All delinquent sums not paid by Subtenant within five (5) business days of the due date shall, at Tenant’s option, bear interest at the rate the Tenant would pay the Landlord under the Master Lease for an equivalent default or the highest rate of interest allowable by law, whichever is less. Interest on all delinquent amounts shall be calculated from the original due date to the date of payment. | |

| c. | Less Than Full Payment. Tenant’s acceptance of less than the full amount of any payment due from Subtenant shall not be deemed an accord and satisfaction or compromise of such payment unless Tenant specifically consents in writing to payment of such lesser sum as an accord and satisfaction or compromise of the amount which Tenant claims. Any portion that remains to be paid by Tenant shall be subject to the late charges and default interest provisions of this Section. |

|

Colliers International WA, LLC 11225 SE 6th St, Suite 240 Bellevue, WA 98004 Phone: 425-453-4545 Fax: 425-453-4540 |

© Commercial Brokers Association ALL RIGHTS RESERVED

Form: SUB_LS Sublease Agreement Rev. 9/2020 Page 4 of 20 |

|

SUBLEASE AGREEMENT

| 5. | SECURITY DEPOSIT. Upon execution of this Sublease, Subtenant shall deliver to Tenant the security deposit specified in Section 1 above. Tenant’s obligations with respect to the security deposit are those of a debtor and not of a trustee, and Tenant may commingle the security deposit with its other funds. If Subtenant defaults in the performance of any covenant or condition of this Sublease, Tenant shall have the right, but not the obligation, to use or retain all or any portion of the security deposit for the payment of: (i) Base Rent, Additional Rent, or any other sum as to which Subtenant is in default; or (ii) the amount Tenant spends or may become obligated to spend, or to compensate Tenant for any losses incurred by reason of Subtenant’s default. Subtenant acknowledges, however, that the security deposit shall not be considered as a measure of Subtenant’s damages in case of default by Subtenant, and any payment to Tenant from the security deposit shall not be construed as a payment of liquidated damages for Subtenant’s default. If at any time during the Term of the Sublease the security deposit delivered by Subtenant becomes insufficient to cover the amounts required under this Section 5, whether or not due to Tenant’s application of all or a portion of the security deposit contemplated by this Section, Subtenant shall, within five (5) days after written demand therefore by Tenant, deposit with Tenant an amount sufficient to replenish the security deposit to the amount required in Section 1 above. If Subtenant is not in default of any covenant or condition of this Sublease at the end of the Term, Tenant shall return any unused portion of the security deposit without interest within 30 days after the surrender of the Subleased Premises by Subtenant in the condition required by Section 9 of this Sublease. |

| 6. | MASTER LEASE. Tenant represents to Subtenant that as of the effective date of this Sublease: (a) Tenant has delivered to Subtenant a complete copy of the Master Lease (which may contain redacted business terms), which represents all agreements between Landlord and Tenant relating to the leasing, use, and occupancy of the Subleased Premises, and (b) Tenant has not received notice of an uncured breach or default from Landlord under the Master Lease. Tenant shall not agree to an amendment to the Master Lease which would have an adverse effect on Subtenant’s occupancy of the Subleased Premises or its intended use of the Subleased Premises, without obtaining Subtenant’s prior written consent, which consent shall not be unreasonably withheld, conditioned, or delayed. Subtenant represents that it has read and is familiar with the terms of the Master Lease. |

This Sublease is subject to and subordinate to the Master Lease. If the Master Lease terminates, this Sublease shall automatically terminate. Tenant and Subtenant shall not, by their omission or act, do or permit anything to be done which would cause a default under the Master Lease. If the Master Lease terminates or is forfeited as a result of a default or breach by Tenant or Subtenant under this Sublease and/or the Master Lease, then the defaulting party shall be liable to the non-defaulting party for the damage suffered as a result of such termination or forfeiture. Tenant shall exercise diligent, commercially reasonable efforts to cause Landlord to perform its obligations under the Master Lease for the benefit of the Subtenant.

All the terms, covenants and conditions contained in the Master Lease are incorporated into and made a part of this Sublease by this reference as if Tenant were the landlord under the Master Lease, the Subtenant were the tenant under the Master Lease, and the Subleased Premises were the Master Premises, except as may be inconsistent with the terms contained in this Sublease and except for the following: Subtenant shall be responsible for all utilities and services used by Subtenant in the Subleased Premises to the extent not already provided by and/or billed by Landlord. Subtenant shall not be responsible for any additional rent or operating costs billed as additional rent by the Master Lease. (none if not specified).

| 7. | ADDITIONAL CHARGES. If Tenant shall be charged for additional rent or other sums pursuant to the provisions of the Master Lease, Subtenant shall be liable for its Sublease Share, as stated in Section 1 above, of such additional rent or sums, including without limitation, payments for taxes, common area charges, utilities and services, and operating costs. Subtenant shall be responsible for determining the availability of utilities and for determining the adequacy of their capacities for Subtenant’s needs. Subtenant shall install and connect, as necessary, and directly pay for all water, sewer, gas, janitorial, electricity, garbage removal, heat, telephone, Internet, cable services, and other utilities and services used by Subtenant at the Subleased Premises during the Term to the extent not already provided by and/or billed by Tenant or Landlord. Notwithstanding the foregoing, if Subtenant’s use of the Premises incurs utility service charges which are above those usual and customary for the Permitted Use, Tenant reserves the right to require Subtenant to pay a reasonable additional charge for such usage. If Subtenant shall procure any additional service for the Subleased Premises, including but not limited to after-hours HVAC services, Subtenant shall pay for same at the rates charged by Landlord and shall make such payment to Tenant or to Landlord, as Tenant shall direct. Any sums payable by Subtenant under this Section shall constitute Additional Rent and shall be paid to Tenant no later than five (5) days before they are due from Tenant to Landlord under the Master Lease. If Tenant shall receive any refund for Additional Rent or sums paid under the Master Lease, then, to the extent such refund relates to time periods falling within the Term of this Sublease, Subtenant shall receive a refund proportionate to the amounts previously paid by Subtenant for the same. Tenant shall, upon request by Subtenant, furnish Subtenant with copies of all statements received from Landlord of actual or estimated Additional Rent or other sums charged under the Master Lease. |

|

Colliers International WA, LLC 11225 SE 6th St, Suite 240 Bellevue, WA 98004 Phone: 425-453-4545 Fax: 425-453-4540 |

© Commercial Brokers Association ALL RIGHTS RESERVED

Form: SUB_LS Sublease Agreement Rev. 9/2020 Page 5 of 20 |

|

SUBLEASE AGREEMENT

Notwithstanding anything in this Sublease to the contrary, the only services or utilities to which Subtenant is entitled under this Sublease are those to which Tenant is entitled under the Master Lease.

| 8. | ALTERATIONS. Subtenant may make alterations, additions or improvements to the Subleased Premises(the “Alterations”), only with the prior written consent of Tenant and, to the extent required by the Master Lease, Landlord. The term “Alterations” shall not include: (i) any of Subtenant’s Work approved by Tenant pursuant to Exhibit 4, and (ii)the installation of shelves, movable partitions, or Subtenant’s equipment and trade fixtures, which may be installed and removed without damaging existing improvements or the structural integrity of the Subleased Premises, Master Premises, Building, or Property, and Tenant’s consent shall not be required for Subtenant’s installation of those items except to the extent Tenant must obtain the consent of Landlord under the Master Lease for such installations. Subtenant shall perform all work within the Subleased Premises at Subtenant’s expense in compliance with all applicable laws and shall complete all Alterations in accordance with plans and specifications approved by Tenant, using contractors approved by Tenant, and in a manner so as to not unreasonably interfere with other tenants. Subtenant shall pay when due, all claims for labor or materials furnished to or for Subtenant at or for use in the Subleased Premises, which claims are or may be secured by any mechanics’ or materialmens’ liens against the Subleased Premises or Property or any interest therein. Except as otherwise provided in the Work Letter attached as Exhibit 4 with respect to Subtenant’s Work, Subtenant shall remove all Alterations at the end of the Sublease term unless Tenant conditioned its consent upon Subtenant leaving a specified Alteration at the Subleased Premises, in which case Subtenant shall not remove such Alteration and it shall become Tenant’s property. Subtenant shall immediately repair any damage to the Subleased Premises or adjacent portions of the Master Premises, Building and Property caused by installation and/or removal of improvements performed as part of Subtenant’s Work and/or Alterations. |

