UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to § 240.14a-12 |

| AIRSHIP AI HOLDINGS, INC. |

| (Name of Registrant as Specified in Its Charter) |

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

AIRSHIP AI HOLDINGS, INC.

8210 154th Ave NE

Redmond, WA 98052

November 12, 2024

Dear Stockholders:

You are cordially invited to attend the 2024 Annual Meeting of Stockholders of Airship AI Holdings, Inc. (the “Company”) and any adjournments or postponements thereof (the “Annual Meeting”). The Annual Meeting will be held on Friday, December 13, 2024, at 1:30 p.m., Pacific time. This year’s Annual Meeting will be a completely virtual meeting, which will be conducted via live webcast on the Internet, providing a consistent experience to all stockholders regardless of location. You will be able to attend the meeting online, vote your shares electronically and submit your questions during the Annual Meeting by visiting https://web.lumiconnect.com/209220134. There will not be a physical meeting and you will not be able to attend the Annual Meeting in person. The Company believes that a virtual stockholder meeting provides greater access to those who may want to attend and therefore has chosen this over an in-person meeting. Details regarding how to participate in the meeting online and the business to be conducted at the Annual Meeting are more fully described in the accompanying Proxy Statement.

Stockholders of record as of the close of business on November 4, 2024 are entitled to notice of, and are cordially invited to, attend this virtual Annual Meeting, or any adjournments or postponements thereof.

YOUR VOTE IS IMPORTANT. Whether or not you plan to attend the virtual Annual Meeting, we request that you submit your vote via the Internet, telephone or mail. To ensure that your vote is recorded promptly, please vote as soon as possible, even if you plan to attend the meeting, by submitting your proxy by telephone, via the Internet at the address listed on the Internet Notice or proxy card or, if you received paper copies of these materials, by signing, dating and returning the proxy card, which requires no postage if mailed in the United States. We encourage stockholders to submit their proxy via the Internet or telephone.

This notice, the attached Proxy Statement, and the Company’s Annual Report on Form 10-K for the fiscal year ending December 31, 2023 will be first transmitted to stockholders on or about November 13, 2024.

|

|

| By order of the Board of Directors, |

|

|

|

|

|

|

|

|

| /s/ Victor Huang |

|

|

|

| Victor Huang |

|

|

|

| Chairman and Chief Executive Officer |

|

Redmond, Washington

November 12, 2024

AIRSHIP AI HOLDINGS, INC.

