Exhibit 99.2

1 Real Time. Actionable. Intelligence. J une 2023 Airship AI Holdings, Inc. – Investor Presentation www.airship.ai

Disclaimers Basis of Presentation This Presentation (this “Presentation”) is provided for informational purposes only and has been prepared to assist interested parties in making their own evaluation with respect to an investment in connection with a potential business combination between Airship AI Holdings, Inc . (“Airship AI”) and BYTE Acquisition Corp . (“BYTE”) and related transactions (the “Potential Business Combination”) and for no other purpose . By accepting, reviewing or reading this Presentation, you will be deemed to have agreed to the obligations and restrictions set out below . This Presentation may be deemed to be an offering of BYTE or Airship AI securities, made in reliance on an exemption from the registration requirements under the Securities Act of 1933 , as amended and the securities laws of any other applicable jurisdiction, which exemptions apply to offers and sales of securities that do not involve a public offering . The market for any such securities may be illiquid and you may not be able to readily sell such securities . Investing in such securities would be speculative, involving a high degree of risk, and may result in the loss of the entire amount invested . Any such securities have not been approved or recommended by any federal, state or foreign securities authorities, nor have any of these authorities passed upon the merits of such an offering or determined that this Presentation is accurate or complete . Any representation to the contrary is a criminal offense . No Offer or Solicitation This Presentation and any oral statements made in connection with this Presentation do not constitute an offer to sell, or a solicitation of an offer to buy, or a recommendation to purchase, any securities in any jurisdiction, or the solicitation of any vote, consent or approval in any jurisdiction in connection with the Potential Business Combination or any related transactions, nor shall there be any sale, issuance or transfer of any securities in any jurisdiction where, or to any person to whom, such offer, solicitation or sale may be unlawful under the laws of such jurisdiction . This Presentation does not constitute either advice or a recommendation regarding any securities . No offering of securities shall be made except by means of a prospectus meeting the requirements of the Securities Act of 1933 , as amended, or an exemption therefrom . No Representations and Warranties No representations or warranties, express, implied or statutory are given in, or in respect of, this Presentation, and no person may rely on the information contained in this Presentation . Any data on past performance or modeling contained herein is not an indication as to future performance . This data is subject to change . Recipients of this Presentation are not to construe its contents, or any prior or subsequent communications from or with BYTE, Airship AI or their respective representatives as investment, legal or tax advice . Each recipient should seek independent third party legal, regulatory, accounting and/or tax advice regarding this Presentation . In addition, this Presentation does not purport to be all - inclusive or to contain all of the information that may be required to make a full analysis of Airship AI or the Potential Business Combination . Recipients of this Presentation should each make their own evaluation of Airship AI and of the relevance and adequacy of the information and should make such other investigations as they deem necessary . BYTE and Airship AI assume no obligation to update the information in this Presentation . Each recipient also acknowledges and agrees that the information contained in this Presentation (i) is preliminary in nature and is subject to change, and any such changes may be material and (ii) should be considered in the context of the circumstances prevailing at the time and has not been, and will not be, updated to reflect material developments which may occur after the date of this Presentation . To the fullest extent permitted by law, in no circumstances will Airship AI or BYTE or any of their respective subsidiaries, stockholders, affiliates, representatives, partners, directors, officers, employees, advisers or agents be responsible or liable for any direct, indirect or consequential loss or loss of profit arising from the use of this Presentation, its contents, its omissions, reliance on the information contained within it or on opinions communicated in relation thereto or otherwise arising in connection therewith . This Presentation discusses trends and markets that Airship AI’s leadership team believes will impact the development and success of Airship AI based on its current understanding of the marketplace . Industry and Market Data Industry and market data used in this Presentation have been obtained from third - party industry publications and sources as well as from research reports prepared for other purposes . Neither BYTE nor Airship AI has independently verified the data obtained from these sources and cannot assure you of the reasonableness of any assumptions used by these sources or the data’s accuracy or completeness . 2

Disclaimers Forward - Looking Statements The disclosure herein includes certain statements that are not historical facts but are forward - looking statements for purposes of the safe harbor provisions under the United States Private Securities Litigation Reform Act of 1995 . Forward - looking statements generally are accompanied by words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,” “plan,” “project,” “forecast,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook,” and similar expressions that predict or indicate future events or trends or that are not statements of historical matters, but the absence of these words does not mean that a statement is not forward looking . These forward - looking statements include, but are not limited to, ( 1 ) statements regarding estimates and forecasts of other financial, performance and operational metrics and projections of market opportunity ; ( 2 ) references with respect to the anticipated benefits of the proposed Business Combination and the projected future financial performance of Airship AI following the proposed Business Combination ; ( 3 ) changes in the market for Airship AI’s services and technology, and expansion plans and opportunities ; ( 4 ) Airship AI’s unit economics ; ( 5 ) the sources and uses of cash of the proposed Business Combination ; ( 6 ) the anticipated capitalization and enterprise value of Airship Pubco following the consummation of the proposed Business Combination ; ( 7 ) the projected technological developments of Airship AI ; ( 8 ) current and future potential commercial and customer relationships ; ( 9 ) the ability to operate efficiently at scale ; ( 10 ) anticipated investments in capital resources and research and development, and the effect of these investments ; ( 11 ) the amount of redemption requests made by BYTS’ public shareholders ; ( 12 ) the ability of Airship Pubco to issue equity or equity - linked securities in the future ; ( 13 ) the failure to achieve the minimum cash at closing requirements ; ( 14 ) the inability to obtain or maintain the listing of the combined company’s common stock on Nasdaq following the proposed Business Combination, including but not limited to redemptions exceeding anticipated levels or the failure to meet Nasdaq's initial listing standards in connection with the consummation of the proposed Business Combination ; and ( 15 ) expectations related to the terms and timing of the proposed Business Combination . These statements are based on various assumptions, whether or not identified in this Presentation, and on the current expectations of BYTS’ and Airship AI’s management and are not predictions of actual performance . These forward - looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability . Actual events and circumstances are difficult or impossible to predict and will differ from assumptions . Many actual events and circumstances are beyond the control of Airship AI . These forward - looking statements are subject to a number of risks and uncertainties, as set forth in the section entitled “Risk Factors” and “Cautionary Note Regarding Forward - Looking Statements” in BYTS’ Annual Report on Form 10 - K for the year ended December 31 , 2022 , which was filed with the SEC on March 31 , 2023 , and/or will be contained in the Registration Statement and the Proxy Statement/Prospectus when available, and in those other documents that BYTS has filed, or will file, with the SEC . If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward - looking statements . The risks and uncertainties above are not exhaustive, and there may be additional risks that neither BYTS nor Airship AI presently know or that BYTS and Airship AI currently believe are immaterial that could also cause actual results to differ from those contained in the forward - looking statements . In addition, forward looking statements reflect BYTS’ and Airship AI’s expectations, plans or forecasts of future events and views as of the date of this Presentation . BYTS and Airship AI anticipate that subsequent events and developments will cause BYTS’ and Airship AI’s assessments to change . However, while BYTS and Airship AI may elect to update these forward - looking statements at some point in the future, BYTS and Airship AI specifically disclaim any obligation to do so . These forward - looking statements should not be relied upon as representing BYTS’ and Airship AI’s assessments as of any date subsequent to the date of this Presentation . Accordingly, undue reliance should not be placed upon the forward - looking statements . Trademarks BYTE and Airship AI own or have rights to various trademarks, service marks and trade names that they use in connection with the operation of their respective businesses . This Presentation also contains trademarks, service marks, trade names and copyrights of third parties, which are the property of their respective owners . The use or display of third parties’ trademarks, service marks, trade names or products in this Presentation is not intended to, and does not imply, a relationship with BYTE or Airship AI, an endorsement or sponsorship by or of BYTE or Airship AI, or a guarantee that Airship AI or BYTE will work or will continue to work with such third parties . Solely for convenience, the trademarks, service marks, trade names and copyrights referred to in this Presentation may appear without the TM, SM, ® or © symbols, but such references are not intended to indicate, in any way, that BYTE, Airship AI, or the any third - party will not assert, to the fullest extent under applicable law, their rights or the right of the applicable licensor to these trademarks, service marks, trade names and copyrights . Financial Information; Non - GAAP Financial Measures Some of the historical financial information contained in this Presentation is unaudited and does not conform to Regulation S - X . This Presentation contains certain estimated preliminary financial results and key operating metrics for the year ended December 31 , 2022 . This information is preliminary and subject to change . As such, Airship AI's actual results may differ from the estimated preliminary results presented herein . Accordingly, such information and data may not be included in, may be adjusted in or may be presented differently in any proxy statement or registration statement to be filed by BYTE with the SEC . In addition, financial information and data contained in this Presentation, such as Adjusted EBITDA and Adjusted EBITDA margin have not been prepared in accordance with United States generally accepted accounting principles (“GAAP”) . Adjusted EBITDA is defined as net earnings (loss) before interest expense, income tax expense (benefit), depreciation and amortization, as adjusted to exclude stock based compensation . These non - GAAP financial measures, and other measures that are calculated using such non - GAAP measures, are an addition to, and not a substitute for or superior to, measures of financial performance prepared in accordance with GAAP and should not be considered as an alternative to revenue, operating income, profit before tax, net income or any other performance measures derived in accordance with GAAP . For the same reasons, Airship AI is unable to address the probable significance of the unavailable information, which could be material to future results . BYTE and Airship AI believe these non - GAAP measures of financial results, including on a forward - looking basis, provide useful information to management and investors regarding certain financial and business trends relating to Airship AI’s financial condition and results of operations . Airship AI’s management uses these non - GAAP measures for trend analyses, for purposes of determining management incentive compensation, and for budgeting and planning purposes . BYTE and Airship AI believe that the use of these non - GAAP financial measures provides an additional tool for investors to use in evaluating projected operating results and trends in and in comparing Airship AI’s financial measures with other similar companies, many of which present similar non - GAAP financial measures to investors . However, there are a number of limitations related to the use of these non - GAAP measures and their nearest GAAP equivalents . 3

Disclaimers For example, other companies may calculate non - GAAP measures differently, or may use other measures to calculate their financial performance, and therefore Airship AI’s non - GAAP measures may not be directly comparable to similarly titled measures of other companies . See the Appendix for definitions of these non - GAAP financial measures and reconciliations of these non - GAAP financial measures to the most directly comparable GAAP measures . Use of Projections This Presentation contains projected financial information with respect to Airship AI, namely revenue, year - over - year growth, gross profit, gross profit margin, operating expenses, operating income (loss), Adjusted EBITDA and Adjusted EBITDA margin . Such projected financial information constitutes forward - looking information, and is for illustrative purposes only and should not be relied upon as necessarily being indicative of future results . The projections, estimates and targets in this Presentation are forward - looking statements that are based on assumptions that are inherently subject to significant uncertainties and contingencies, many of which are beyond BYTE’s and Airship AI’s control . See “Forward - Looking Statements” above . The assumptions and estimates underlying the projected, expected or target results are inherently uncertain and are subject to a wide variety of significant business, weather, economic, regulatory, competitive, technological, and other risks and uncertainties that could cause actual results to differ materially from those contained in such projections, estimates and targets . The inclusion of projections, estimates and targets in this Presentation should not be regarded as an indication that BYTE and Airship AI, or their representatives, considered or consider the financial projections, estimates and targets to be a reliable prediction of future events . Neither the independent auditors of BYTE nor the independent registered public accounting firm of Airship AI has audited, reviewed, compiled or performed any procedures with respect to the projections for the purpose of their inclusion in this Presentation, and accordingly, neither of them expressed an opinion or provided any other form of assurance with respect thereto for the purpose of this Presentation . Important Information for Investors and Stockholders In connection with the Potential Business Combination, BYTE and Airship AI are expected to prepare a registration statement on Form S - 4 (the “Registration Statement”) to be filed with the SEC by BYTE, which will include preliminary and definitive proxy statements to be distributed to BYTE’s shareholders in connection with BYTE’s solicitation for proxies for the vote by BYTE’s shareholders in connection with the Potential Business Combination and other matters as described in the Registration Statement, as well as the prospectus relating to the offer of the securities to be issued to Airship AI’s shareholders in connection with the completion of the Potential Business Combination . After the Registration Statement has been filed and declared effective, BYTE will mail a definitive proxy statement/prospectus and other relevant documents to its shareholders as of the record date to be established for voting on the Potential Business Combination . BYTE’s shareholders and other interested persons are advised to read, once available, the preliminary proxy statement/prospectus and any amendments thereto and, once available, the definitive proxy statement/prospectus, in connection with BYTE’s solicitation of proxies for its special meeting of shareholders to be held to approve, among other things, the Potential Business Combination, because these documents will contain important information about BYTE, Airship AI and the Potential Business Combination . Shareholders may also obtain a copy of the preliminary or definitive proxy statement/prospectus, once available, as well as other documents filed with the SEC regarding the Potential Business Combination and other documents filed with the SEC by BYTE, without charge, at the SEC’s website located at www . sec . gov or by directing a request to BYTE Acquisition Corp . , 445 Park Avenue, 9 th Floor New York, NY 10022 . BYTE and Airship AI and their respective directors and executive officers and other members of management, under SEC rules and other members of management, may be deemed to be participants in the solicitation of proxies of BYTE’s shareholders in connection with the Potential Business Combination . Investors and security holders may obtain more detailed information regarding BYTE’s directors and executive officers in BYTE’s filings with the SEC, including BYTE’s Annual Report on Form 10 - K filed with the SEC on April 6 , 2022 . Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies to BYTE’s shareholders in connection with the Potential Business Combination, including a description of their direct and indirect interests, which may, in some cases, be different than those of BYTE’s shareholders generally, will be set forth in the Registration Statement and the definitive proxy statement/prospectus, when available . Shareholders, potential investors and other interested persons should read the Registration Statement and the definitive proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions . This Presentation is not a substitute for the Registration Statement, the definitive proxy statement/prospectus or for any other document that BYTE may file with the SEC in connection with the Potential Business Combination . INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION . Investors and security holders may obtain free copies of other documents filed with the SEC by BYTE through the website maintained by the SEC at www . sec . gov . Changes and Additional Information in Connection with SEC Filings The information in this Presentation has not been reviewed by the SEC and certain information, such as financial measures referenced herein, may not comply in certain respects with SEC rules . As a result, the information in the Registration Statement and the definitive proxy statement/prospectus may differ from this Presentation to comply with SEC rules . The Registration Statement and the definitive proxy statement/prospectus will include substantial additional information about Airship AI and BYTE not contained in this Presentation . Once filed, the information in the Registration Statement and the definitive proxy statement/prospectus will update and supersede the information presented in this Presentation . INVESTMENT IN ANY SECURITIES DESCRIBED HEREIN HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SEC OR ANY OTHER REGULATORY AUTHORITY NOR HAS ANY AUTHORITY PASSED UPON OR ENDORSED THE MERITS OF THE POTENTIAL BUSINESS COMBINATION OR THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED HEREIN . ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE . 4