| 9. | REPAIRS AND MAINTENANCE; SURRENDER. Subtenant shall, at its sole cost and expense, maintain the Subleased Premises in good condition and promptly make all repairs and replacements, whether structural or non-structural, necessary to keep the Subleased Premises safe and in good condition, including all utilities and other systems serving the Subleased Premises. Subtenant shall not damage any demising wall or disturb the structural integrity of the Subleased Premises and shall promptly repair any damage or injury done to any such demising walls or structural elements caused by Subtenant or its employees, officers, agents, servants, contractors, customers, clients, visitors, guests, or other licensees or invitees. If Subtenant fails to maintain or repair the Subleased Premises, Tenant may enter the Subleased Premises and perform such repair or maintenance on behalf of Subtenant. In such case, Subtenant shall be obligated to pay to Tenant immediately upon receipt of demand for payment, as Additional Rent, all costs incurred by Tenant in performing such repair or maintenance on behalf of Subtenant. Subtenant shall be obligated to repair or maintain only those portions of the Subleased Premises as required of Tenant under the Master Lease. Tenant shall not be required to perform any maintenance, repairs, or improvements that are the obligation of Landlord under the Master Lease (provided that Tenant shall exercise diligent, commercially reasonable efforts to cause Landlord to perform its obligations under the Master Lease for the benefit of the Subtenant) or to make any changes to the Subleased Premises because of the enactment of any law, ordinance, regulation, order or code during the Term. Notwithstanding anything in this Section to the contrary, Subtenant shall not be responsible for any repairs to the Subleased Premises made necessary by the acts of Tenant, Landlord, or their respective employees, officers, agents, servants, contractors, customers, clients, visitors, guests, or other licensees or invitees. |

Upon expiration or earlier termination of the Term, Subtenant shall promptly and peacefully surrender the Subleased Premises to Tenant, together with all keys, in as good condition as when received by Subtenant or as thereafter improved (but subject to any obligations to remove any Subtenant’s Work and Alterations and/or to restore the same as provided elsewhere in this Sublease), reasonable wear and tear and insured casualty excepted.

|

Colliers International WA, LLC 11225 SE 6th St, Suite 240 Bellevue, WA 98004 Phone: 425-453-4545 Fax: 425-453-4540 |

© Commercial Brokers Association ALL RIGHTS RESERVED

Form: SUB_LS Sublease Agreement Rev. 9/2020 Page 6 of 20 |

|

SUBLEASE AGREEMENT

| 0. | ACCESS AND RIGHT OF ENTRY. After reasonable notice from Tenant (except in cases of emergency, where no notice is required), Subtenant shall permit Tenant and/or Landlord and their respective agents, employees and contractors to enter the Subleased Premises at reasonable times to make repairs, alterations, improvements or inspections. This Section shall not impose any repair or other obligation upon Tenant or Landlord not expressly stated elsewhere in this Sublease. After reasonable notice to Subtenant, each of Tenant and Landlord, as the case may be, shall have the right to enter the Subleased Premises for the purpose of (a) showing the Subleased Premises to prospective purchasers or lenders at any time, and to prospective tenants within 180 days prior to the expiration or sooner termination of the Term; and (b) posting “for lease” signs within 180 days prior to the expiration or sooner termination of the Term. |

| 1. | DESTRUCTION OR CONDEMNATION. |

| a. | Damage and Repair. If either Landlord or Tenant terminates the Master Lease as a result of condemnation of or casualty to the Subleased Premises, Master Premises, or Building or Property in accordance with the Master Lease, this Sublease shall terminate on the same date and in accordance therewith. If the Subleased Premises or the portion of the Building or Property reasonably necessary for Subtenant’s occupancy are damaged, destroyed or rendered untenantable, by fire or other casualty, Tenant may, at its option: (a) terminate this Sublease, or (b) restore (or cause Subtenant to restore) the Subleased Premises and the portion of the Building and Property reasonably necessary for Subtenant’s occupancy to the same or substantially similar condition that existed before the casualty event. Provided, however, if such casualty event occurs during the last six (6) months of the Term, then either Subtenant or Tenant may elect to terminate this Sublease. If, within 60 days after Tenant’s receipt of written notice from Subtenant that Subtenant deems the Subleased Premises or the portion of the Property reasonably necessary for Subtenant’s occupancy untenantable, Tenant fails to notify Subtenant of its election to restore those areas, or if Tenant is unable to restore those areas which Tenant is expressly required hereunder to restore within six (6) months of the date of the casualty event, then Subtenant may elect to terminate this Sublease by written notice given to Tenant at any time prior to the date on which Tenant substantially completes restoration of those areas which it is required hereunder to restore. |

If Tenant restores the Subleased Premises or the Property as provided under this Section, Tenant shall proceed with reasonable diligence to complete the work, and Base Rent shall be abated in the same proportion as the untenantable portion of the Subleased Premises bears to the whole Subleased Premises, provided that there shall be a Base Rent abatement only if the damage or destruction of the Subleased Premises or the Property did not result from, or was not contributed to directly or indirectly by, the act, fault or neglect of Subtenant or Subtenant’s employees, officers, agents, servants, contractors, customers, clients, visitors, guests, or other licensees or invitees. No damages, compensation or claim shall be payable by Tenant for Subtenant’s inconvenience, loss of business or annoyance directly, incidentally or consequentially arising from any repair or restoration of any portion of the Subleased Premises, Master Premises, Building, or Property. Tenant shall have no obligation to carry insurance of any kind for the protection of Subtenant or any Alterations or improvements paid for or installed by or on behalf of Subtenant; any Tenant’s Work or Subtenant’s Work identified in Exhibit 4 (regardless of who may have completed them); Subtenant’s furniture; or on any fixtures, equipment, improvements or appurtenances of Subtenant under this Sublease; and Tenant shall not be obligated to repair any damage thereto or replace the same unless the damage is caused by Tenant’s negligence.

| b. | Condemnation. If either Landlord or Tenant terminates the Master Lease based on any provision in the Master Lease relating to eminent domain or conveyance under threat of condemnation, this Sublease shall terminate on the same date and in accordance therewith. If the Subleased Premises, the portion of the Building or Property reasonably necessary for Subtenant’s occupancy, or 50% or more of the total rentable area of the Property are made untenantable by eminent domain, or conveyed under a threat of condemnation, this Sublease shall terminate at the option of each of Tenant and Subtenant as of the earlier of the date title vests in the condemning authority or the condemning authority first has possession of the portion of the Property taken by the condemning authority. All Rent and other payments required under this Sublease shall be paid to that date. |

|

Colliers International WA, LLC 11225 SE 6th St, Suite 240 Bellevue, WA 98004 Phone: 425-453-4545 Fax: 425-453-4540 |

© Commercial Brokers Association ALL RIGHTS RESERVED

Form: SUB_LS Sublease Agreement Rev. 9/2020 Page 7 of 20 |

|

SUBLEASE AGREEMENT

If the condemning authority takes a portion of the Subleased Premises or the portion of the Property necessary for Subtenant’s occupancy that does not render them untenantable, then this Sublease shall continue in full force and effect and the Base Rent shall be equitably reduced based on the proportion by which the floor area of the Subleased Premises is reduced. The reduction in Base Rent shall be effective on the earlier of the date the condemning authority first has possession of such portion or title vests in the condemning authority. The Subleased Premises or the portion of the property reasonably necessary for Subtenant’s occupancy shall not be deemed untenantable if 25% or less of each of those areas is condemned. As between Tenant and Subtenant, Tenant shall be entitled to the entire award from the condemning authority attributable to the value of the Master Premises, Subleased Premises, or the Property or Building, and Subtenant shall make no claim for the value of its subleasehold estate or the Subtenant’s Work or any Alterations. Subtenant shall be permitted to make a separate claim against the condemning authority for moving expenses or damages resulting from interruption in its business if this Sublease is terminated under this Section, provided that in no event shall Subtenant’s claim reduce Landlord’s or Tenant’s awards.