8210 154th Ave NE

Redmond, WA 98052

Notice of the 2024 Annual Meeting of Stockholders

| Date: | Friday, December 13, 2024 |

| Time: | 1:30 p.m. Pacific time |

| Location: | https://web.lumiconnect.com/209220134 |

|

|

|

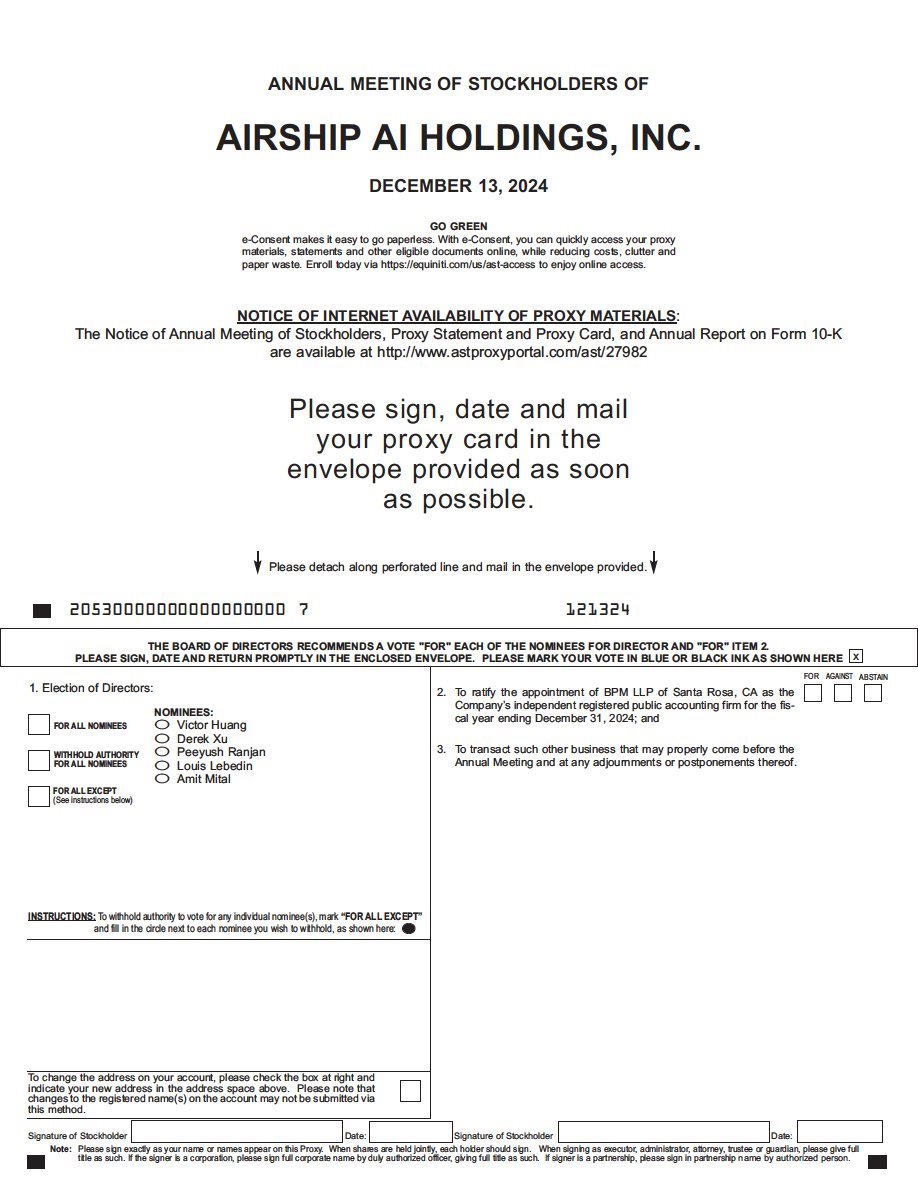

| Proposals: | 1. To elect five nominees to serve on the Board of Directors of the Company (the “Board”) until the 2025 Annual Meeting of Stockholders;

2. To ratify the appointment of BPM LLP of Santa Rosa, CA as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024; and

3. To transact such other business that may properly come before the Annual Meeting and at any adjournments or postponements thereof. |

|

|

|

| Who Can Vote: | Stockholders of record at the close of business on November 4, 2024. |

|

|

|

| How You Can Vote: | IMPORTANT NOTICE REGARDING INTERNET AVAILABILITY OF PROXY MATERIALS

The attached Proxy Statement and our Annual Report on Form 10-K, as filed with the Securities and Exchange Commission, are available on the Internet at http://www.astproxyportal.com/ast/27982. The Annual Report includes our audited consolidated financial statements for the fiscal year ended December 31, 2023.

|

|

| It is important that your shares be represented and voted at the meeting. You can vote your shares via the Internet or telephone or by mail by completing and returning the accompanying proxy card in the accompanying self-addressed envelope. Voting instructions are printed on the proxy card. You may revoke a proxy at any time before its exercise at the meeting by following the instructions in the accompanying Proxy Statement. |

|

|

| By order of the Board of Directors, |

|

|

|

|

|

|

|

|

| /s/ Victor Huang |

|

|

|

| Victor Huang |

|

|

|

| Chairman and Chief Executive Officer |

|

Redmond, Washington

November 12, 2024

| Your Vote Is Important. Whether You Own One Share or Many, Your Prompt Cooperation in Voting Your Proxy is Greatly Appreciated. |