Victor Huang Chairman & CEO A i r s h i p AI Ho l d i ng s , In c . P au l A ll en President A i r s h i p AI Ho l d i ng s , In c . Today’s Presenters Sam Gloor CEO & CFO BYTE Acquisition Corp. 5

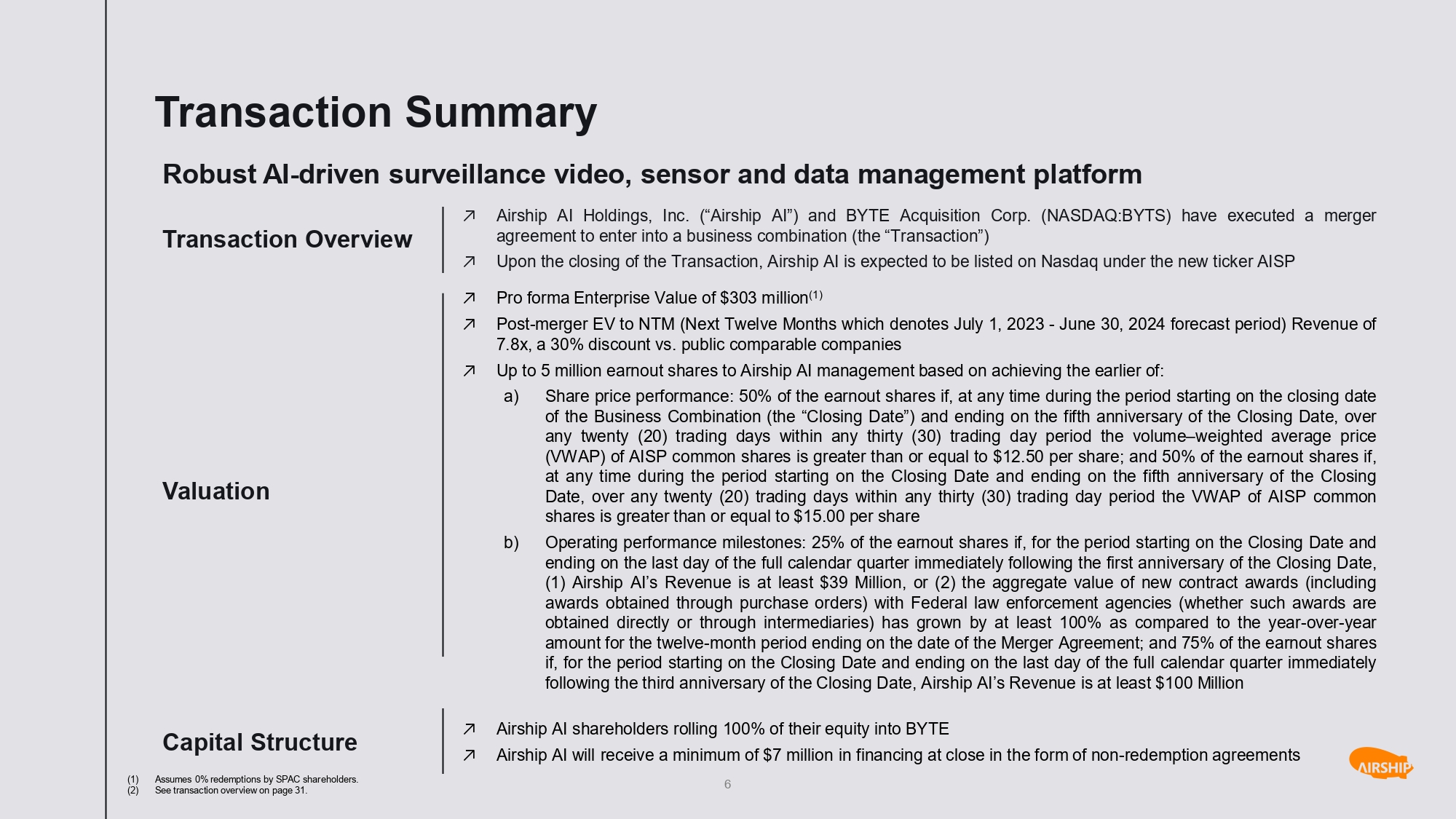

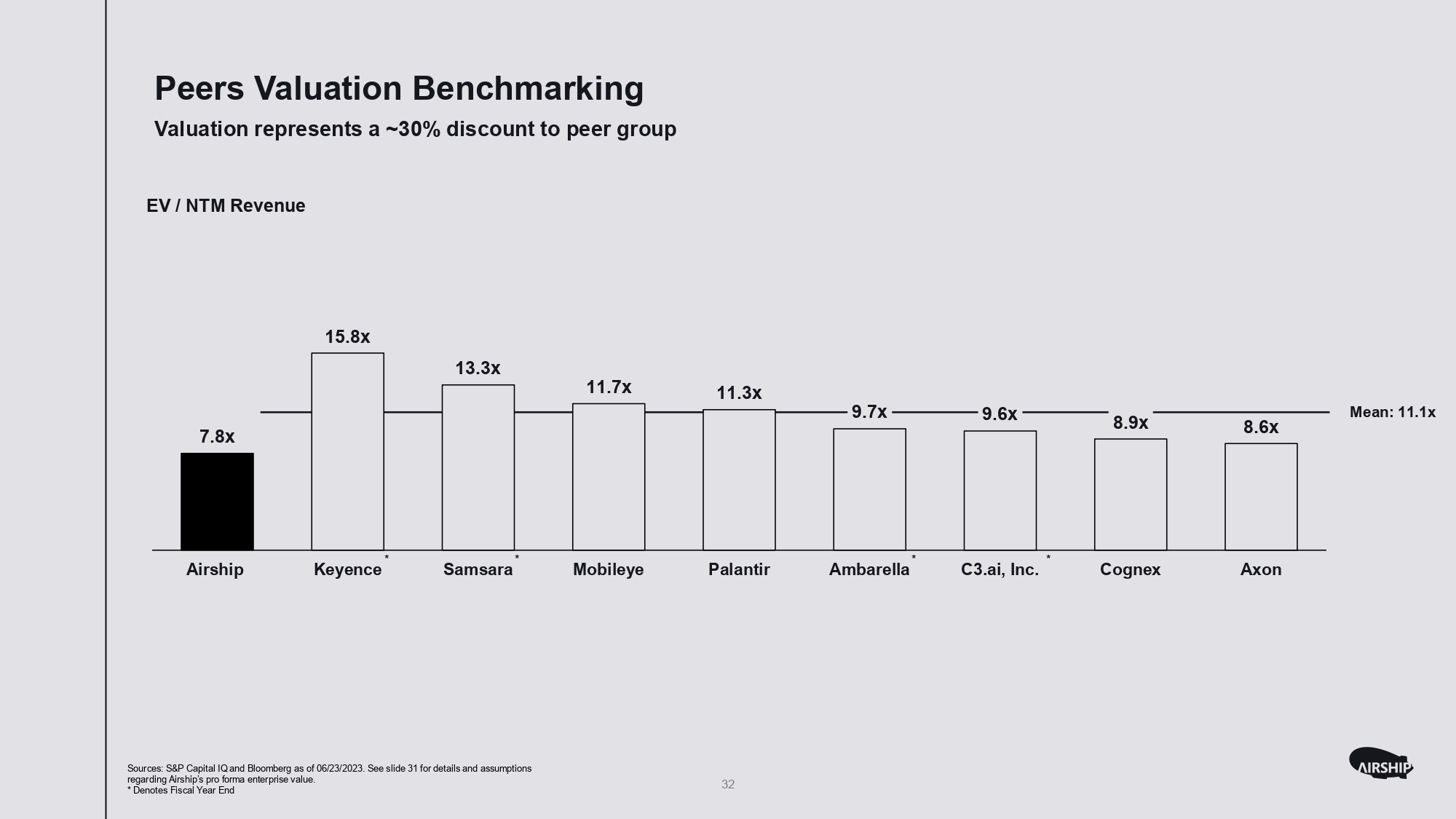

6 њ Airship AI Holdings, Inc. (“Airship AI”) and BYTE Acquisition Corp. (NASDAQ:BYTS) have executed a merger agreement to enter into a business combination (the “Transaction”) њ Upon the closing of the Transaction, Airship AI is expected to be listed on Nasdaq under the new ticker AISP Transaction Overview њ Pro forma Enterprise Value of $303 million (1) њ Post - merger EV to NTM (Next Twelve Months which denotes July 1, 2023 - June 30, 2024 forecast period) Revenue of 7.8x, a 30% discount vs. public comparable companies њ Up to 5 million earnout shares to Airship AI management based on achieving the earlier of: a) Share price performance : 50 % of the earnout shares if, at any time during the period starting on the closing date of the Business Combination (the “Closing Date”) and ending on the fifth anniversary of the Closing Date, over any twenty ( 20 ) trading days within any thirty ( 30 ) trading day period the volume – weighted average price (VWAP) of AISP common shares is greater than or equal to $ 12 . 50 per share ; and 50 % of the earnout shares if, at any time during the period starting on the Closing Date and ending on the fifth anniversary of the Closing Date, over any twenty ( 20 ) trading days within any thirty ( 30 ) trading day period the VWAP of AISP common shares is greater than or equal to $ 15 . 00 per share b) Operating performance milestones : 25 % of the earnout shares if, for the period starting on the Closing Date and ending on the last day of the full calendar quarter immediately following the first anniversary of the Closing Date, (1) Airship AI’s Revenue is at least $ 39 Million, or ( 2 ) the aggregate value of new contract awards (including awards obtained through purchase orders) with Federal law enforcement agencies (whether such awards are obtained directly or through intermediaries) has grown by at least 100 % as compared to the year - over - year amount for the twelve - month period ending on the date of the Merger Agreement ; and 75 % of the earnout shares if, for the period starting on the Closing Date and ending on the last day of the full calendar quarter immediately following the third anniversary of the Closing Date, Airship AI’s Revenue is at least $ 100 Million Valuation њ Airship AI shareholders rolling 100% of their equity into BYTE њ Airship AI will receive a minimum of $7 million in financing at close in the form of non - redemption agreements Capital Structure Robust AI - driven surveillance video, sensor and data management platform Transaction Summary (1) Assumes 0% redemptions by SPAC shareholders. (2) See transaction overview on page 31.

Our Mission 7 Leverage Artificial Intelligence (“AI”) at the edge to help improve public safety and operational efficiency for public sector and commercial customers by providing predictive analysis of events before they occur and provide meaningful intelligence to decision makers. The Edge – a place where unstructured data, including surveillance video, sensors and radar, is generated

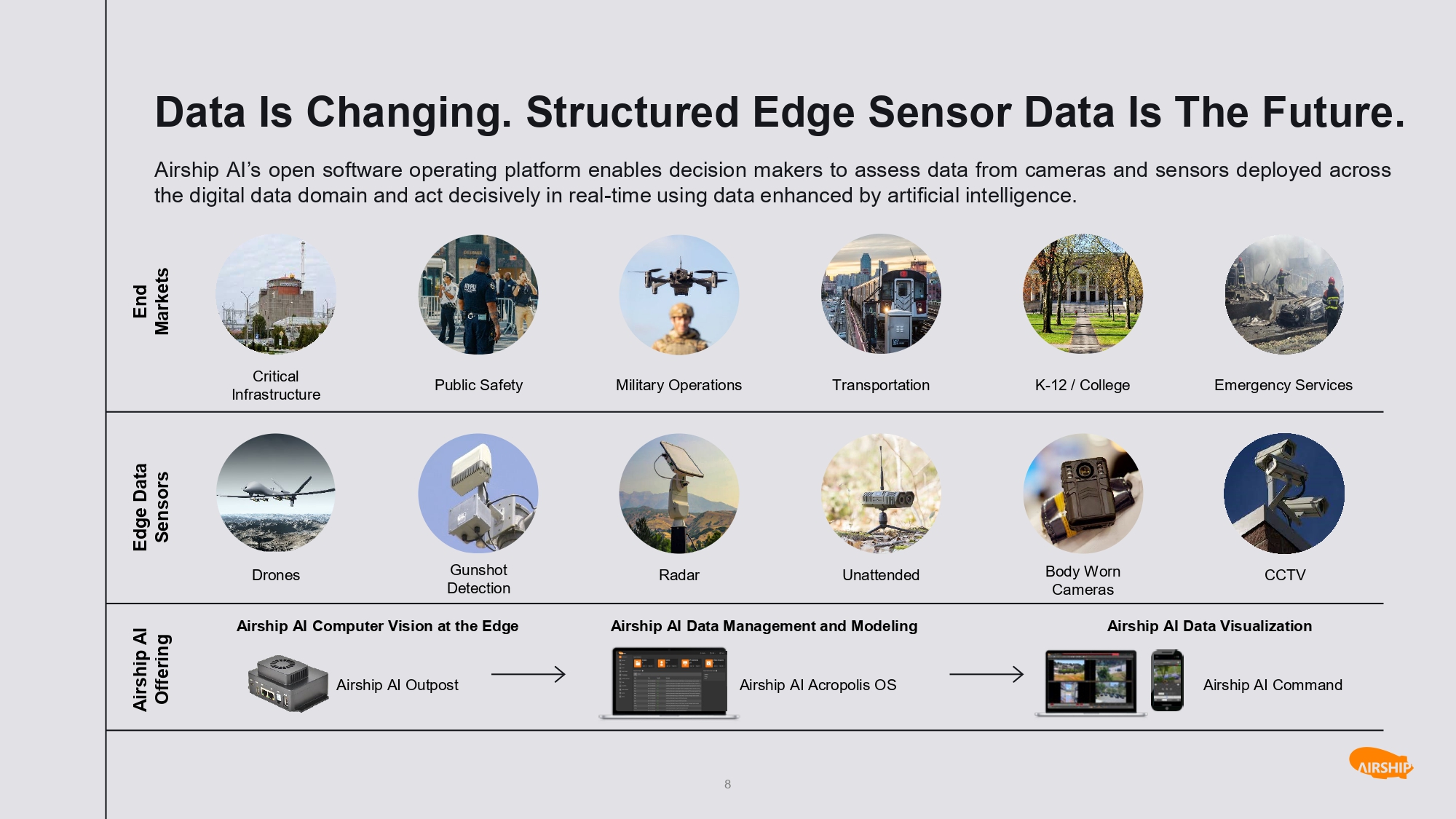

Data Is Changing. Structured Edge Sensor Data Is The Future. Airship AI’s open software operating platform enables decision makers to assess data from cameras and sensors deployed across the digital data domain and act decisively in real - time using data enhanced by artificial intelligence. K - 12 / College Transportation Critical In f r a s t r u c tu re Military Operations Public Safety Drones Gunshot D ete c t i on R adar Unattended CC T V Edge Data Sensors A irs h ip A I Offering Airship AI Outpost Airship AI Computer Vision at the Edge Airship AI Data Management and Modeling Airship AI Data Visualization End M arke t s Emergency Services Airship AI Acropolis OS Airship AI Command 8 Bod y W o rn Cameras