| 12. | INSURANCE. Subtenant shall procure and maintain, at its sole cost and expense, such liability insurance as is required to be carried by Tenant under the Master Lease, including, without limitation, obtaining additional insured endorsement(s) naming Tenant and Landlord as additional insureds, in the manner required therein, and property insurance as is required to be carried by Tenant under the Master Lease to the extent property insurance pertains to the Subleased Premises. If the Master Lease requires Tenant to insure leasehold improvements or Alterations, then Subtenant shall insure the leasehold improvements which are located in the Subleased Premises, as well as the Tenant’s Work and Subtenant’s Work, and any Alterations in the Subleased Premises performed by or on behalf of Subtenant. Subtenant shall furnish to Tenant certificates of Subtenant’s insurance policies and copies of any endorsements required hereunder not later than 10 days prior to Subtenant’s taking possession of the Subleased Premises. Tenant shall carry insurance as required by the Master Lease and shall not be obligated to carry property or liability insurance to the extent such insurance is an obligation of Landlord under the Master Lease. |

Tenant and Subtenant hereby release each other and their respective employees, officers, agents, servants, contractors, customers, clients, visitors, guests, or other licensees or invitees, from responsibility for and waive their respective claims for recovery of any loss or damage arising from any cause covered by insurance required to be carried by each of them. Each party shall provide notice to the insurance carrier or carriers of this mutual waiver of subrogation, and shall cause its respective insurance carriers to waive all rights of subrogation against the other. This waiver shall not apply to the extent of the deductible amounts to any such policies or to the extent of liability exceeding the limits of such policies. Tenant agrees to use reasonable efforts to obtain from Landlord for the benefit of Subtenant the same waiver of claims for any loss or damage arising from any cause covered by insurance required to be carried by Landlord under the Master Lease and, if and to the extent of such waiver received from Landlord, Subtenant agrees to grant the same waiver to Landlord.

| 13. | ASSIGNMENT AND SUBLETTING. Subtenant shall not assign, sublet, mortgage, encumber or otherwise transfer any interest in this Sublease or any part of the Subleased Premises (collectively referred to as a “Transfer”), without first obtaining the written consent of Tenant, which shall not be unreasonably withheld or delayed. Tenant may condition its consent on (a) obtaining any required consent from Landlord; (b) Subtenant satisfying any conditions to the Transfer imposed by Landlord and/or required to be satisfied by Tenant under the Master Lease; and (c) such other reasonable conditions that Tenant may impose. No Transfer shall relieve Subtenant of any liability under this Sublease notwithstanding Tenant’s consent to such Transfer. Consent to any Transfer shall not operate as a waiver of the necessity for Tenant’s consent to any subsequent Transfer. In connection with each request for consent to a Transfer, Subtenant shall pay the reasonable cost of processing same, including attorneys’ fees and any cost charged by Landlord for granting its consent under the Master Lease, upon demand of Tenant. |

Any transfer of this Sublease by merger, consolidation, redemption or liquidation of Subtenant, or any change in the ownership of, or power to vote, which singularly or collectively represents a majority of the beneficial interest in Subtenant, shall constitute a Transfer.

|

Colliers International WA, LLC 11225 SE 6th St, Suite 240 Bellevue, WA 98004 Phone: 425-453-4545 Fax: 425-453-4540 |

© Commercial Brokers Association ALL RIGHTS RESERVED

Form: SUB_LS Sublease Agreement Rev. 9/2020 Page 8 of 20 |

|

SUBLEASE AGREEMENT

As a condition to the Landlord’s and Tenant’s approval, if given, any potential assignee or sublessee otherwise approved shall assume all obligations of Subtenant under this Sublease and shall be jointly and severally liable with Subtenant and any guarantor for the payment of Rent and other charges due hereunder and performance of all obligations of Subtenant under this Sublease. In connection with any Transfer, Subtenant shall provide Landlord and Tenant with copies of all assignments, subleases and assumption agreements and related documents.

| 14. | MORTGAGE SUBORDINATION AND ATTORNMENT. This Sublease shall automatically be subordinate to any mortgage or deed of trust created by Landlord to the extent the Master Lease is subordinate to the same mortgage or deed of trust, and Subtenant shall attorn upon the same terms and conditions as the Tenant in the Master Lease, provided Subtenant shall enjoy the terms and conditions relating to such subordination and attornment to the same extent as Tenant under the terms of the Master Lease. |

| 15. | HOLDOVER. If Subtenant shall, without the written consent of Tenant, remain in possession of the Subleased Premises and shall fail to return the Subleased Premises to Tenant after the expiration or termination of the Sublease, the tenancy shall be a holdover tenancy at sufferance, which may be terminated in accordance with Washington law; provided that, upon expiration of the Master Lease, such holdover tenancy by Subtenant shall automatically be deemed a tenancy at sufferance, terminable immediately. Unless Tenant agrees in writing to a different rental rate Subtenant agrees to pay to Tenant 150% of the rate of Base Rent last payable under this Sublease or the holdover rental rate provided in the Master Lease, whichever is greater, during any holdover tenancy, in addition to all Additional Rent and other sums due under this Sublease. All other terms of the Sublease shall remain in effect. Nothing herein shall be deemed Tenant’s consent to holdover by Subtenant, or be deemed to permit Subtenant to remain in possession of the Subleased Premises on and after expiration of the Master Lease. |

| 16. | NOTICES. All notices under this Sublease shall be in writing and effective (i) when delivered in person or via overnight courier to the other party, or (ii) three (3) days after being sent by registered or certified mail to the other party at the addresses set forth in Section 1. The addresses for notices and payment of Rent set forth in Section 1 may be modified by either party only by written notice delivered in conformance with this Section. |

| 17. | ESTOPPEL CERTIFICATES. Upon the written request of Tenant, Subtenant shall execute and deliver to Tenant and/or Landlord or their designee a written estoppel certificate on the same terms and conditions as required of Tenant under the Master Lease. |

| 18. | GENERAL. |

| a. | Heirs and Assigns. This Sublease shall apply to and be binding upon Tenant and Subtenant and their respective heirs, executors, administrators, successors and assigns. |

| b. | Brokers’ Fees. Subtenant represents and warrants to Tenant that except for Subtenant’s Broker, if any, described and disclosed in Section 20 of this Sublease, it has not engaged any firm, finder or other person who would be entitled to any commission or fees for the negotiation, execution or delivery of this Sublease and shall indemnify and hold harmless Tenant against any loss, cost, liability or expense incurred by Tenant as a result of any claim asserted by any such firm, finder or other person on the basis of any arrangements or agreements made or alleged to have been made by or on behalf of Subtenant. Tenant represents and warrants to Subtenant that except for Tenant’s Broker, if any, described and disclosed in Section 20, it has not engaged any firm, finder or other person who would be entitled to any commission or fees for the negotiation, execution or delivery of this Sublease and shall indemnify and hold harmless Subtenant against any loss, cost, liability or expense incurred by Subtenant as a result of any claim asserted by any such firm, finder or other person on the basis of any arrangements or agreements made or alleged to have been made by or on behalf of Tenant. |

|

Colliers International WA, LLC 11225 SE 6th St, Suite 240 Bellevue, WA 98004 Phone: 425-453-4545 Fax: 425-453-4540 |