2024 ANNUAL MEETING OF STOCKHOLDERS

PROXY STATEMENT

| 3 | |

|

|

|

| QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS | |

|

|

|

| 8 | |

|

|

|

| 10 | |

|

|

|

| 14 | |

|

|

|

| 20 | |

|

|

|

| 22 | |

|

|

|

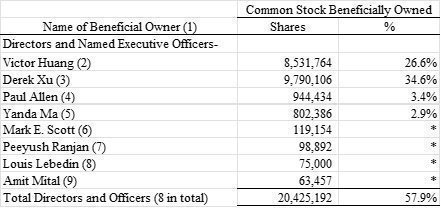

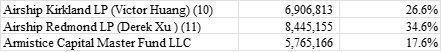

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 21 |

|

|

|

| 26 | |

|

|

|

| PROPOSAL 2 – RATIFICATION OF THE APPOINTMENT OF OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 27 |

|

|

|

| OTHER INFORMATION |

|

| 2 |

| Table of Contents |

FOR THE

2024 Annual Meeting of Stockholders

OF

AIRSHIP AI HOLDINGS, INC.

Our Board of Directors (the “Board”) has made this Proxy Statement and related materials available to you on the Internet, or at your request has delivered printed versions to you by mail, in connection with the Board’s solicitation of proxies for our 2024 Annual Meeting of Stockholders (the “Annual Meeting”), and any adjournments or postponements thereof. If you requested printed versions of these materials by mail, they will also include a proxy card for the Annual Meeting.

Pursuant to rules adopted by the Securities and Exchange Commission (“SEC”), we are providing access to our proxy materials over the Internet. Accordingly, we are sending a Notice of Internet Availability of Proxy Materials (the “Notice”) to our stockholders of record and beneficial owners as of the record date identified below. The mailing of the Notice, Proxy Statement and related materials to our stockholders as of the Record Date (as defined below) is scheduled to begin on or about November 13, 2024.

IMPORTANT NOTICE REGARDING THE INTERNET AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL STOCKHOLDERS MEETING TO BE HELD ON December 13, 2024: This Proxy Statement, the accompanying proxy card or voting instruction card and our 2023 Annual Report on Form 10-K are available at http://www.astproxyportal.com/ast/27982 and on our website at www. https://ir.airship.ai/.

In this Proxy Statement, the terms the “Company,” “Airship AI,” “we,” “us,” and “our” refer to Airship AI Holdings, Inc. and its subsidiaries, including Airship AI, Inc., a Washington corporation (“Airship”). The mailing address of our principal executive offices is 8210 154th Ave NE, Redmond, WA 98052, and our telephone number is (877) 462-4250.

What is a proxy?

A proxy is your legal designation of another person or persons (the “proxy”) to vote on your behalf. By completing and returning the enclosed proxy card, you are giving Victor Huang, the Company’s Chief Executive Officer, and Mark E. Scott, the Company’s Chief Financial Officer, or either of them, the authority to vote your shares in the manner you indicate on your proxy card.

Why did I receive more than one proxy card?

You will receive multiple proxy cards if you hold your shares in different ways (e.g., joint tenancy, trusts, and custodial accounts) or in multiple accounts. If your shares are held by a broker (i.e., in “street name”), you will receive your proxy card or other voting information from your broker, and you will return your proxy card or cards to your broker. You should vote on and sign each proxy card you receive.

How to Attend the Virtual Annual Meeting

You may attend the Annual Meeting online only if you are a Airship AI’s stockholder who is entitled to vote at the Annual Meeting, or if you hold a valid proxy for the Annual Meeting. The Annual Meeting will be a completely virtual meeting and is scheduled to be held on December 13, 2024 at 1:30 p.m. Pacific time, via live webcast through the following link: https://web.lumiconnect.com/209220134. You will need the 16-digit control number provided in the Notice of Internet Availability of Proxy Materials, on your proxy card (if applicable) or on the instructions that accompanied your proxy materials. You may attend the Annual Meeting, vote, and submit a question during the Annual Meeting by visiting https://web.lumiconnect.com/209220134 and using your 16-digit control number. If you are not a stockholder of record but hold shares as a beneficial owner in “street name,” you should contact your bank or broker to obtain your 16-digit control number or otherwise vote through the bank or broker. If you lose your 16-digit control number, you may join the Annual Meeting as a “Guest” but you will not be able to vote, ask questions or access the list of stockholders as of the Record Date. The meeting webcast will begin promptly at 1:30 p.m., Pacific time. Online check-in will begin at 1:15 p.m. Pacific time, and you should allow ample time for check-in procedures.