9 Screenshot of Airship AI software processing pre - recorded stock video of Tokyo crosswalk

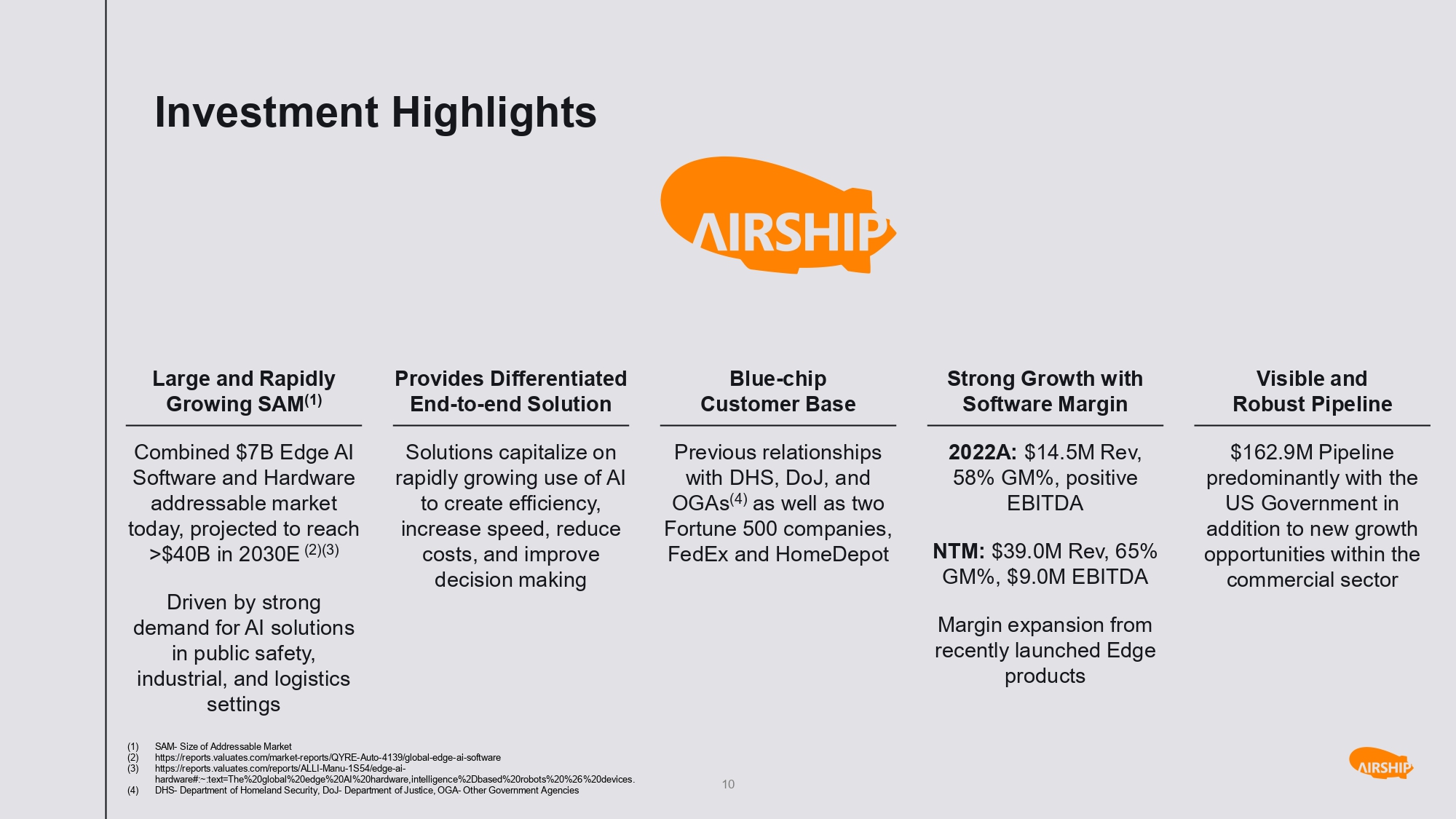

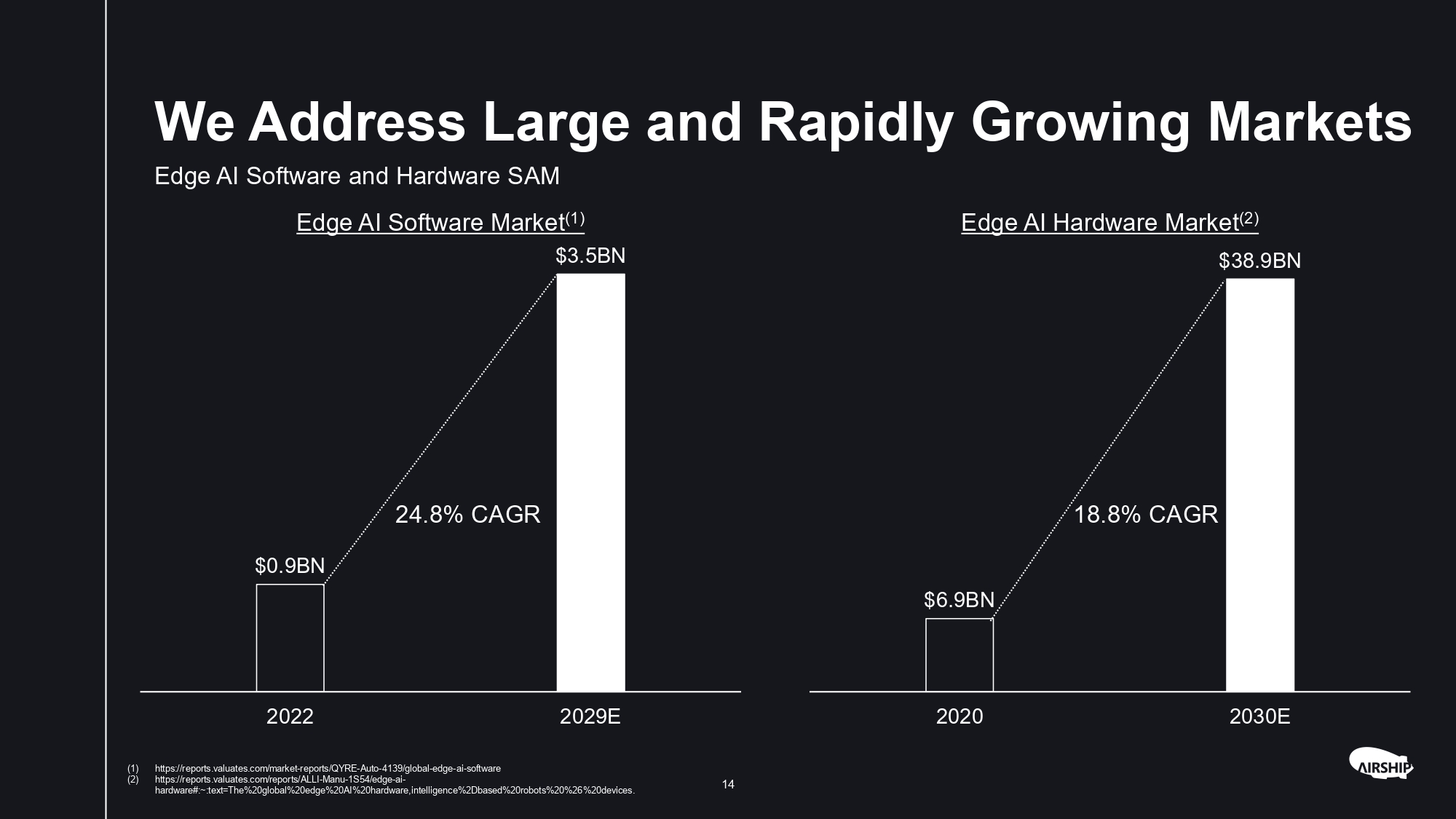

10 Investment Highlights C o m b i ne d $7 B Edg e A I Software and Hardware addressable market today, projected to reach >$40 B in 2030 E ( 2 )( 3 ) Driven by strong de m an d f o r A I s o l u t i ons in public safety, industrial, and logistics settings Solutions capitalize on rapidly growing use of AI to create efficiency, increase speed, reduce costs, and improve decision making Previous relationships with DHS, DoJ, and OGAs (4) as well as two Fortune 500 companies, FedEx and HomeDepot 2022A: $14.5M Rev, 58% GM%, positive EBITDA NTM: $39.0M Rev, 65% GM%, $9.0M EBITDA Margin expansion from recently launched Edge products $162.9M Pipeline predominantly with the US Government in addition to new growth opportunities within the commercial sector Large and Rapidly Growing SAM (1) Provides Differentiated End - to - end Solution Blue - chip Customer Base Strong Growth with Software Margin Visible and Robust Pipeline (1) SAM - Size of Addressable Market (2) https://reports.valuates.com/market - reports/QYRE - Auto - 4139/global - edge - ai - software (3) https://reports.valuates.com/reports/ALLI - Manu - 1S54/edge - ai - hardware#:~:text=The%20global%20edge%20AI%20hardware,intelligence%2Dbased%20robots%20%26%20devices. (4) DHS - Department of Homeland Security, DoJ - Department of Justice, OGA - Other Government Agencies

11 01 Market O ve r v i ew

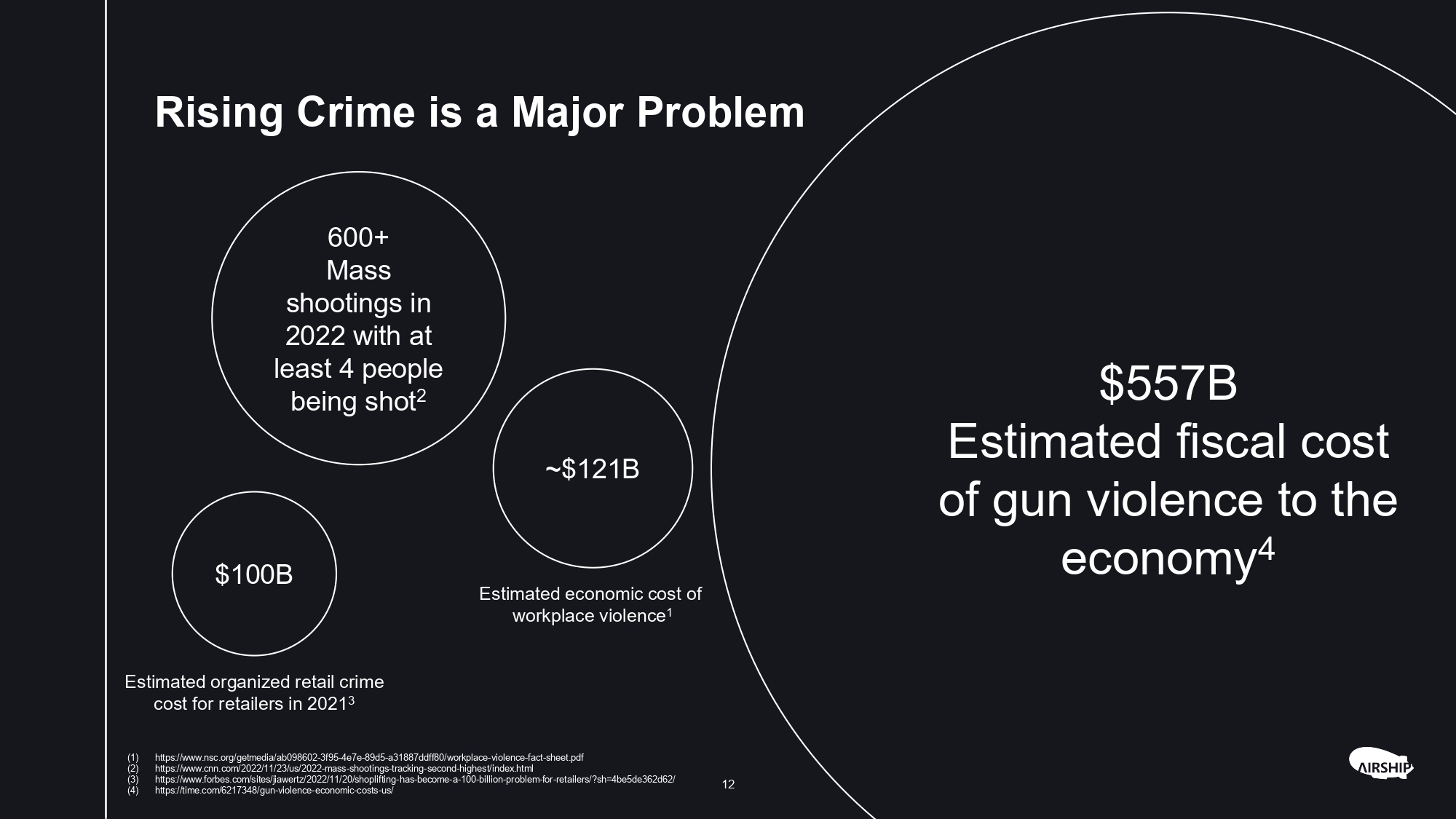

12 $100B 600+ Mass shootings in 2022 with at least 4 people being shot 2 ~ $121B Estimated economic cost of workplace violence 1 Estimated organized retail crime cost for retailers in 2021 3 Rising Crime is a Major Problem $557B Estimated fiscal cost of gun violence to the economy 4 (1) https:// www.nsc.org/getmedia/ab098602 - 3f95 - 4e7e - 89d5 - a31887ddff80/workplace - violence - fact - sheet.pdf (2) https:// www.cnn.com/2022/11/23/us/2022 - mass - shootings - tracking - second - highest/index.html (3) https://www.forbes.com/sites/jiawertz/2022/11/20/shoplifting - has - become - a - 100 - billion - problem - for - retailers/?sh=4be5de362d62/ (4) https://time.com/6217348/gun - violence - economic - costs - us/