© Commercial Brokers Association ALL RIGHTS RESERVED

Form: SUB_LS Sublease Agreement Rev. 9/2020 Page 9 of 20 |

|

SUBLEASE AGREEMENT

| c. | Entire Agreement. This Sublease, which incorporates portions of the Master Lease, contains all of the covenants and agreements between Tenant and Subtenant relating to the Subleased Premises. No prior or contemporaneous agreements or understandings pertaining to the Sublease shall be valid or of any force or effect and the covenants and agreements of this Sublease shall not be altered, modified, or amended to except in writing signed by Tenant and Subtenant. | |

| d. | Severability. Any provision of this Sublease which shall prove to be invalid, void or illegal shall in no way affect, impair or invalidate any other provision of this Sublease. |

| e. | Governing Law. This Sublease shall be governed by and construed in accordance with the laws of the State of Washington. |

| f. | Memorandum of Sublease. Neither this Sublease nor any memorandum or “short form” thereof shall be recorded without Tenant’s prior consent. |

| g. | Submission of Sublease Form Not an Offer. One party’s submission of this Sublease to the other for review shall not constitute an offer to sublease the Subleased Premises. This Sublease shall not become effective and binding upon Tenant and Subtenant until it has been fully executed by both Tenant and Subtenant, and consented to by Landlord (if required by the Master Lease). |

| h. | Authority of Parties. Each party to this Sublease represents and warrants to the other that the person executing this Sublease on behalf of such party has the authority to enter into this Sublease on behalf of this Sublease, that the execution and delivery of this Sublease has been duly authorized, and that upon such execution and delivery this Sublease shall be binding upon and enforceable against such party upon execution and delivery. |

| 19. | EXHIBITS AND RIDERS. The following exhibits and riders are made a part of this Sublease: |

Exhibit 1: Legal Description of the Master Premises or Property

Exhibit 2: Master Lease

Exhibit 3: Outline of Subleased Premises

Exhibit 4: Work Letter

Other: Sublease Addendum

| 20. | AGENCY DISCLOSURE. At the signing of this Sublease, |

Tenant is represented by Talor Okada of Colliers International WA, LLC (insert name of Broker and Firm as licensed) (the “Tenant’s Broker”); and Subtenant is represented by Brian Biege & Jacob Hamlin of CBRE,Inc. (insert name of Broker and Firm as licensed) (the “Subtenant’s Broker”).

This Agency Disclosure creates an agency relationship between Subtenant, Subtenant’s Broker (if any such person is disclosed), and any managing brokers who supervise Subtenant’s Broker’s performance (collectively the “Supervising Brokers”). In addition, this Agency Disclosure creates an agency relationship between Tenant, Tenant’s Broker (if any such person is disclosed), and any managing brokers who supervise Tenant’s Broker’s performance (also collectively the “Supervising Brokers”). If Tenant’s Broker and Subtenant’s Broker are different real estate licensees affiliated with the same Firm, then both Tenant and Subtenant confirm their consent to that Firm and both Tenant’s and Subtenant’s Supervising Brokers acting as dual agents. If Tenant’s Broker and Subtenant’s Broker are the same real estate licensee who represents both parties, then both Subtenant and Tenant acknowledge that the Broker, his or her Supervising Brokers, and his or her Firm are acting as dual agents and hereby consent to such dual agency. If Tenant’s Broker, Subtenant’s Broker, their Supervising Brokers, or their Firm are dual agents, Subtenant and Tenant consent to Tenant’s Broker, Subtenant’s Broker, and their Firm being compensated based on a percentage of the rent or as otherwise disclosed on an attached addendum. Neither Tenant’s Broker, Subtenant’s Broker nor either of their Firms are receiving compensation from more than one party to this transaction unless otherwise disclosed on an attached addendum, in which case Subtenant and Tenant consent to such compensation.

|

Colliers International WA, LLC 11225 SE 6th St, Suite 240 Bellevue, WA 98004 Phone: 425-453-4545 Fax: 425-453-4540 |

© Commercial Brokers Association ALL RIGHTS RESERVED

Form: SUB_LS Sublease Agreement Rev. 9/2020 Page 10 of 20 |

|

SUBLEASE AGREEMENT

Subtenant and Tenant confirm receipt of the pamphlet entitled “The Law of Real Estate Agency.”

| 21. | CONSENT BY LANDLORD. This Sublease shall be of no force or effect unless consented to by Landlord within 10 days of execution, if such consent is required under the Master Lease. Tenant and Subtenant agree for the benefit of Landlord that this Sublease and Landlord’s consent shall not (a) create privity of contract between Landlord and Subtenant; (b) be deemed to have amended the Master Lease in any regard (unless Landlord shall have expressly agreed in writing to such amendment); or (c) be construed as a consent by Landlord to any future assignment or subletting. Landlord’s consent shall, however, be deemed evidence of Landlord’s agreement that Subtenant may use the Subleased Premises for the purpose set forth in Section 1(g) and that Subtenant shall be entitled to the waiver of claims and of the right of subrogation as provided in Section 12, Insurance, above. |

| 22. | COMMISSION AGREEMENT. If Tenant has not entered into a listing agreement (or other compensation agreement with Tenant’s Firm), Tenant agrees to pay a commission to Tenant’s Firm (as identified in the Agency Disclosure Section above) as follows: |

| ☐ | $ |

| ☐ | % of the gross rent payable pursuant to this Sublease |

| ☐ | $ per rentable square foot of the Subleased Premises |

| ☒ | Other Per the Listing Agreement Between Tenant and Tenant’s Broker |

Tenant’s Broker ☐ shall ☒ shall not (shall not if not filled in) be entitled to a commission upon the extension by Subtenant of the Term pursuant to any right reserved to Subtenant under the Sublease calculated ☒ as provided above or ☐ as follows (if no box is checked, as provided above). Tenant’s Broker ☐ shall ☒ shall not (shall not if not filled in) be entitled to a commission upon any expansion of the Subleased Premises pursuant to any right reserved to Subtenant under the Sublease, calculated ☒ as provided above or ☐ as follows______ (if no box is checked, as provided above).

With respect to any commission earned upon execution of this Sublease or pursuant to any expansion of the Subleased Premises, Tenant shall pay one-half upon execution of the Sublease and one-half upon occupancy of the Subleased Premises by Subtenant. With respect to any commission earned upon extension of the Term of this Sublease, Tenant shall pay one-half upon execution of any amendment/addenda to the Sublease extending the Term and one-half upon the commencement date of such extended term. Tenant’s Broker shall pay to Subtenant’s Broker (as identified in the Agency Disclosure section above), the amount stated in a separate agreement between them or, if there is no agreement, $____or____% (complete only one) of any commission paid to Tenant’s Broker, within five (5) days after receipt by Tenant’s Broker.

If any other lease or sale is entered into between Tenant and Subtenant pursuant to a right reserved to Subtenant under the Sublease, Tenant ☐ shall ☐ shall not (shall not if not filled in) pay an additional commission according to any commission agreement or, in the absence of one, according to Tenant’s Broker’s commission schedule in effect as of the execution of this Sublease. Tenant’s successor shall be obligated to pay any unpaid commissions upon any transfer of this Sublease and any such transfer shall not release the transferor from liability to pay such commissions.

| 23. | BROKER PROVISIONS. |

TENANT’S BROKER AND SUBTENANT’S BROKER HAVE MADE NO REPRESENTATIONS OR WARRANTIES CONCERNING THE SUBLEASED PREMISES; THE MEANING OF THE TERMS AND CONDITIONS OF THIS SUBLEASE; LANDLORD’S, TENANT’S OR SUBTENANT’S FINANCIAL STANDING; ZONING; COMPLIANCE OF THE SUBLEASED PREMISES WITH APPLICABLE LAWS; SERVICE OR CAPACITY OF UTILITIES; OPERATING COSTS; OR HAZARDOUS MATERIALS. LANDLORD, TENANT AND SUBTENANT ARE EACH ADVISED TO SEEK INDEPENDENT LEGAL ADVICE ON THESE AND OTHER MATTERS ARISING UNDER THIS SUBLEASE.

|

Colliers International WA, LLC 11225 SE 6th St, Suite 240 Bellevue, WA 98004 Phone: 425-453-4545 Fax: 425-453-4540 |

© Commercial Brokers Association ALL RIGHTS RESERVED

Form: SUB_LS Sublease Agreement Rev. 9/2020 Page 11 of 20 |

|

SUBLEASE AGREEMENT

Helion Energy, Inc. |

JDL Digital Systems, Inc. | |

| TENANT: | SUBTENANT: | |

| Paul Gentsch | Victor Huang | |

| /s/ Paul Gentsch | /s/ Victor Huang | |

By: |

By: | |

| Chief of Staff | CEO | |

| Jul 28, 2023 Its: | 7/26/2023 Its: |

24. LANDLORD’S CONSENT.

Landlord consents to the foregoing Sublease without waiver of any restriction in the Master Lease concerning further assignment, subletting or transfer, nor shall its consent to the Sublease constitute a consent to any amendment or modification of the Sublease, without Landlord’s prior written consent. The execution of this Sublease by Subtenant and Tenant shall indicate the joint and several confirmation by Tenant and Subtenant of the foregoing terms and conditions and of Tenant’s and Subtenant’s agreement to be bound thereby, and shall constitute Subtenant’s acknowledgment it has received a copy of the Master Lease from Tenant.

| LANDLORD: | |

| LANDLORD: | |

| By: | |

| Its: |

|

Colliers International WA, LLC 11225 SE 6th St, Suite 240 Bellevue, WA 98004 Phone: 425-453-4545 Fax: 425-453-4540 |

© Commercial Brokers Association ALL RIGHTS RESERVED

Form: SUB_LS Sublease Agreement Rev. 9/2020 Page 12 of 20 |

|

SUBLEASE AGREEMENT

STATE OF

WASHINGTON

COUNTY OF ___________________________

This record was acknowledged before me on_________________ , 20 ____, by ___________________ as___________of_______________________.

| Notary Public for the State of Washington |

My commission expires:____________________________

STATE OF

WASHINGTON

COUNTY OF ___________________________

This record was acknowledged before me on_________________ , 20 ____, by ___________________ as ___________of_______________________ .

| Notary Public for the State of Washington |

My commission expires:____________________________

|

Colliers International WA, LLC 11225 SE 6th St, Suite 240 Bellevue, WA 98004 Phone: 425-453-4545 Fax: 425-453-4540 |

© Commercial Brokers Association ALL RIGHTS RESERVED

Form: SUB_LS Sublease Agreement Rev. 9/2020 Page 13 of 20 |

|

SUBLEASE AGREEMENT

STATE OF

WASHINGTON

COUNTY OF ___________________________

This record was acknowledged before me on_________________ , 20 ____, by ___________________as ___________of_______________________ .

| Notary Public for the State of Washington |

My commission expires:________________________________

STATE OF

WASHINGTON

COUNTY OF ___________________________

This record was acknowledged before me on_________________ , 20 ____, by ___________________as ___________of_______________________ .

| Notary Public for the State of Washington |

My commission expires:________________________________

|

Colliers International WA, LLC 11225 SE 6th St, Suite 240 Bellevue, WA 98004 Phone: 425-453-4545 Fax: 425-453-4540 |

© Commercial Brokers Association ALL RIGHTS RESERVED

Form: SUB_LS Sublease Agreement Rev. 9/2020 Page 14 of 20 |

|

SUBLEASE AGREEMENT

EXHIBIT 1

[Legal Description of Master Premises or Property]

________

Lot 4 of City of Redmond short plat No. SS-85-11R, recorded under Recording No. 8912190943, said short plat being a revision of short plat recorded under Recording No. 8512260700, said short plat being a subdivision of the east half of the southwest quarter of Section 2, township 25 north, range 5 east, W.M., in King County, Washington.

Except those portions of said lots conveyed to the City of Redmond by deed recorded under Recording No. 8810070396 and 8907120649.

|

Colliers International WA, LLC 11225 SE 6th St, Suite 240 Bellevue, WA 98004 Phone: 425-453-4545 Fax: 425-453-4540 |

© Commercial Brokers Association ALL RIGHTS RESERVED

Form: SUB_LS Sublease Agreement Rev. 9/2020 Page 15 of 20 |

|

SUBLEASE AGREEMENT

EXHIBIT

2

[Master Lease]

________

SEE ATTACHED

|

Colliers International WA, LLC 11225 SE 6th St, Suite 240 Bellevue, WA 98004 Phone: 425-453-4545 Fax: 425-453-4540 |

© Commercial Brokers Association ALL RIGHTS RESERVED

Form: SUB_LS Sublease Agreement Rev. 9/2020 Page 16 of 20 |

|

SUBLEASE AGREEMENT

EXHIBIT 3

[Outline of the Subleased Premises]

________

|

Colliers International WA, LLC 11225 SE 6th St, Suite 240 Bellevue, WA 98004 Phone: 425-453-4545 Fax: 425-453-4540 |

© Commercial Brokers Association ALL RIGHTS RESERVED

Form: SUB_LS Sublease Agreement Rev. 9/2020 Page 17 of 20 |

|

SUBLEASE AGREEMENT

EXHIBIT

4

[Work Letter]

CHECK IF APPLICABLE:

1. ☒ Improvements to be Completed by Tenant

A. Performance of Improvements. Subject to the terms and conditions of this Sublease, the Master Lease, and any Improvement Allowance provided herein, Tenant’s obligations to improve the Subleased Premises shall be limited to the work (“Tenant’s Work”) described below. All other work shall be performed by Subtenant at its sole expense or, if performed by Tenant, shall be promptly reimbursed by Subtenant. Tenant’s Work shall be deemed to be “substantially complete” on the date that Tenant notifies Subtenant that Tenant’s Work is complete, except for punch list items that do not impair the use or operations thereof, would not prevent Subtenant from occupancy and/or performing Subtenant’s Work, and except for that portion of Tenant’s Work, if any, which cannot be feasibly performed before Subtenant completes Subtenant’s Work, fixturing, or decorating.

The work to be done by Tenant in satisfying its obligation to complete Tenant’s Work under the Sublease shall be limited to the following (check one):

☒ As identified below (check and describe all that apply);

☐ FLOOR: _______

☐ FLOOR: _______

☐ CEILING: _______

☐ LIGHTING: _______

☐ WASHROOM(S): _______

☐ ELECTRICAL: _______

☐ HVAC: _______

☒ OTHER: 1.Tenant shall demise the Subleased Premises, including but not limited to wall, mechanical, electrical, and plumbing infrastructure (Wall, mechanical, electrical, and plumbing infrastructure shall be demised as deemed reasonably practical by Tenant) from the balance of the Master Premises at Tenant’s sole cost and expense.

2. Tenant shall reinstall doors and frames in the first-floor office portion of the Subleased Premises.

3. Tenant shall deliver the Subleased Premises in “broom clean” condition and ready for occupancy as reasonably determined by Tenant.

☐ As mutually agreed upon between Tenant and Subtenant as follows:

a. Within______ days (ten (10) days if not filled in) after mutual acceptance of the Sublease, Subtenant shall prepare and submit for Tenant’s review a preliminary sketch of the improvements to be performed by Tenant (“Preliminary Tenant Plan”). Tenant and Subtenant shall cooperate in good faith to adopt a mutually acceptable Preliminary Tenant Plan. Subtenant acknowledges that the timelines set forth in this Section 1 with respect to Tenant’s promulgation and approval of the Tenant Improvement Plans (as such term is defined herein) may be subject to reasonable extensions to the extent additional time is necessary to obtain any consent of Landlord that may be required under the Master Lease.

b. Upon Tenant’s approval of the Preliminary Tenant Plan, Tenant shall promptly prepare (or cause to be prepared) construction documents (i.e., those plans used for submittal to the appropriate governmental bodies for all necessary permits and approvals for Tenant’s Work, if any) for Subtenant’s review and approval, which approval shall not be unreasonably withheld, conditioned or delayed. The construction documents, once approved, shall then constitute “Tenant’s Improvement Plans.”

|

Colliers International WA, LLC 11225 SE 6th St, Suite 240 Bellevue, WA 98004 Phone: 425-453-4545 Fax: 425-453-4540 |

© Commercial Brokers Association ALL RIGHTS RESERVED

Form: SUB_LS Sublease Agreement Rev. 9/2020 Page 18 of 20 |

|

SUBLEASE AGREEMENT

c. Tenant shall submit the Tenant’s Improvement Plans to the appropriate governmental body for plan checking and issuance of necessary permits and approvals, as applicable. Tenant and Subtenant shall cooperate and use commercially reasonable efforts to cause to be made any changes in the Tenant’s Improvement Plans necessary to obtain such permits and approvals; provided, however, any costs and expenses resulting from the foregoing changes to Tenant’s Work that exceed the Improvement Allowance shall be borne at Subtenant’s sole cost and expense.