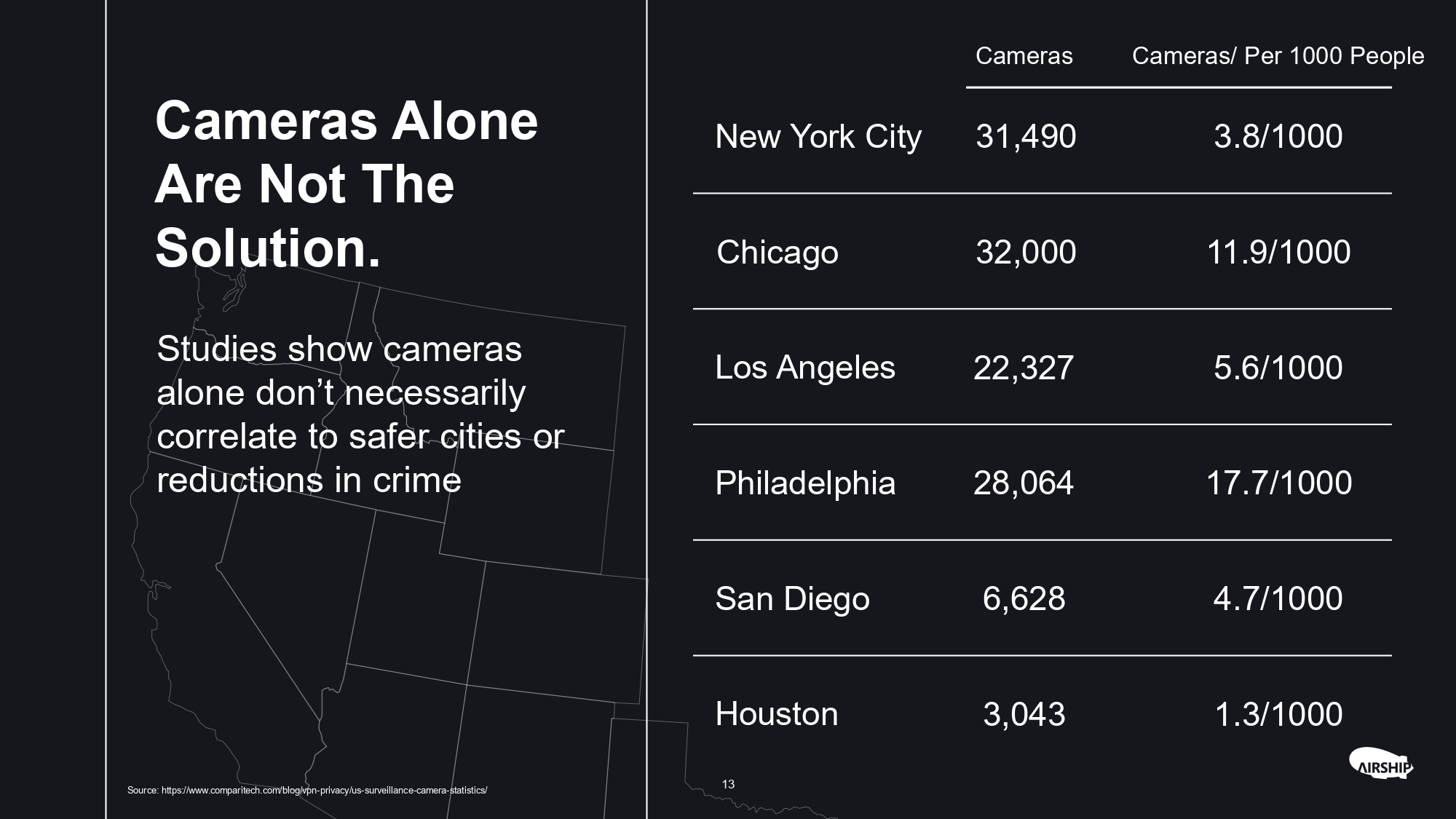

13 Cameras Alone Are Not The Solution. Studies show cameras alone don’t necessarily correlate to safer cities or reductions in crime Cameras/ Per 1000 People Cameras 3.8/1000 31,490 New York City 11.9/1000 32,000 Chicago 5.6/1000 22,327 Los Angeles 17.7/1000 28,064 Philadelphia 4.7/1000 6,628 San Diego 1.3/1000 3,043 Houston Source: https:// www.comparitech.com/blog/vpn - privacy/us - surveillance - camera - statistics/

14 $6.9BN $38.9BN 202 0 2030 E $0.9BN $3.5BN 18.8% CAGR 24.8% CAGR We Address Large and Rapidly Growing Markets Edge AI Software and Hardware SAM Edge AI Software Market (1) Edge AI Hardware Market (2) 2022 2029E (1) https://reports.valuates.com/market - reports/QYRE - Auto - 4139/global - edge - ai - software (2) https://reports.valuates.com/reports/ALLI - Manu - 1S54/edge - ai - hardware#:~:text=The%20global%20edge%20AI%20hardware,intelligence%2Dbased%20robots%20%26%20devices.

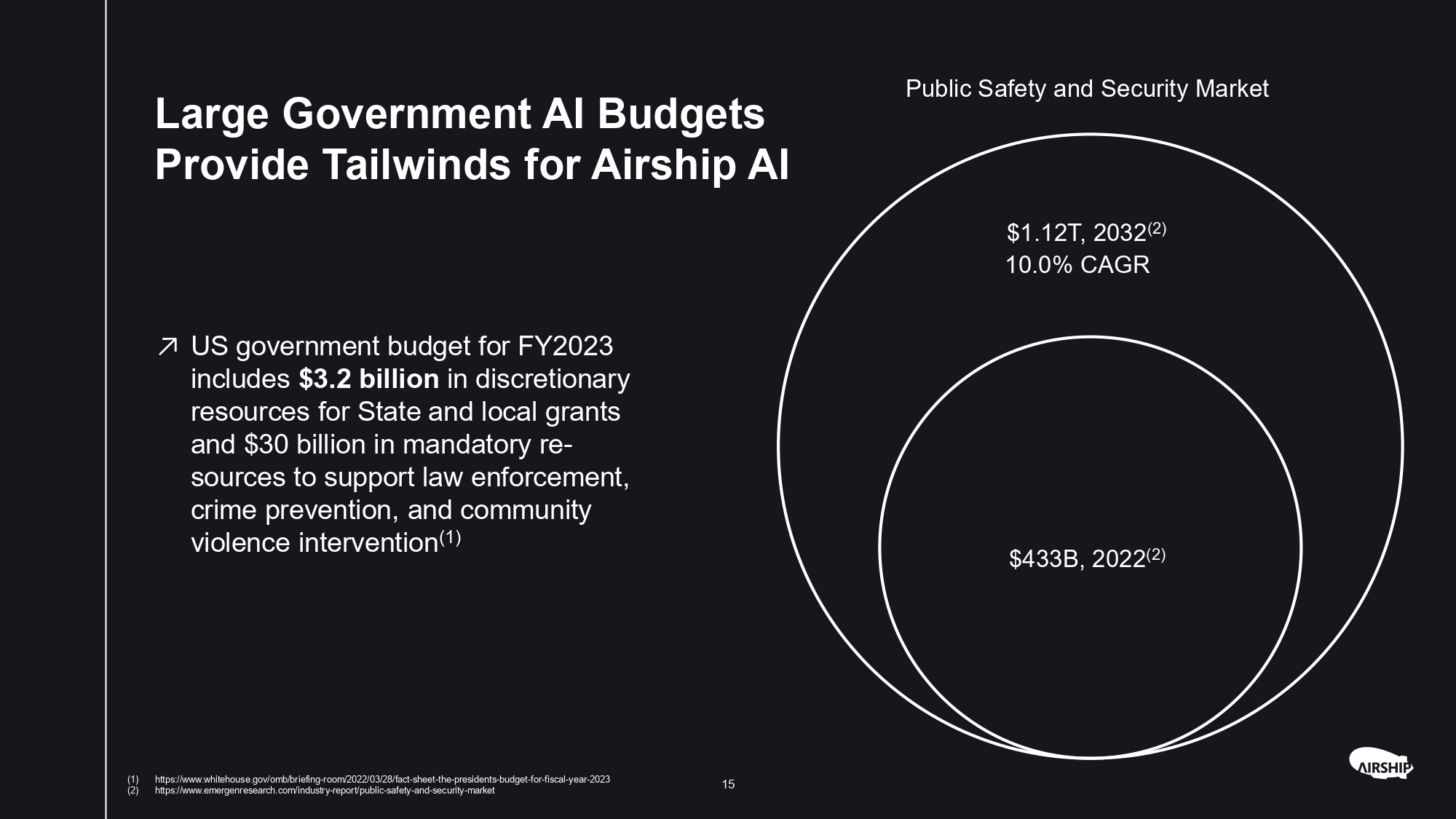

15 Public Safety and Security Market Large Government AI Budgets Provide Tailwinds for Airship AI $1.12T, 2032 (2) 10.0% CAGR $433B, 2022 (2) њ US government budget for FY2023 includes $3.2 billion in discretionary resources for State and local grants and $30 billion in mandatory re - sources to support law enforcement, crime prevention, and community violence intervention (1) (1) https:// www.whitehouse.gov/omb/briefing - room/2022/03/28/fact - sheet - the - presidents - budget - for - fiscal - year - 2023 (2) https:// www.emergenresearch.com/industry - report/public - safety - and - security - market

02 C omp a n y Overview 16

Airship AI At A Glance NTM Revenue | NTM EBITDA NTM Gross Margin 65% $162 . 9M $5 . 5 M+ Historical Customers Key Highlights $39.0M | $9.0M Department of Ho m e l an d S e c ur ity Depar t m ent of Justice U S S pe c i al Opera ti ons Command U S I n t e lli gen c e Community City of Miami Police Department Ch i c ago Police Ho m e Depot F ed Ex Texas Department of Public Safety Virginia State Police Turns Data Into Real - time Actionable Intelligence њ Gathers unstructured data from the edge, applies AI analytics, and provides visualization tools to improve decision making in mission critical environments 100% Employee Owned And Bootstrap Funded њ 100% U S o w ned and hea dq u a r te r e d i n R ed m o nd , W A w i th ~ 50 e m p l o y e e s The Standard In the Federal Investigative Space њ Supports the collection, management, analysis, and data sharing of digital based evidence for investigative purposes Open Architecture Can Integrate with Best of Breed Solutions V a li dat e d P i pe li ne Book i n g s & B illi n g s њ Works with major camera platforms and related sensors as well as many third - party analytic platforms providing true single - pane - of - glass data visualization. 17

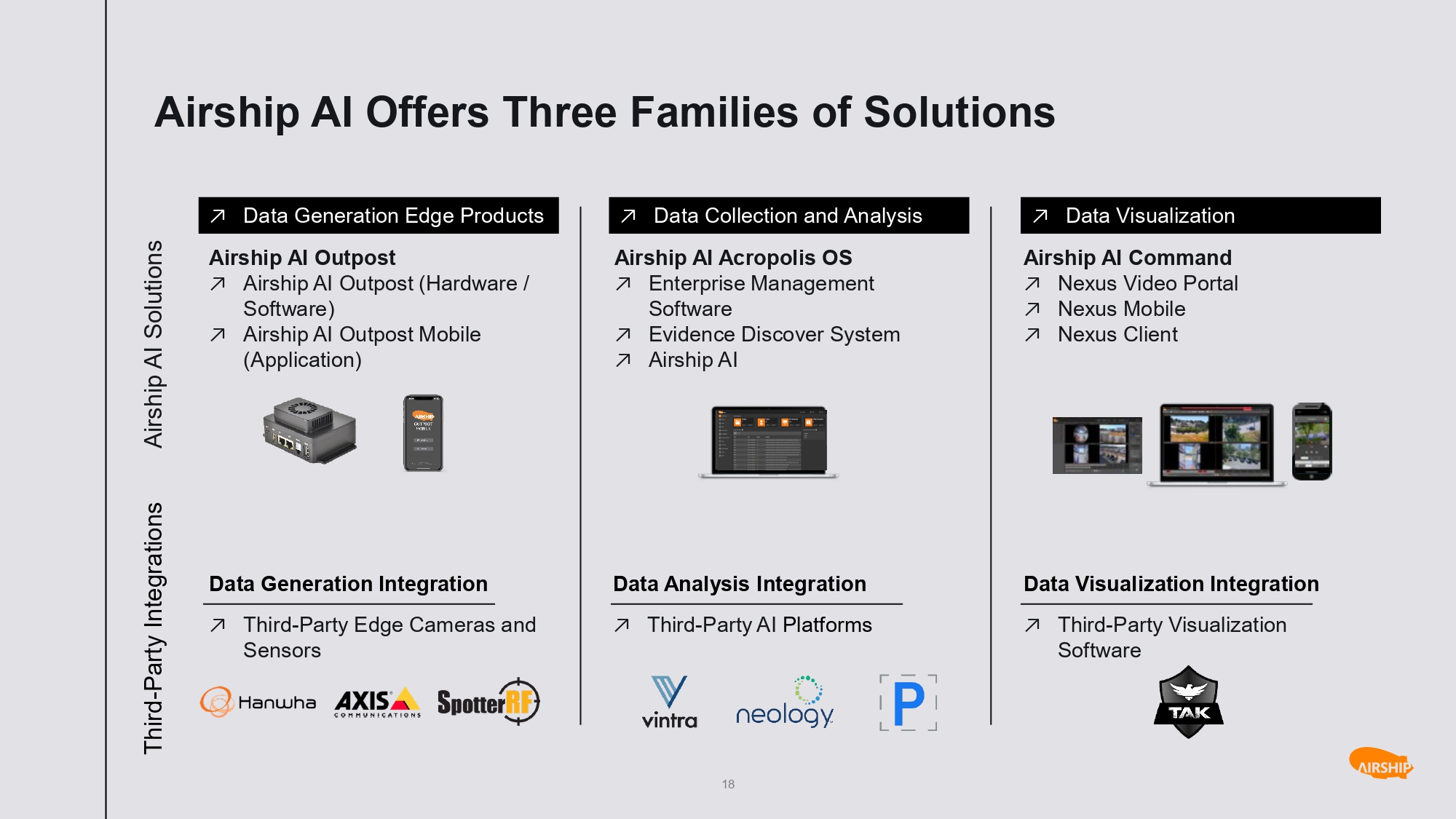

Airship AI Offers Three Families of Solutions A i r s h i p AI S o l ut i ons Third - Party Integrations Airship AI Outpost њ A ir s h ip A I O u t po s t ( H a r d w a re / Software) њ A ir s h ip A I O u t po s t M ob ile (Application) Data Generation Integration њ Third - Party Edge Cameras and Sensors њ Data Generation Edge Products Airship AI Acropolis OS њ En t e r p ri s e M anage m en t Software њ Evidence Discover System њ Air s hi p AI Data Analysis Integration њ T hir d - P a r t y AI Pl a tf or m s њ D a t a C o ll e ct i o n an d Ana l y s is Airship AI Command њ Nexus Video Portal њ Nexus Mobile њ Nexus Client Data Visualization Integration њ T hir d - Par t y V i s uali z a t io n Software њ Data Visualization 18

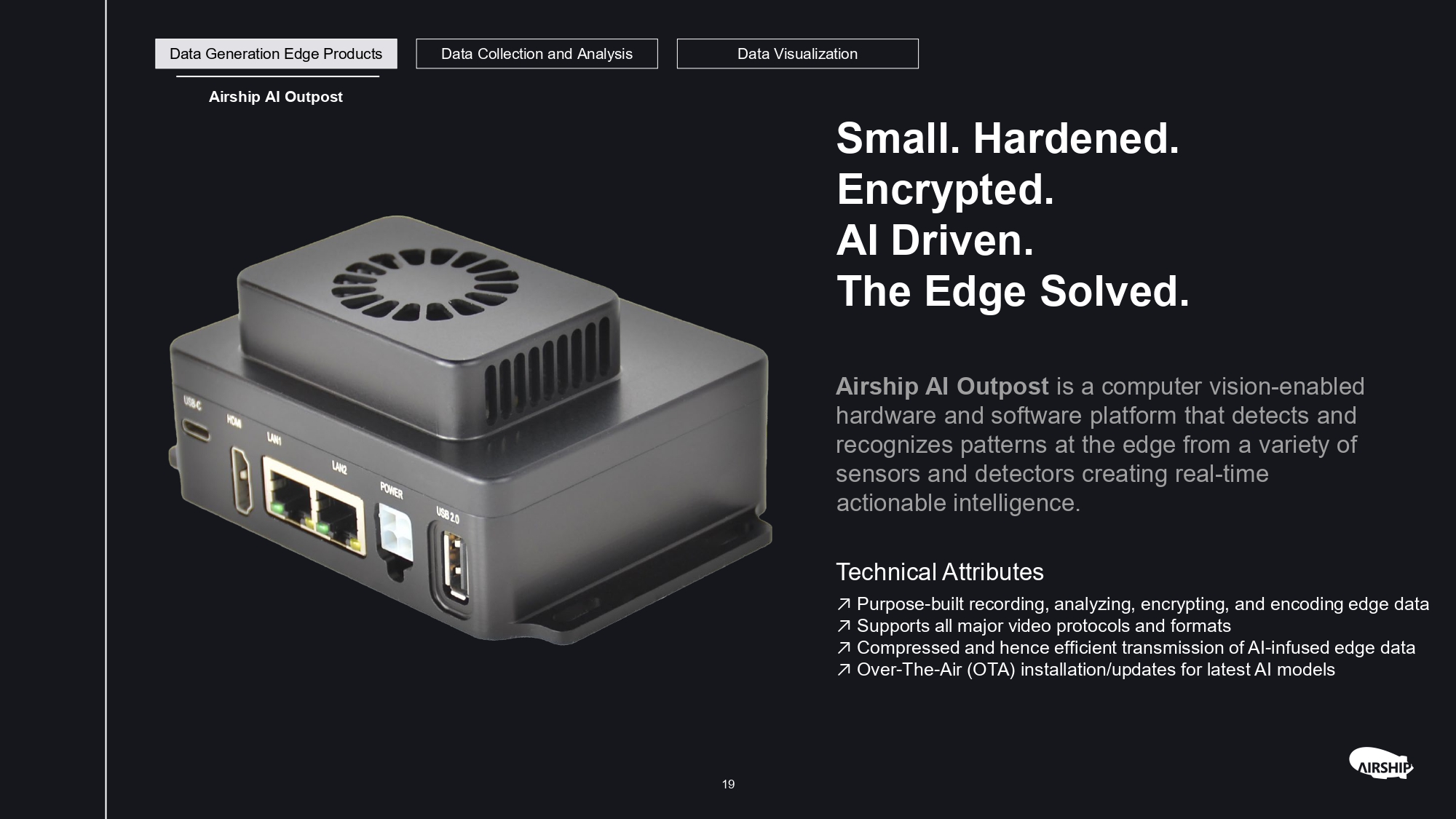

Small. Hardened. Encrypted. AI Driven. The Edge Solved. Airship AI Outpost is a computer vision - enabled hardware and software platform that detects and recognizes patterns at the edge from a variety of sensors and detectors creating real - time actionable intelligence. T e c hn ic a l Att r i butes њ Purpose - built recording, analyzing, encrypting, and encoding edge data њ Supports all major video protocols and formats њ Compressed and hence efficient transmission of AI - infused edge data њ Over - The - Air (OTA) installation/updates for latest AI models Data Generation Edge Products Data Collection and Analysis Data Visualization Airship AI Outpost 19

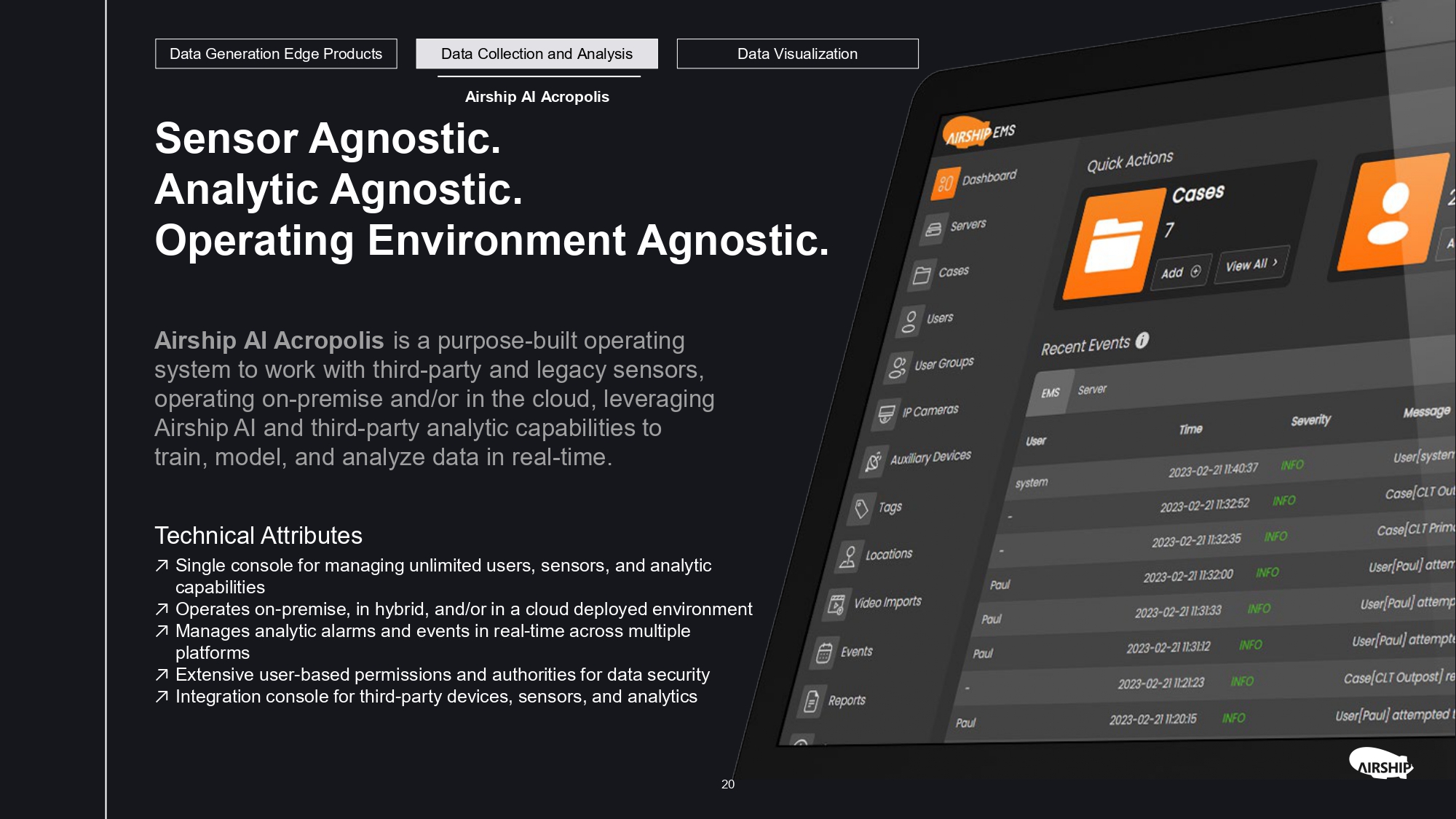

Airship AI Acropolis is a purpose - built operating system to work with third - party and legacy sensors, operating on - premise and/or in the cloud, leveraging Airship AI and third - party analytic capabilities to train, model, and analyze data in real - time. T e c hn ic a l Att r i butes њ Single console for managing unlimited users, sensors, and analytic capabilities њ Operates on - premise, in hybrid, and/or in a cloud deployed environment њ Manages analytic alarms and events in real - time across multiple platforms њ Extensive user - based permissions and authorities for data security њ Integration console for third - party devices, sensors, and analytics Data Generation Edge Products Data Collection and Analysis Data Visualization Airship AI Acropolis Sensor Agnostic. Analytic Agnostic. Operating Environment Agnostic. 20

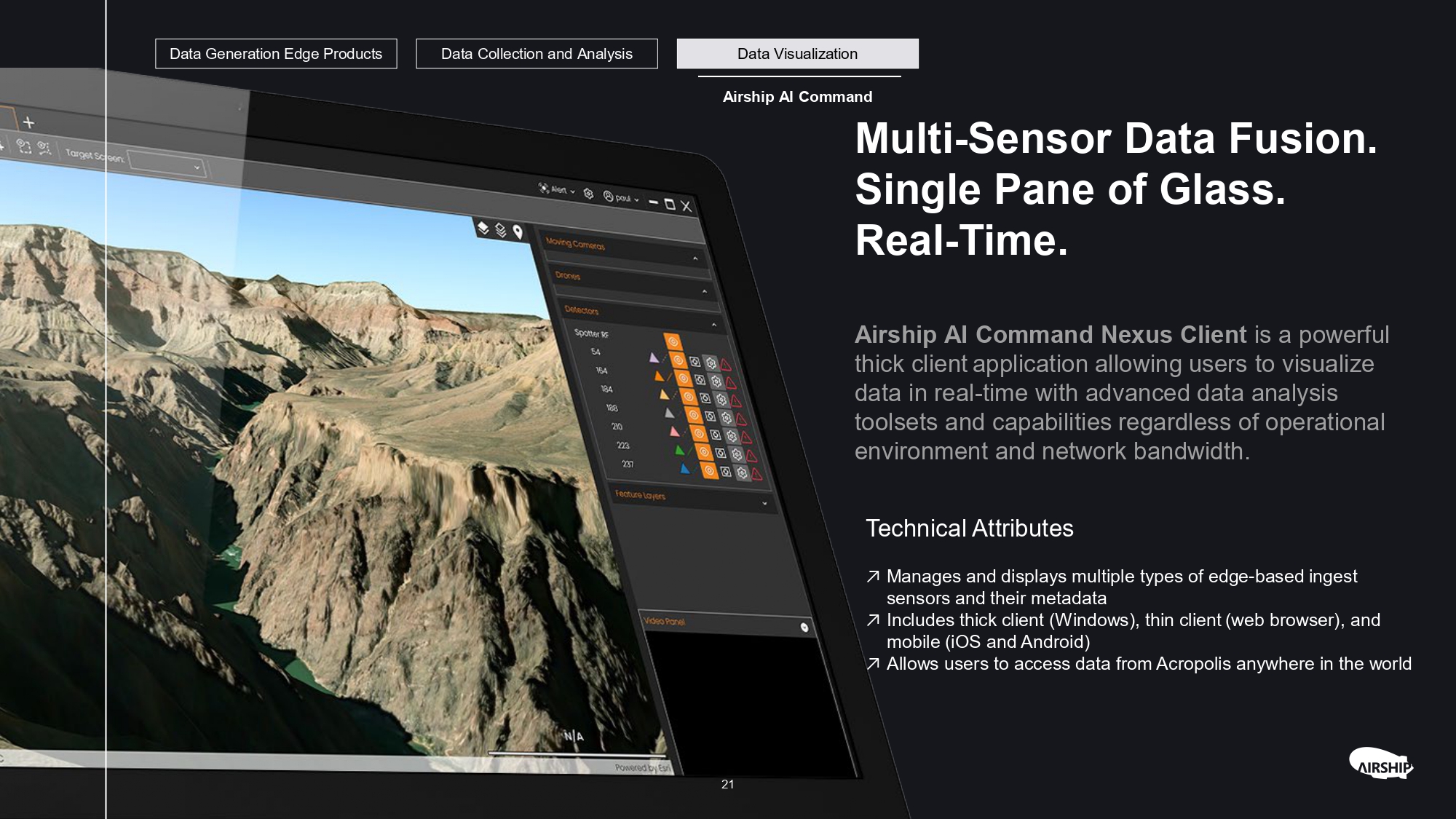

њ Manages and displays multiple types of edge - based ingest sensors and their metadata њ Includes thick client (Windows), thin client (web browser), and m ob il e (i OS and And r o i d) њ Allows users to access data from Acropolis anywhere in the world Data Generation Edge Products Data Collection and Analysis Data Visualization Airship AI Command Multi - Sensor Data Fusion. Single Pane of Glass. Real - Time. Airship AI Command Nexus Client is a powerful thick client application allowing users to visualize data in real - time with advanced data analysis toolsets and capabilities regardless of operational environment and network bandwidth. T e c hn ic a l Att r i butes 21

њ Complete end - to - end solution њ Early adopter of the NVIDIA chip for an IoT device which gives Airship AI and its customers a “bleeding edge solution” Diffe r ent ia ted End - to - End Technology Solution њ Authority To Operate (ATO) on Trusted US Government Managed Networks њ ATO in a FedRamp High (highest level) on US Government Cloud Networks Hardened and Secure Platform њ “Lens To Server” US based technical support from customer cleared Airship AI employees Superior Customer Experience њ Third - party edge sensor, device, analytic and detector agnostic њ Inter - operability avoids customers rip - and - replace Significant Cost Savings Why C u st o mers Choose Airship AI 22

Federal Law Enforcement Agency Customer Highlights Customer Mission To investigate, disrupt, and dismantle terrorist and criminal organizations in support of the safety of the United States and its territories Solution Objective Scalable enterprise - level cost - effective solution meeting agency goals for evidence collection, management, processing and exploitation in support of a wide range of operational requirements utilizing a diverse collection of third - party sensors and devices Airship AI Solution Deployed Airship AI Acropolis as a system of systems providing an enterprise - level video acquisition, storage, exploitation, and content management system for 45+ regional field offices. Expanded footprint to include interview rooms, mobile surveillance platforms, and other platforms used to collect evidence / support operational investigations 4000 * + C on c u rr ent S y stem Users 2000 * + Concurrent Sensors Connected 1000 * + Concurrent In v e s t i g at i ons M ana g ed Human Traffickers, Organized Crime Groups, Drug Cartels, and Criminals Prosecuted 2 3 * Company Estimates Source: Information on the slide is based on management's internal historical records and may be subject to change. This information may not be indicative of future results, which may differ materially. 23