B. Defects in Tenant’s Work. If Subtenant fails to notify Tenant of any defects in the Tenant’s Work within 30 days of delivery of possession of the Premises to Subtenant, Subtenant shall be deemed to have accepted the Subleased Premises in their then-existing condition. If Subtenant discovers any major defects in the Tenant’s Work during this 30-day period that would prevent Subtenant from using the Subleased Premises for the Permitted Use, Subtenant shall notify Tenant and the Sublease Commencement Date shall be delayed until after Tenant has notified Subtenant that Tenant has corrected the major defects and Subtenant has had five (5) days to inspect and approve the Subleased Premises. The Sublease Commencement Date shall not be delayed if Subtenant’s inspection reveals minor defects in the Tenant’s Work that will not prevent Subtenant from using the Subleased Premises for the Permitted Use. Subtenant shall prepare a punch list of all minor defects in Tenant’s Work and provide the punch list to Tenant, which Tenant shall promptly correct.

2. ☐ Improvements to be Completed by Subtenant

A. Performance of Improvements. Subject to the terms and conditions of the Sublease, the Master Lease, and any Improvement Allowance provided herein, Subtenant shall complete, at its sole cost and expense, the work identified in the Subtenant Improvement Plans (as such term is defined below) adopted by Tenant and Subtenant in accordance with the provisions below (“Subtenant’s Work”). Subtenant’s Work shall be performed lien free and in a workmanlike manner, without interference with other work, if any, being done in the Subleased Premises, Master Premises, or Property, including any of Tenant’s Work, and in compliance with all laws and reasonable rules promulgated from time to time by Tenant, its architect and contractors, Landlord or its property manager.

The work to be done by Subtenant in satisfying its obligation to complete Subtenant’s Work under the Sublease shall be limited to the following (check one):

☐ As identified below (check and describe all that apply);

☐ FLOOR: _______

☐ WALLS: _______

☐ CEILING: _______

☐ LIGHTING: _______

☐ WASHROOM(S): _______

☐ ELECTRICAL: _______

☐ HVAC: _______

☐ OTHER: _______

☐ As mutually agreed upon between Tenant and Subtenant as follows:

| a. | Within____days (ten (10) days if not filled in) after mutual acceptance of the Sublease, Subtenant shall prepare and submit for Tenant’s review a preliminary sketch of the Subtenant Improvements (“Preliminary Subtenant Plan”). Tenant and Subtenant shall cooperate in good faith to adopt a mutually acceptable Preliminary Subtenant Plan. Subtenant acknowledges that the timelines set forth in this Section 2 with respect to Tenant’s promulgation and approval of the Subtenant Improvement Plans (as such term is defined herein) may be subject to reasonable extensions to the extent additional time is necessary to obtain any consent of Landlord that may be required under the Master Lease. |

|

Colliers International WA, LLC 11225 SE 6th St, Suite 240 Bellevue, WA 98004 Phone: 425-453-4545 Fax: 425-453-4540 |

© Commercial Brokers Association ALL RIGHTS RESERVED

Form: SUB_LS Sublease Agreement Rev. 9/2020 Page 19 of 20 |

|

SUBLEASE AGREEMENT

| b. | Upon approval of the Preliminary Subtenant Plan by Tenant, Subtenant shall promptly prepare construction documents (i.e., those plans used for submittal to the appropriate governmental bodies for all necessary permits and approvals for the Subtenant’s Work, if any) for Tenant’s review and approval. The construction documents, once approved, shall then constitute the “Subtenant Improvement Plans.” |

| c. | Upon approval by Tenant, Subtenant shall submit the Subtenant Improvements Plans to the appropriate governmental body for plan checking and issuance of necessary permits and approvals. Subtenant, with Tenant’s approval, shall cause to be made any changes in the Subtenant Improvements Plans necessary to obtain such permits and approvals. |

| d. | Tenant makes no warranty or representation of any type or nature with respect to the adequacy or sufficiency of the Subtenant Improvements Plans for any purpose. Tenant makes no warranty or representation of any type or nature with respect to the quality, suitability, or ability of contractor or the quality of the work or materials supplied or performed with respect to the Subtenant Improvements by contractor, the subcontractors, Subtenant’s agents, or any other person or entity. |

| B. | General Requirements. Subtenant shall submit to Tenant, prior to the commencement of the construction of Subtenant’s Work, the following information for Tenant’s review and approval (check all that apply): |

☐ The names, contact names, addresses, and license numbers of all general contractors and subcontractors Subtenant intends to use in the construction of Subtenant’s Work.

☐ A reasonably detailed schedule for Subtenant’s performance of Subtenant’s Work (including, without limitation, the date on which Subtenant’s Work will commence, the estimated date of completion of Subtenant’s Work, and the date on which Subtenant expects to open for business in the Premises).

☐ Evidence of insurance as required in the Sublease and Master Lease and any other insurance usual and customary for performance of Subtenant’s Work and requested by Tenant.

☐ Copies of all required governmental permits.

| C. | Contractor Qualifications. All contractors and subcontractors to perform Subtenant’s Work shall be licensed contractors, capable of performing quality workmanship and working in harmony with Tenant’s general contractor in the Building. Upon notice from Tenant, Subtenant shall stop using (or cause contractor or any subcontractor to stop using) any person or entity disturbing labor harmony with any work force or trade engaged in performing Subtenant’s Work or other work, labor, or services in or about the Building. All work shall be coordinated with any on-going construction work on the Building. Tenant shall have the right to disapprove, in Tenant’s reasonable discretion, any contractor or subcontractor which Subtenant desires to engage for Subtenant’s Work. |

3. Improvement Allowance

Provided there is no uncured Event of Default by Subtenant under the Sublease, upon completion of Tenant’s Work or Subtenant’s Work, as applicable, Tenant shall provide an allowance (“Improvement Allowance”) toward the costs and expenses associated with improvements to the Premises in accordance with the following (check one):

☐ $___per rentable square foot of the Premises. The Improvement Allowance shall be used only for (choose one): ☐ Tenant’s Work, or ☐ Subtenant’s Work, excepting_____. If costs associated with completing Subtenant’s Work exceed the Improvement Allowance, or if any costs of Subtenant’s Work are not to be paid out of the Improvement Allowance, then the excess or excluded amount shall be paid directly by Subtenant.

|

Colliers International WA, LLC 11225 SE 6th St, Suite 240 Bellevue, WA 98004 Phone: 425-453-4545 Fax: 425-453-4540 |

© Commercial Brokers Association ALL RIGHTS RESERVED

Form: SUB_LS Sublease Agreement Rev. 9/2020 Page 20 of 20 |

|

SUBLEASE AGREEMENT

☐ None; Subtenant shall be obligated to pay all costs, expenses and fees associated with completing the Subtenant’s Work in accordance with the Subtenant Improvement Plans.

☐ None; Tenant shall be obligated to pay all costs, expenses and fees associated with completing the Tenant’s Work in accordance with the Tenant Improvement Plans, however, excepting any costs related to Subtenants’ furniture, cabling, fixtures and equipment, design services, and ____, and in no event in an amount exceeding $ _____.

4. ☐ Removal of Improvements/Surrender. The following scope of Subtenant’s Work (check one):

☐ shall become the property of Tenant

☐ shall be removed by Subtenant at its sole cost and expense

upon the expiration or earlier termination of the Sublease Term:___.

|

Colliers International WA, LLC 11225 SE 6th St, Suite 240 Bellevue, WA 98004 Phone: 425-453-4545 Fax: 425-453-4540 |

© Commercial Brokers Association ALL RIGHTS RESERVED

Form: SUB-LA Sublease Addendum Rev. 4/2019 Page 1 of 1 |

|

ADDENDUM/AMENDMENT

TO

CBA SUBLEASE

CBA Text Disclaimer: Text deleted by licensee indicated by strike.