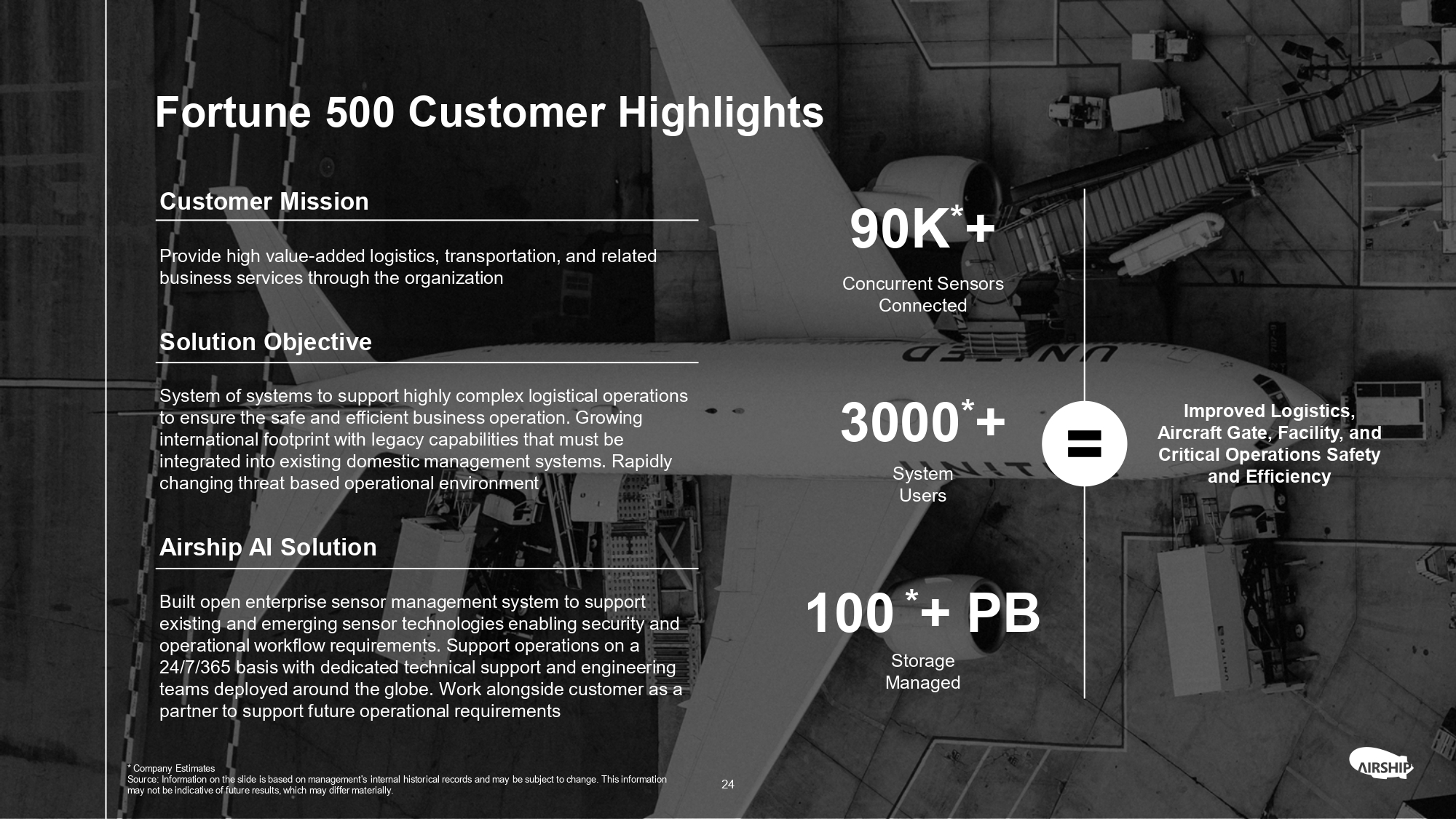

Fortune 500 Customer Highlights Customer Mission Provide high value - added logistics, transportation, and related business services through the organization Airship AI Solution Built open enterprise sensor management system to support existing and emerging sensor technologies enabling security and operational workflow requirements. Support operations on a 24/7/365 basis with dedicated technical support and engineering teams deployed around the globe. Work alongside customer as a partner to support future operational requirements Solution Objective System of systems to support highly complex logistical operations to ensure the safe and efficient business operation. Growing international footprint with legacy capabilities that must be integrated into existing domestic management systems. Rapidly changing threat based operational environment 100 * + P B Storage M ana g ed 90K * + Concurrent Sensors Connected 3000 * + S y stem Users Improved Logistics, Aircraft Gate, Facility, and Critical Operations Safety and Efficiency 2 3 * Company Estimates Source: Information on the slide is based on management's internal historical records and may be subject to change. This information may not be indicative of future results, which may differ materially. 24

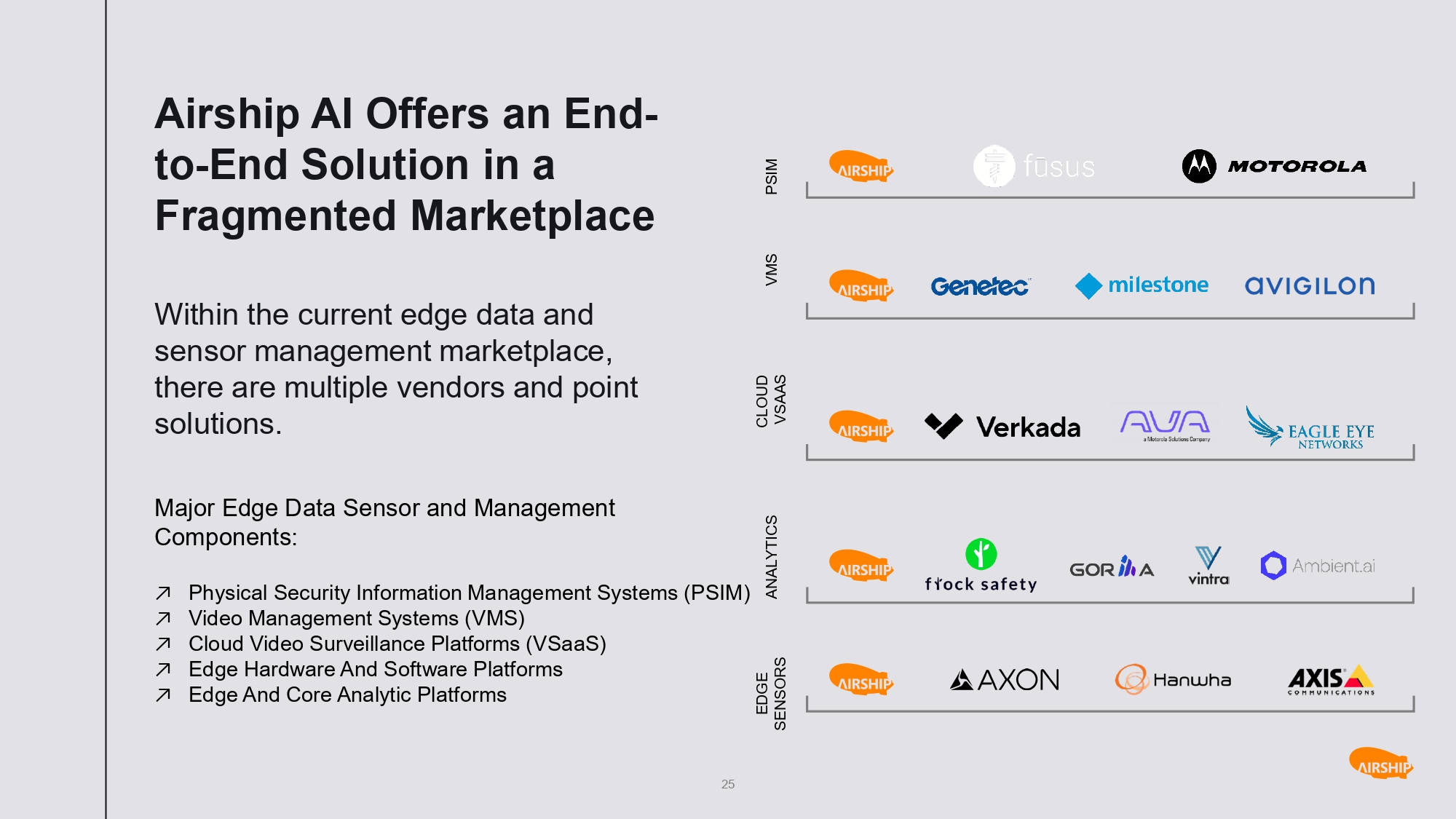

Airship AI Offers an End - to - End Solution in a Fragmented Marketplace Within the current edge data and sensor management marketplace, there are multiple vendors and point solutions. Major Edge Data Sensor and Management Components: њ Physical Security Information Management Systems (PSIM) њ Video Management Systems (VMS) њ Cloud Video Surveillance Platforms (VSaaS) њ Edg e H a r d w a re An d So ft w a re P l a tf o r m s њ Edg e An d C o re Ana l y t ic P l a tf o r m s PSI M C L O UD VSAAS ANALYTICS EDGE SE N S O RS VM S 25

Airship AI Leadership Team Victor Huang Chairman & CEO Yanda Ma CTO, Engineering Mark Scott CFO Peeyush Ranjan Board Member Derek Xu Founder & COO Chad Anderson VP, Operations Paul Allen President Whitney Dilling V P , C u st o m e r Experience 26

03 Financial O ve r v i ew 27

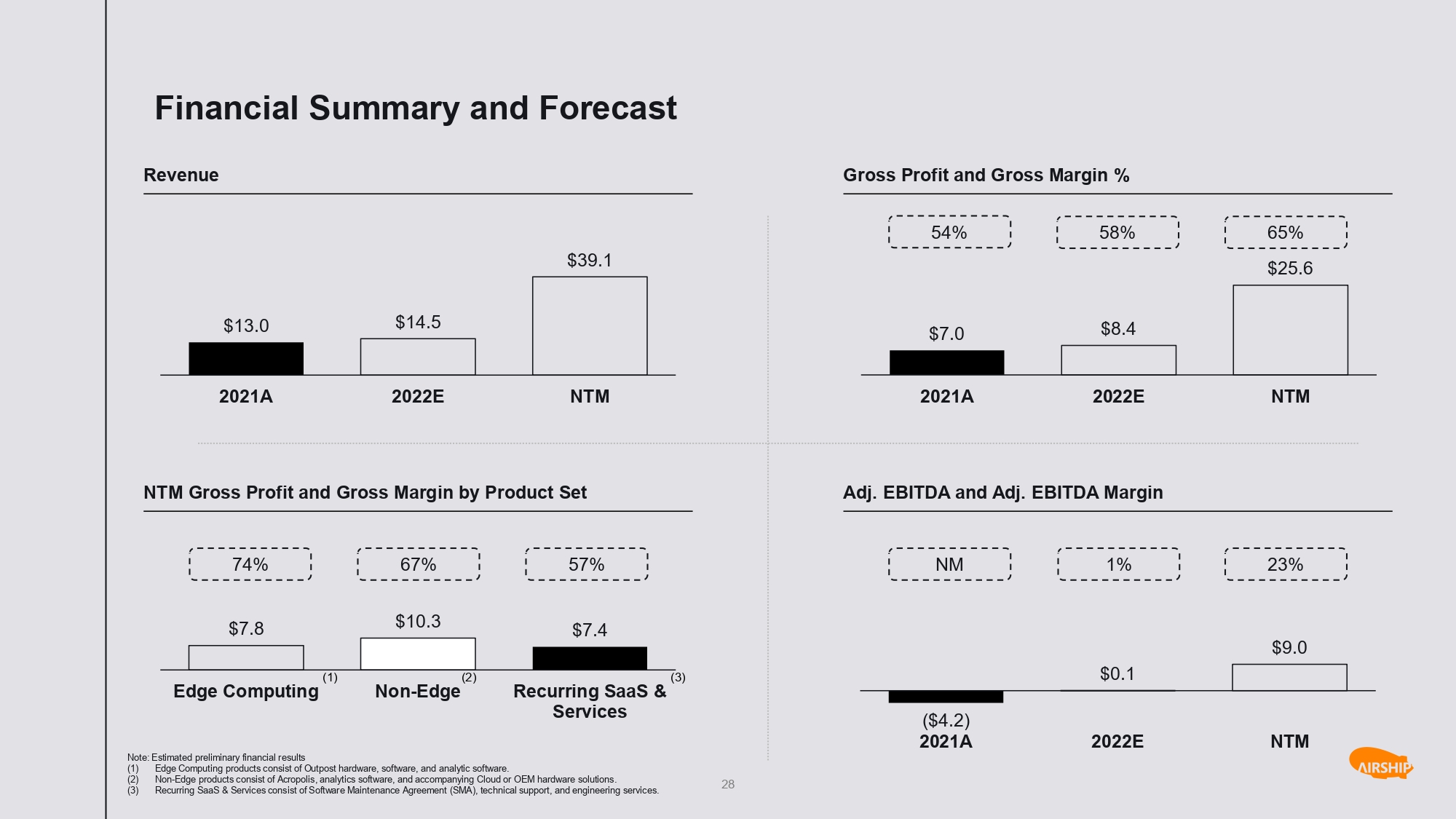

28 $7.0 $8.4 $25.6 2 0 21A 2 0 22E NT M Financial Summary and Forecast 54% 58% $13.0 $14.5 $39.1 2 0 2 1A 2 0 2 2E NT M Gross Profit and Gross Margin % Revenue $7.8 $10.3 $7.4 74% 67% 57% $0.1 $9.0 ($4.2) 2 0 21A 2 0 22E NT M NM 1% Adj. EBITDA and Adj. EBITDA Margin NTM Gross Profit and Gross Margin by Product Set (2) Non - Edge (1) Edge Computing (3) Recurring SaaS & Services Note: Estimated preliminary financial results (1) Edge Computing products consist of Outpost hardware, software, and analytic software. (2) Non - Edge products consist of Acropolis, analytics software, and accompanying Cloud or OEM hardware solutions. (3) Recurring SaaS & Services consist of Software Maintenance Agreement (SMA), technical support, and engineering services. 65% 23%

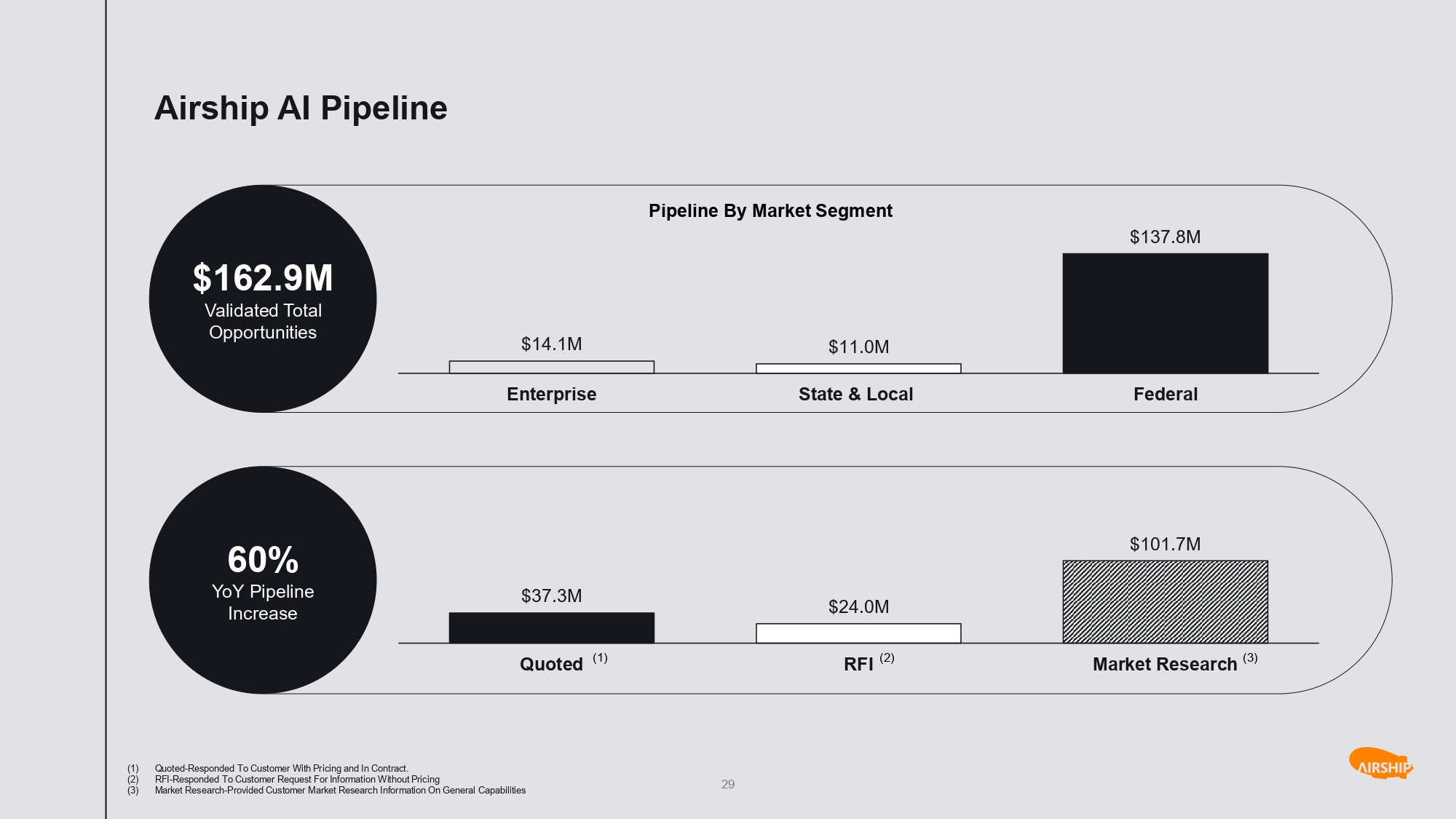

29 Airship AI Pipeline 60% Y oY P i pe li ne Increase $37.3M $24.0M $101.7M Quoted (1) RFI (2) Market Research (3) $14.1M $11.0M $137.8M E n t e r p r i se State & Local Federal Pipeline By Market Segment $162.9M V a li dat e d T otal Opportunities (1) Quoted - Responded To Customer With Pricing and In Contract. (2) RFI - Responded To Customer Request For Information Without Pricing (3) Market Research - Provided Customer Market Research Information On General Capabilities

30 04 T r a n sac t io n Overview

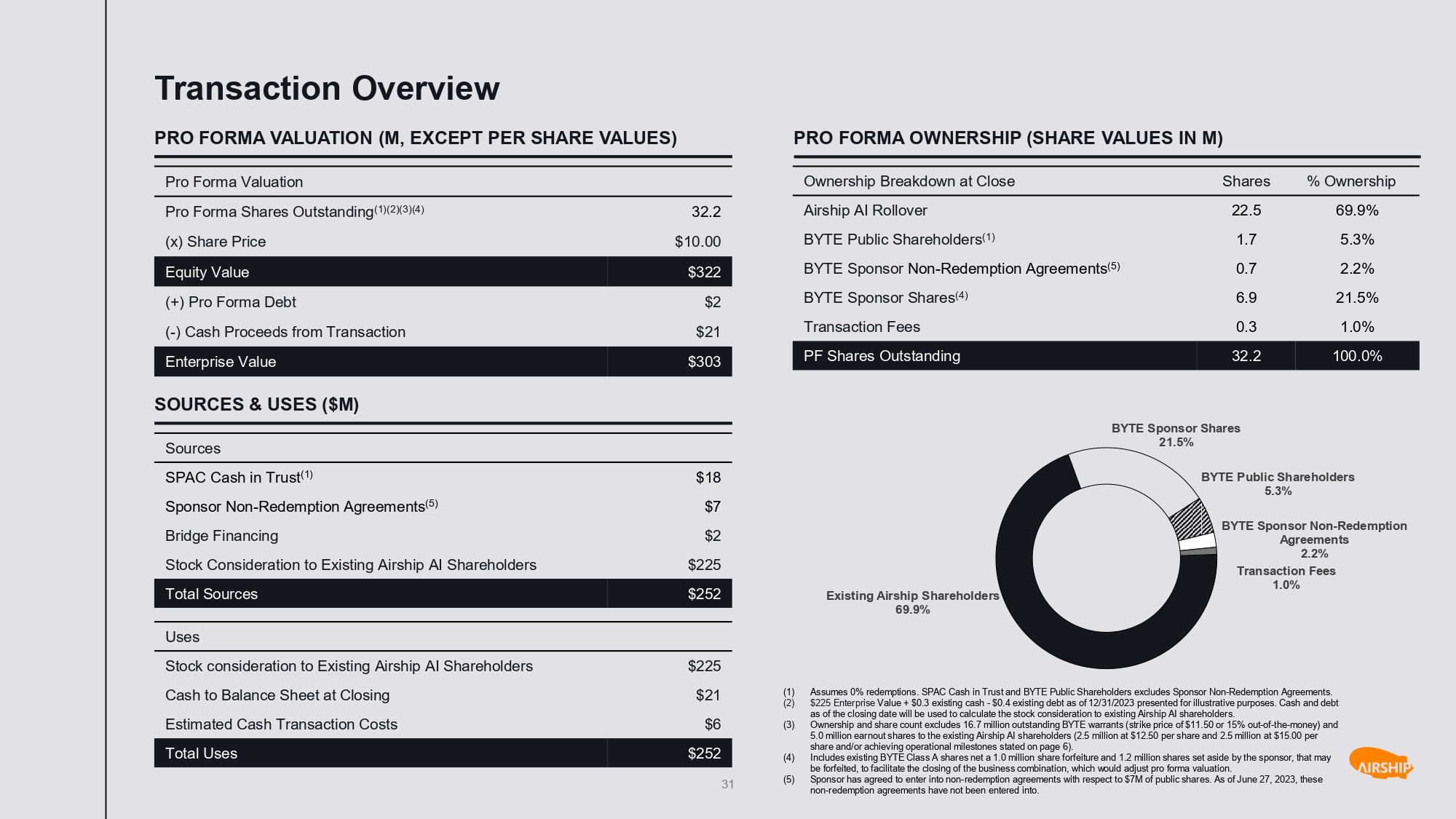

31 PRO FORMA OWNERSHIP (SHARE VALUES IN M) PRO FORMA VALUATION (M, EXCEPT PER SHARE VALUES) SOURCES & USES ($M) Transaction Overview Existing Airship Shareholders 69.9% BYTE Sponsor Shares 21.5% B Y T E Public Sh are hold er s 5.3% BYTE Sponsor Non - Redemption Agreements 2.2% T ra n sact ion F ees 1.0% Sources $18 SPAC Cash in Trust (1) $7 Sponsor Non - Redemption Agreements (5) $2 Bridge Financing $225 Stock Consideration to Existing Airship AI Shareholders $252 Total Sources Uses $225 Stock consideration to Existing Airship AI Shareholders $21 Cash to Balance Sheet at Closing $6 Estimated Cash Transaction Costs $252 Total Uses % Ownership Shares Ownership Breakdown at Close 69.9% 22.5 Airship AI Rollover 5.3% 1.7 BYTE Public Shareholders (1) 2.2% 0.7 BYTE Sponsor Non - Redemption Agreements (5) 21.5% 6.9 BYTE Sponsor Shares (4) 1.0% 0.3 Transaction Fees 100.0% 32.2 PF Shares Outstanding Pro Forma Valuation 32.2 Pro Forma Shares Outstanding (1)(2)(3)(4) $10.00 (x) Share Price $322 Equity Value $2 (+) Pro Forma Debt $21 ( - ) Cash Proceeds from Transaction $303 Enterprise Value (1) Assumes 0% redemptions. SPAC Cash in Trust and BYTE Public Shareholders excludes Sponsor Non - Redemption Agreements. (2) $225 Enterprise Value + $0.3 existing cash - $0.4 existing debt as of 12/31/2023 presented for illustrative purposes. Cash and debt as of the closing date will be used to calculate the stock consideration to existing Airship AI shareholders. (3) Ownership and share count excludes 16.7 million outstanding BYTE warrants (strike price of $11.50 or 15% out - of - the - money) and 5.0 million earnout shares to the existing Airship AI shareholders (2.5 million at $12.50 per share and 2.5 million at $15.00 per share and/or achieving operational milestones stated on page 6). (4) Includes existing BYTE Class A shares net a 1.0 million share forfeiture and 1.2 million shares set aside by the sponsor, that may be forfeited, to facilitate the closing of the business combination, which would adjust pro forma valuation. (5) Sponsor has agreed to enter into non - redemption agreements with respect to $7M of public shares. As of June 27, 2023, these non - redemption agreements have not been entered into.

32 Mean: 11.1x Peers Valuation Benchmarking Sources: S&P Capital IQ and Bloomberg as of 06/23/2023. See slide 31 for details and assumptions regarding Airship’s pro forma enterprise value. * Denotes Fiscal Year End * * Valuation represents a ~30% discount to peer group EV / NTM Revenue * * 7.8x 15.8x 13.3x 11.7x 11.3x 9.7x 9.6x 8.9x 8.6x Airship K eyence Sa m sa r a M ob i l eye Palantir A m ba r e l l a C3.ai, Inc. C ognex A xon

Risk Factors All references to the “Company,” “we,” “us” or “our” refer to Airship AI . The risks presented below are some of the general risks related to the business of the Company and such list is not exhaustive . The list below has been prepared solely for purposes of inclusion in this Presentation and not for any other purpose . You should carefully consider these risks and uncertainties, together with the information in the Company’s consolidated financial statements and related notes . Risks relating to the business of the Company will be disclosed in future documents filed or furnished by the Company and/or BYTE with the SEC . The risks presented in such filings will be consistent with those that would be required for a public company in their SEC filings, including with respect to the business and securities of the Company and may differ significantly from, and be more extensive than, those presented below . Risks Related to Our Business • Marginal profitability by the Company could have a material adverse effect on our business. • We may require substantial additional funding, which may not be available to us on acceptable terms, or at all, and, if not so available, may require us to delay, limit, reduce or cease our operations. • We have a limited operating history. There can be no assurance that we will be successful in growing our business. • We face intense competition within our industry and are subject to the effects of technology change. • Our proprietary products and services and service delivery may not operate properly, which could damage our reputation, give rise to claims against us, or divert application of our resources from other purposes, any of which could harm our business and operating results. • If critical components used in our products become scarce or unavailable, we may incur delays in delivering our products and providing services, which could damage our business. We rely on a sustainable supply chain. Any issues with this supply chain could adversely affect daily business operations and profitability. • If our security measures are breached or fail and unauthorized access is obtained to a customer’s data, our service may be perceived as insecure, the attractiveness of our services to current or potential customers may be reduced, and we may incur significant liabilities. • The loss of one or more of our significant customers, or any other reduction in the amount of revenue we derive from any such customer, would adversely affect our business, financial condition, results of operations and growth prospects. • We depend on key information systems and third - party service providers. • Cyber - attacks and security vulnerabilities could lead to reduced revenue, increased costs, liability claims, or harm to our competitive position. • Claims by others that we infringe their intellectual property could force us to incur significant costs or revise the way we conduct our business. • Our success depends upon the continued protection of our intellectual property rights, and we may be forced to incur substantial costs to maintain, defend, protect and enforce our intellectual property rights. • We depend on our management team and other key employees, and the loss of one or more of these employees or an inability to attract and retain highly skilled employees could adversely affect our business. • Our business depends, in part, on sales to government organizations, and significant changes in the contracting or fiscal policies of such government organizations could have an adverse effect on our business and operating results. • The COVID - 19 pandemic and the efforts to mitigate its impact may have an adverse effect on our business, liquidity, results of operations, financial condition and price of our securities. Risks Related to Legal, Compliance and Regulations • Changes in current laws or regulations or the imposition of new laws or regulations, or interpretations thereof, in the intelligence gathering and analysis sector or data management, by federal or state agencies in the United States or foreign jurisdictions could impair our ability to compete, and could materially harm our business, financial condition and results of operations . • Our management has limited experience in operating a public company . The requirements of being a public company may strain our resources and divert management’s attention, and the increases in legal, accounting and compliance expenses that will result from being a public company may be greater than we anticipate . • As a private company, we have not been required to document and test our internal controls over financial reporting nor has our management been required to certify the effectiveness of our internal controls and our auditors have not been required to opine on the effectiveness of our internal control over financial reporting . Failure to maintain adequate financial, information technology and management processes and controls could impair our ability to comply with the financial reporting and internal controls requirements for publicly traded companies, which could lead to errors in our financial reporting and adversely affect our business . • Current or future litigation or administrative proceedings could have a material adverse effect on our business, financial condition and results of operations . 33

Risks Related to BYTE and the business combination • BYTE and Airship may not be able to obtain the required shareholder approvals to consummate the business combination. • The consummation of the business combination is subject to unanticipated conditions that could adversely affect the combined company or the expected benefits of the business combination. • BYTE’s sponsor and directors have potential conflicts of interest in recommending that its shareholders vote in favor of approval of the business combination. • BYTE’s initial shareholders, officers, and directors may agree to vote in favor of the business combination, regardless of how its public shareholders vote. • BYTE’s sponsors, directors, officers, advisors, and their affiliates may enter into certain transactions, including purchasing shares or warrants from public shareholders, which may influence a vote on the business combination and reduce the public “float” of its securities . • Each of BYTE and the Company has incurred and will incur substantial costs in connection with the business combination, private placement, and related transactions, such as legal, accounting, consulting, and financial advisory fees, which will be paid out of the proceeds of the business combination and the private placement . • The ability of BYTE’s public shareholders to exercise redemption rights with respect to a large number of shares could deplete BYTE’s trust account prior to the business combination and thereby diminish the amount of working capital of the combined company . • Subsequent to the consummation of the business combination, the combined company may be required to take write - downs or write - offs and restructuring, impairment, or other charges that could have a significant negative effect on its financial condition, results of operations, and share price, which could cause you to lose some or all of your investment . Uncertainty about the effect of the business combination may affect the Company’s ability to retain key employees and integrate management structures and may materially impact the management, strategy, and results of its operation as a combined company . • BYTE is an emerging growth company subject to reduced disclosure requirements, and there is a risk that availing itself of such reduced disclosure requirements will make its common stock less attractive to investors . • The consummation of the business combination is subject to a number of conditions, and, if those conditions are not satisfied or waived, the business combination agreement may be terminated in accordance with its terms and the business combination may not be completed. • Legal proceedings in connection with the business combination, the outcomes of which are uncertain, could delay or prevent the completion of the business combination. • Changes to the proposed structure of the business combination may be required as a result of applicable laws or regulations. • BYTE and the Company will be subject to business uncertainties and contractual restrictions while the business combination is pending, and such uncertainty could have a material adverse effect on BYTE’s and the Company’s business, financial condition, and results of operations . • If BYTE is deemed to be an investment company under the Investment Company Act, it may be required to institute burdensome compliance requirements and its activities may be restricted, which may make it difficult to complete the business combination . • BYTE does not have a specified maximum redemption threshold . The absence of such a redemption threshold may make it possible for BYTE to complete its initial business combination with which a substantial majority of its shareholders or warrant holders do not agree . • BYTE’s sponsor and board of directors and affiliates of BYTE’s management team may receive a positive return on the 8 , 092 , 313 founder shares and 1 , 030 , 000 private placement warrants even if BYTE’s public shareholders experience a negative return on their investment after consummation of the business combination . • If BYTE is unable to complete the business combination or another initial business combination by March 23 , 2023 , BYTE will cease all operations except for the purpose of winding up, redeeming 100 % of the outstanding public shares, and, subject to the approval of its remaining shareholders and BYTE’s board of directors, dissolving and liquidating . In such event, third parties may bring claims against BYTE and, as a result, the proceeds held in the trust account could be reduced and the per - share liquidation price received by shareholders could be less than $ 10 . 00 per share . • The combined company may not be able to realize the anticipated benefits of the business combination . Risk Factors 34