The following is part of the Sublease Agreement dated July 13, 2023,

Between JDL Digital Systems, Inc., a Washington corporation (“Subtenant”)

And Helion Energy, Inc., a Delaware corporation (“Tenant”)

regarding the lease of the Property known as: 8210 154th Ave NE 120 & 250, Redmond, WA 98052

IT IS AGREED BETWEEN THE TENANT AND SUBTENANT AS FOLLOWS: 1. Delivery Date: The date Tenant shall deliver the Subleased Premises to Subtenant shall be upon completion of Tenant’s Work and Landlord’s consent to the Sublease Agreement (the “Delivery Date”).

2. Early Possession: Subtenant may take possession of the Subleased Premises immediately following the Delivery Date, provided Subtenant has met all requirements of the Sublease Agreement, including but not limited to, payment of the Security Deposit and Prepaid Rent, and meeting all Insurance requirements under the Sublease Agreement.

3. The Sublease Commencement Date shall be the later of October 1, 2023 or thirty (30) days following the Delivery Date. Notwithstanding the foregoing, if Subtenant uses the Subleased Premises for any use or purpose other than installing furniture, fixtures, and equipment, then the Sublease Commencement Date shall automatically advance to the date that Subtenant used the Subleases Premises for any use or purpose other than installing furniture, fixtures, and equipment.

| AGENT (COMPANY): | Colliers International WA, LLC | By | /s/ Talor Okada |

ALL OTHER TERMS AND CONDITIONS of said Agreement remain unchanged

| INITIALS: | |||||||

| Tenant: | /s/ PG | Date | Jul 28, 2023 | Subtenant: | /s/ VH | Date | 7/26/2023 |

| Tenant: | Date | Subtenant: | Date |

Exhibit 2

LEASE

CALWEST INDUSTRIAL PROPERTIES, LLC,

a California limited liability company,

Landlord,

and

HELION ENERGY, INC.,

a Delaware corporation,

Tenant

Helion Energy, Inc.

TABLE OF CONTENTS

| Page | ||

| I . | USE AND RESTRICTIONS ON USE | 1 |

| 2. | TERM | 2 |

| 3. | RENT | 2 |

| 4. | RENT ADJUSTMENTS | 3 |

| 5. | SECURITY DEPOSIT | 6 |

| 6. | ALTERATIONS | 6 |

| 7. | REPAIR | 7 |

| 8. | LIENS | 8 |

| 9. | ASSIGNMENT AND SUBLETTING | 8 |

| 10. | INDEMNIFICATION | 10 |

| 11. | INSURANCE | 10 |

| 12. | WAIVER OF SUBROGATION | 11 |

| 13. | SERVICES AND UTILITIES | 11 |

| 14. | HOLDING OVER | 11 |

| 15. | SUBORDINATION | 12 |

| 16. | RULES AND REGULATIONS | 12 |

| 17. | REENTRY BY LANDLORD | 12 |

| 18. | DEFAULT | 12 |

| 19. | REMEDIES | 13 |

| 20. | TENANT’S BANKRUPTCY OR INSOLVENCY | 15 |

| 21. | QUIET ENJOYMENT | 16 |

| 22. | CASUALTY | 16 |

| 23. | EMINENT DOMAIN | 17 |

| 24. | SALE BY LANDLORD | 17 |

| 25. | ESTOPPEL CERTIFICATES | 18 |

| 26. | SURRENDER OF PREMISES | 18 |

| 27. | NOTICES | 18 |

| 28. | TAXES PAYABLE BY TENANT | 19 |

| 29. | RELOCATION OF TENANT [INTENTIONALLY OMITTED] | 19 |

| 30. | BUILDING DEMOLITION [INTENTIONALLY OMITTED] | 19 |

| 31. | DEFINED TERMS AND HEADINGS | 19 |

| 32. | TENANT’S AUTHORITY | 19 |

| 33. | FINANCIAL STATEMENTS AND CREDIT REPORTS | 20 |

| 34. | COMMISSIONS | 20 |

| 35. | TIME AND APPLICABLE LAW | 20 |

| 36. | SUCCESSORS AND ASSIGNS | 20 |

| 37. | ENTIRE AGREEMENT | 20 |

Hellion Energy, Inc.

i

TABLE OF CONTENTS

(continued)

| Page | ||

| 38. | EXAMINATION NOT OPTION | 20 |

| 39. | RECORDATION | 20 |

| 40. | SIGNAGE | 20 |

| 41. | BUILDING SIGNAGE | 20 |

| 42. | OPTION TO RENEW | 21 |

| 43. | ACCELERATION OPTION | 22 |

| 44. | HAZARDOUS MATERIALS | 23 |

| 45. | LIMITATION OF LANDLORD’S LIABILITY | 25 |

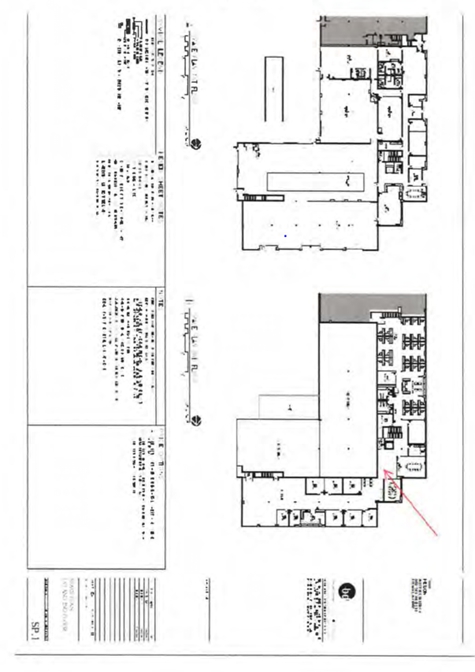

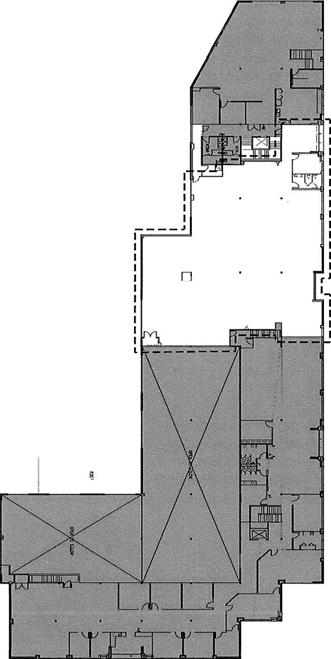

EXHIBIT A - FLOOR PLAN DEPICTING THE PREMISES

EXHIBIT A-1- SITE PLAN

EXHIBIT A-2 - LEGAL DESCRIPTION

EXHIBIT B - INITIAL ALTERATIONS

EXHIBIT C - COMMENCEMENT DATE MEMORANDUM

EXHIBIT D - RULES AND REGULATIONS

EXHIBIT E - TENANT SIGN CRITERIA

EXHIBIT F - HAZARDOUS MATERIALS QUESTIONNAIRE

EXHIBIT G - APPROVED HAZARDOUS MATERIALS

Helion Energy, Inc.

ii

MULTI-TENANT INDUSTRIAL NET LEASE

REFERENCE PAGES

| BUILDING: | Westpark, Building A 8210 154th Avenue NE Redmond, Washington 98052 |

| LANDLORD: | CALWEST INDUSTRIAL PROPERTIES, LLC. a California limited liability company |

| LANDLORD’S ADDRESS: | CalWest Industrial Properties, LLC

With a copy to:

CalWest Industrial Properties, LLC |

| WIRE INSTRUCTIONS AND/OR ADDRESS FOR RENT PAYMENT: |

CalWest Industrial Properties, LLC (Westpark) P.O. Box 740101 Los Angeles, CA 90074-0101 |

| LEASE REFERENCE DATE: | March 17, 2015 |

| TENANT: | HELION ENERGY, INC., a Delaware corporation |

| TENANT’S NOTICE ADDRESS: | |

| (a) As of beginning of Term: | The Premises |

| (b) Prior to beginning of Term (if different): | 8549 154th Avenue Redmond, Washington 98052 |

| PREMISES ADDRESS: | 8210 154th Avenue NE Redmond, Washington 98052 |

| PREMISES RENTABLE AREA: | Approximately 31,271 sq. ft., comprised of 5,385 sq. ft. of office space on the 1st floor, 10,657 sq. ft. of office space on the 2uct floor and 15,229 sq. ft. of warehouse space (for outline of Premises see Exhibit A) |

| USE: | General office, research, development, laboratory and warehouse purposes |

| COMMENCEMENT DATE: | June 1, 2015 |

| TERM OF LEASE: | Approximately sixty-two (62) months beginning on the Commencement Date and ending on the Termination Date. |

| TERMINATION DATE: | July 31, 2020 |

Helion Energy, Inc.

iii

ANNUAL RENT and MONTHLY INSTALLMENT OF

RENT (Article 3)

| Period | Rentable Square Footage |

Annual Rent Per Square Foot |

Annual Rent | Monthly Installment of Rent | |

| from | through | ||||

| 6/1/2015 | 5/31/2016 | 31,271 | $11.86 | $370,731.60 | $30,894.30 |

| 6/1/2016 | 5/31/2017 | 31,271 | $12.21 | $381,853.56 | $31,821.13 |

| 6/1/2017 | 5/31/2018 | 31,271 | $12.58 | $393,309.12 | $32,775.76 |

| 6/1/2018 | 5/31/2019 | 31,271 | $12.95 | $405,108.48 | $33,759.04 |

| 6/1/2019 | 5/31/2020 | 31,271 | $13.34 | $417,261.72 | $34,771.81 |

| 6/1/2020 | 7/31/2020 | 31,271 | $13.74 | $429,779.52 | $35,814.96 |

| * | Monthly Installment of Rent for the first two (2) full calendar months of the Term is subject to abatement as more particularly described in Section 3.3 below. |

| INITIAL ESTIMATED MONTHLY INSTALLMENT OF RENT ADJUSTMENTS (Article 4): | $10,006.72 |

| TENANT’S PROPORTIONATE SHARE: | 56.66% of the Building; 4.00% of the project in which the Building is located |

| SECURITY DEPOSIT: | $90,000.00 |

| ASSIGNMENT/SUBLETTING FEE: | $1,800.00 |

| REAL ESTATE BROKER: | Steve Balkman of NM Puget Sound Properties representing Tenant (“Tenant’s Broker”) and Todd Gauthier, Jason Bloom and Corentin Morel of Kidder Matthews, representing Landlord |

| TENANT’S NAICS CODE: | 541712 |

| AMORTIZATION RATE: | 10.00% |

The Reference Pages information is incorporated into and made a part of the Lease. In the event of any conflict between any Reference Pages information and the Lease, the Lease shall control. The Lease includes Exhibits A through if, all of which are made a part of the Lease.

[REMAINDER OF PAGE INTENTIONALLY LEFT BLANK]

Helion Energy, Inc.

iv

LEASE

By this Lease Landlord hereby leases to Tenant and Tenant hereby leases from Landlord the Premises in the Building as set forth and described on the Reference Pages (the “Premises”). This Lease is solely a lease of space in the Building and does not constitute a lease of any land. The Premises are depicted on the floor plan attached hereto as Exhibit A. and the Building is depicted on the site plan attached hereto as Exhibit A-1, and the real property upon which the Building is located is legally described on Exhibit A-2 attached hereto. The Reference Pages, including all terms defined thereon, are incorporated as part of this Lease.

1. USE AND RESTRICTIONS ON USE.

1.1 The Premises are to be used solely for the purposes set forth on the Reference Pages. Tenant shall not do or permit anything to be done in or about the Premises which will in any way obstruct or interfere with the rights of other tenants or occupants of the Building or injure, annoy, or disturb them, or allow the Premises to be used for any improper, immoral, unlawful, or objectionable purpose, or commit any waste. Tenant shall not do, permit or suffer in, on, or about the Premises the sale of any alcoholic liquor without the written consent of Landlord first obtained. Tenant shall comply with all federal, state and city laws, codes, ordinances, roles and regulations (collectively, “Regulations”) applicable to the use of the Premises and its occupancy and shall promptly comply with all governmental orders and directions for the correction, prevention and abatement of any violations in the Building or appurtenant land, caused or permitted by, or resulting from the specific use by, Tenant, or in or upon, or in connection with, the Premises, all at Tenant’s sole expense. Tenant shall not do or permit anything to be done on or about the Premises or bring or keep anything into the Premises which will in any way increase the rate of invalidate or prevent the procuring of any insurance protecting against loss or damage to the Building or any of its contents by fire or other casualty or against liability for damage to property or injury to persons in or about the Building or any part thereof.

1.2 Tenant shall not, and shall not direct, suffer or permit any of its agents, contractors, employees, licensees or invitees (collectively, the “Tenant Entities”) to at any time use, store, generate, treat, discharge, disburse, handle, manufacture, transport or dispose of (collectively, “Handle”) in or about the Premises or the Building any (collectively “Hazardous Materials”) flammables, explosives, radioactive materials, hazardous wastes or materials, toxic wastes or materials, or other similar substances, petroleum products or derivatives or any substance subject to regulation by or under any federal, state and local laws and ordinances relating to the protection of the environment or the keeping, use or disposition of environmentally hazardous materials, substances, or wastes, presently in effect or hereafter adopted, all amendments to any of them, and all rules and regulations issued pursuant to any of such laws or ordinances (collectively “Environmental Laws”), nor shall Tenant suffer or permit any Hazardous Materials to be used in any manner not fully in compliance with all Environmental Laws, in the Premises or the Building and appurtenant land or allow the environment to become contaminated with any Hazardous Materials. Notwithstanding the foregoing, Tenant may Handle products containing small quantities of Hazardous Materials (such as aerosol cans containing insecticides, toner for copiers, paints, paint remover and the like) to the extent customary and necessary for the use of the Premises for general office purposes; provided that Tenant shall always Handle any such Hazardous Materials in a safe and lawful manner and never allow such Hazardous Materials to contaminate the Premises, Building and appurtenant land or the environment. Tenant shall protect, defend, indemnify and hold each and all of the Landlord Entities (as defined in Article 31) harmless from and against any and all loss, claims, liability or costs (including court costs and attorney’s fees) incurred by reason of any actual or asserted failure of Tenant to fully comply with all applicable Environmental Laws, or the presence, handling, use or disposition in or from the Premises of any Hazardous Materials by Tenant or any Tenant Entity (even though permissible under all applicable Environmental Laws or the provisions of this Lease), or by reason of any actual or asserted failure of Tenant to keep, observe, or perform any provision of this Section 1.2 or Article 44 below. Prior to Tenant (and at least ten (10) days prior to any assignee or any subtenant of Tenant) taking possession of any part of the Premises, Tenant shall disclose to Landlord in writing the names and amounts of all Hazardous Materials, or any combination thereof, which Tenant desires to Handle on, in, under or about the Premises or Project during the Term by executing and delivering to Landlord a “Hazardous Materials Questionnaire”, in the form attached hereto as Exhibit F (as updated and modified by Landlord, from time to time). Landlord hereby approves the Hazardous Materials listed, and in the quantities set forth, on Exhibit G to this Lease, so long as Tenant strictly complies with the terms and conditions of this Lease respecting the Handling of such approved Hazardous Materials. Tenant’s disclosure obligations under this Section 1.2 shall include a requirement that, to the extent Tenant intends to increase the quantities or modify the types of Hazardous Materials listed on Exhibit G to this Lease in any material respect, Tenant shall, concurrently with Tenant’s order of such increased quantities and/or different types of Hazardous Materials, promptly deliver to Landlord a new updated Hazardous Materials Questionnaire, and Landlord shall, if applicable, disapprove Tenant’s use of the modified types and/or amounts of Hazardous Materials disclosed in Tenant’s new Hazardous Materials Questionnaire within ten (10) business days following Landlord’s receipt thereof.

Hellen Energy, inc.