Risk Factors Risks Related to the Combined Company’s Securities Following Consummation of the business combination • The requirements of being a public company may strain our resources, divert management’s attention, and affect our ability to attract and retain executive management and qualified board members. • If, following the business combination, securities or industry analysts do not publish or cease publishing research or reports about the combined company, its business, or its market, or if they change their recommendations regarding the combined company’s securities adversely, the price and trading volume of the combined company’s securities could decline. • An active trading market for the combined company’s shares of common stock may not be available on a consistent basis to provide shareholders with adequate liquidity. The stock price may be volatile, and shareholders could lose all or a significant part of their investment. • Following the completion of the business combination, Airship or its principal shareholders may control a significant percentage of the voting power and will be able to exert significant control over the direction of the business. Such concentration of ownership may affect the market demand for the combined company’s shares. • There can be no assurance that the common stock issued in connection with the business combination will be approved for listing on Nasdaq following the closing, or that the combined company will be able to comply with the continued listing standards of Nasdaq. • Because the Company has no current plans to pay cash dividends for the foreseeable future, you may not receive any return on investment unless you sell your shares for a price greater than that which you paid for them. • Investors in this offering will experience immediate and substantial dilution . Additionally, future sales and issuances of the combined company’s common stock or rights to purchase the combined company’s common stock, including pursuant to the combined company’s equity incentive plans, or other equity securities or securities convertible into the combined company’s common stock ,including BYTE’s outstanding warrants, could result in additional dilution of the percentage ownership of the combined company’s shareholders and could cause the stock price of the combined company’s common stock to decline even if its business is doing well . • Warrants will become exercisable for the combined company’s common stock, which would increase the number of shares eligible for future resale in the public market and result in dilution to the combined company’s shareholders and could also cause the market price of our common stock to drop significantly, even if our business is doing well . • The combined company may issue shares of preferred stock in the future, which could make it difficult for another company to acquire it or could otherwise adversely affect holders of its common stock . • Shareholders will experience immediate dilution as a consequence of the issuance of common stock as consideration in the business combination. Having a minority share position may reduce the influence that shareholders have on the management of the Company. • If we fail to establish and maintain effective internal controls, our ability to produce accurate and timely financial statements could be impaired, which could harm our operating results, investors’ views of us, and, as a result, the value of our common stock. • Our internal controls and procedures may not prevent or detect all errors or acts of fraud. • Changes to, or application of different, financial accounting standards (including PCAOB standards) may result in changes to our results of operations, which changes could be material. • Following the business combination, provisions of Cayman Islands law, could delay or prevent a change in control, which could reduce the market price the combined company’s common stock and frustrate attempts by our shareholders to make changes in management. • The combined company will incur significant expenses as a result of being a public company, which could materially adversely affect the combined company’s business, results of operations, and financial condition. \ • Our quarterly operating results may fluctuate significantly or may fall below the expectations of investors or securities analysts, each of which may cause our stock price to fluctuate or decline. • After the completion of this offering, we may be at an increased risk of securities class action litigation. Risks Related to the Private Placement • Securities issued in the private placement will be restricted securities and will not be registered and therefore will be subject to securities laws restrictions on transferability until such time as the resale of such securities is registered or an exemption from registration is available. • There can be no assurance that BYTE or the Company will be able to raise sufficient capital to consummate the business combination or for use by the combined company following the business combination. • We have broad discretion in how we use the proceeds of this offering and may not use these proceeds effectively, which could affect our results of operations and cause our stock price to decline. 35

05 Appendix 36

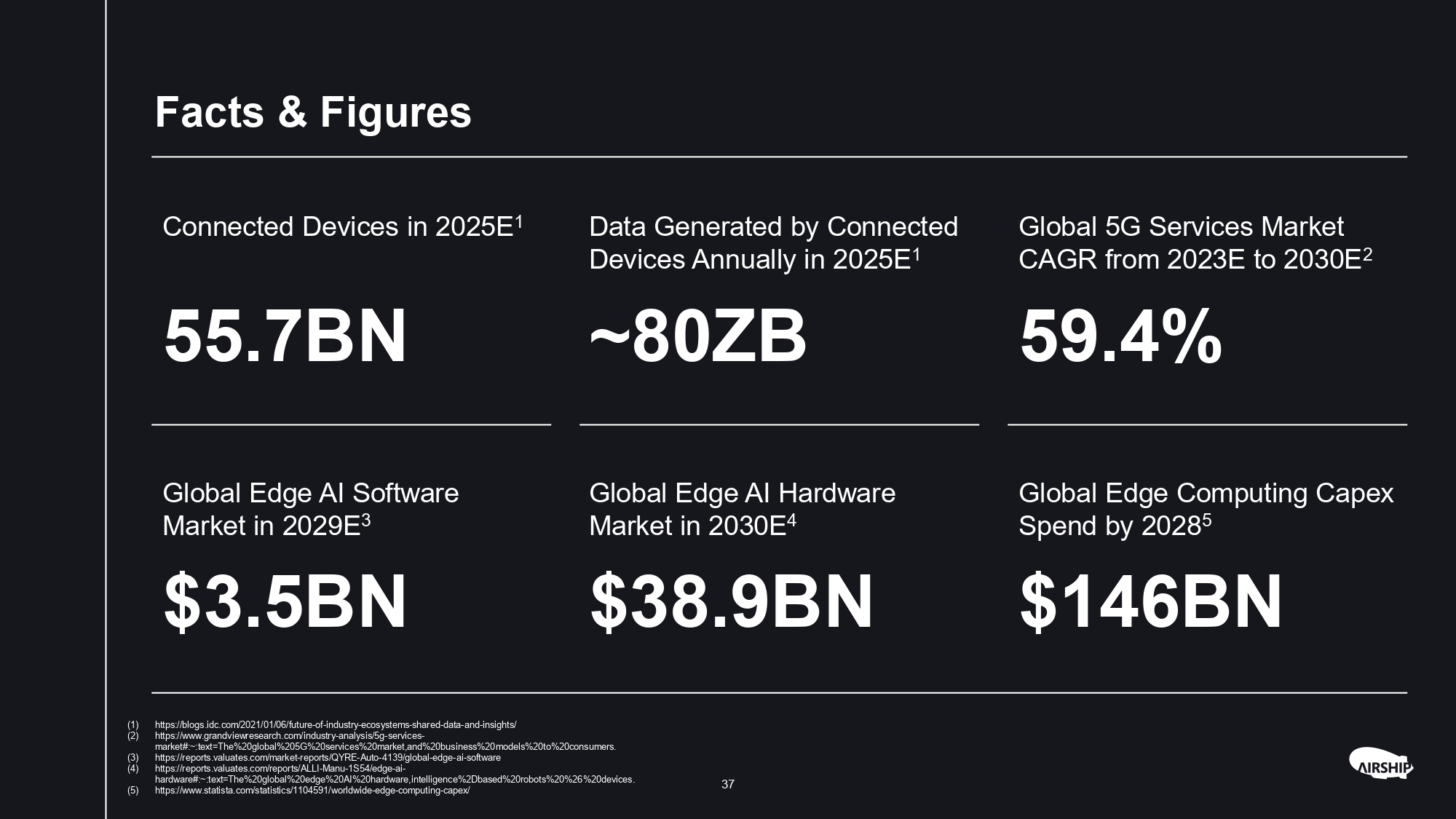

Facts & Figures Global 5G Services Market CAGR from 2023E to 2030E 2 59.4% Data Generated by Connected Devices Annually in 2025E 1 ~80ZB Connected Devices in 2025E 1 55.7BN Global Edge Computing Capex Spend by 2028 5 Global Edge AI Hardware Market in 2030E 4 Global Edge AI Software Market in 2029E 3 $146BN $38.9BN $3.5BN https://blogs.idc.com/2021/01/06/future - of - industry - ecosystems - shared - data - and - insights/ (1) https:// www.grandviewresearch.com/industry - analysis/5g - services - (2) market#:~:text=The%20global%205G%20services%20market,and%20business%20models%20to%20consumers. https://reports.valuates.com/market - reports/QYRE - Auto - 4139/global - edge - ai - software (3) https://reports.valuates.com/reports/ALLI - Manu - 1S54/edge - ai - (4) 37 hardware#:~:text=The%20global%20edge%20AI%20hardware,intelligence%2Dbased%20robots%20%26%20devices. https ://w ww .stati s ta.com/statistics/1104591/worldwide - edge - computing - capex/ (5)

Best of Breed Partners Supporting Blue Chip Customers Airship AI partners with industry leading edge data and analytic companies to build on and integrate with as we have expanded our full - spectrum offerings to support customer requirements across a wide variety of emerging operational challenges Airship AI chose NVIDIA on which to develop our edge analytic software platform, leveraging their industry leading small form factor Jetson platform and existing investments in the application framework and developer tools around Deep Stream to speed up our AI model development and deployment process . Airship AI chose Dell around which to build and tailor our enterprise management platform, leveraging their expansive experience in providing enterprise grade hardware and storage solutions . Airship AI chose AWS around which to build and tailor our cloud Software As A Service (SaaS) offering, leveraging their expansive cloud toolset for managing complex datasets and analytics for mission critical customer environments . 38

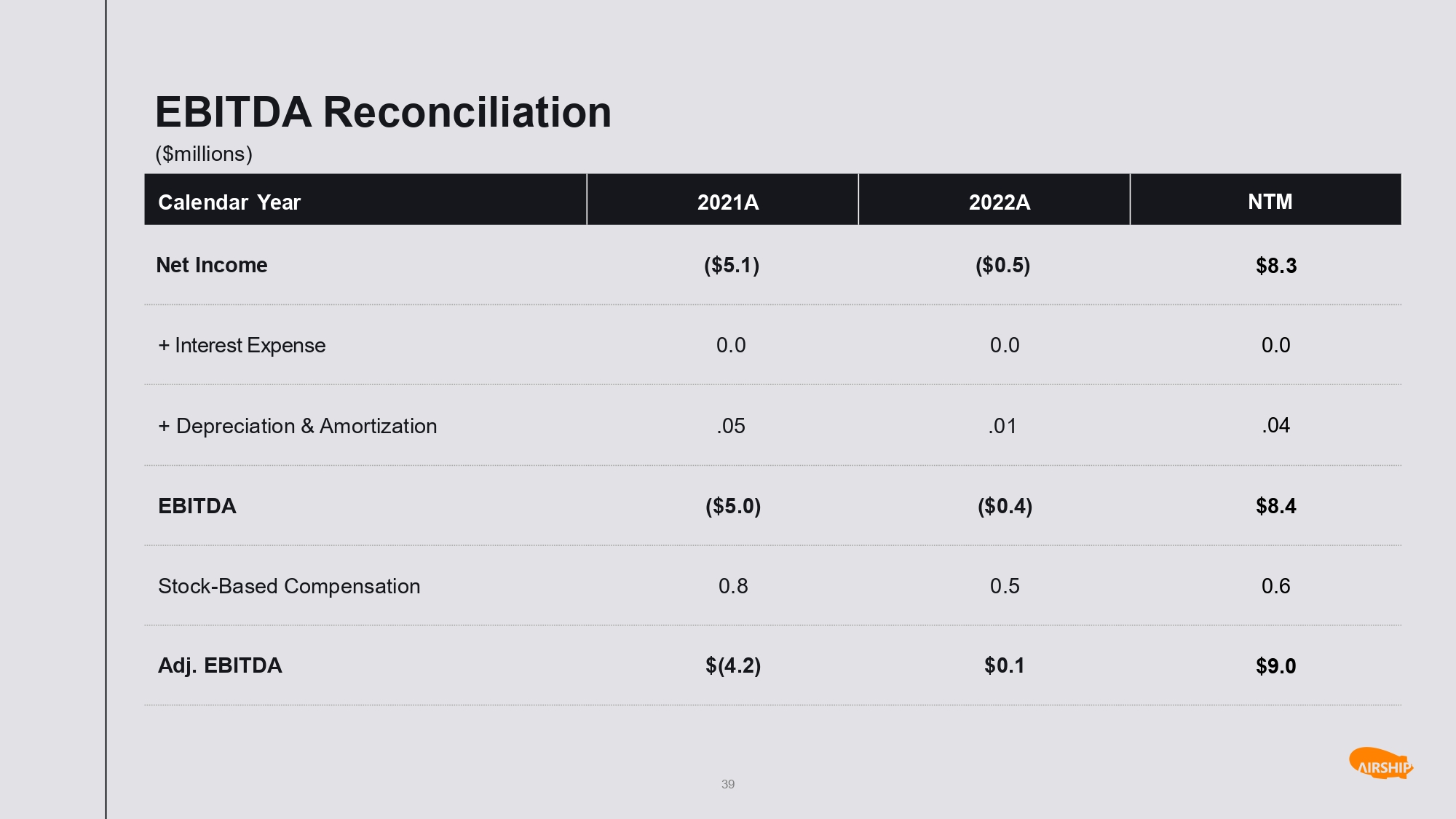

NTM 2022A 2021A Calendar Year $8.3 ($0.5) ($5.1) Net Income 0.0 0.0 0.0 + I n t ere s t E x pen s e .04 .01 .05 + Depreciation & Amortization $8.4 ($0.4) ($5.0) EBITDA 0.6 0.5 0.8 Stock - Based Compensation $9.0 $0.1 $(4.2) Adj. EBITDA 39 EBITDA Reconciliation ($millions)