| 3 |

| Table of Contents |

Reasons for Virtual Annual Meeting

We believe that hosting a virtual meeting this year is in the best interests of the Company and its stockholders. A virtual meeting enables increased stockholder attendance and participation because stockholders can participate from any location around the world. There will not be a physical meeting location and you will not be able to attend the meeting in person.

Technical Difficulties

We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual meeting website. If you encounter any technical difficulties with the virtual meeting platform on the meeting date, please call the technical support number to be provided on the website portal used to access the virtual meeting.

Question and Answer Session

As part of the Annual Meeting, we will hold a live Q&A session, during which we intend to answer appropriate questions submitted by stockholders during the meeting that are pertinent to the Company and the meeting matters. The Company will endeavor to answer as many questions submitted by stockholders as time permits. Only stockholders that have accessed the Annual Meeting as a stockholder (rather than a “Guest”) by following the procedures outlined above in “How to Attend the Virtual Meeting” will be permitted to submit questions during the Annual Meeting. Each stockholder is limited to no more than two questions. Questions should be succinct and only cover a single topic. We will not address questions that are, among other things:

|

| · | irrelevant to the business of the Company or to the business of the Annual Meeting; |

|

|

|

|

|

| · | related to material non-public information of the Company, including the status or results of our business since our last Quarterly Report on Form 10-Q; |

|

|

|

|

|

| · | related to any pending, threatened or ongoing litigation; |

|

|

|

|

|

| · | related to personal grievances; |

|

|

|

|

|

| · | derogatory references to individuals or that are otherwise in bad taste; |

|

|

|

|

|

| · | substantially repetitious of questions already made by another stockholder; |

|

|

|

|

|

| · | in excess of the two question limit; |

|

|

|

|

|

| · | in furtherance of the stockholder’s personal or business interests; or |

|

|

|

|

|

| · | out of order or not otherwise suitable for the conduct of the Annual Meeting as determined by the Chair or Secretary in their reasonable judgment. |

Additional information regarding the Q&A session will be available in the “Rules of Conduct” available on the Annual Meeting webpage for stockholders that have accessed the Annual Meeting as a stockholder (rather than a “Guest”) by following the procedures outlined above in “How to Attend the Virtual Meeting”.

| 4 |

| Table of Contents |

Voting Information

Who is qualified to vote?

You are qualified to receive notice of and to vote at the Annual Meeting if you own shares of common stock of the Company as of the close of business on our record date of November 4, 2024 (the “Record Date”).

How many shares of Common Stock may vote at the Annual Meeting?

As of the close of business on November 4, 2024, the Record Date for determination of stockholders entitled to vote at the Annual Meeting, there were outstanding 26,954,871 shares of our common stock, par value $0.0001 per share, all of which are entitled to vote with respect to all matters to be acted upon at the Annual Meeting. Each stockholder of record is entitled to one vote for each share of our common stock held by such stockholder.

What is the difference between a “stockholder of record” and a “street name” holder?

These terms describe how your shares are held. If your shares are registered directly in your name with Equiniti Trust Company, LLC, the Company’s transfer agent, you are a “stockholder of record.” If your shares are held in the name of a brokerage, bank, trust or other nominee as a custodian, you are a “street name” holder.

How do I vote my shares?

If you are a “stockholder of record,” you can vote your proxy by mailing in the enclosed proxy card or by voting by phone or Internet by following the instructions on your proxy card as set forth below. Please refer to the specific instructions set forth in the proxy card made available with this Proxy Statement. If you hold your shares in “street name,” your broker/bank/trustee/nominee will provide you with materials and instructions for voting your shares.

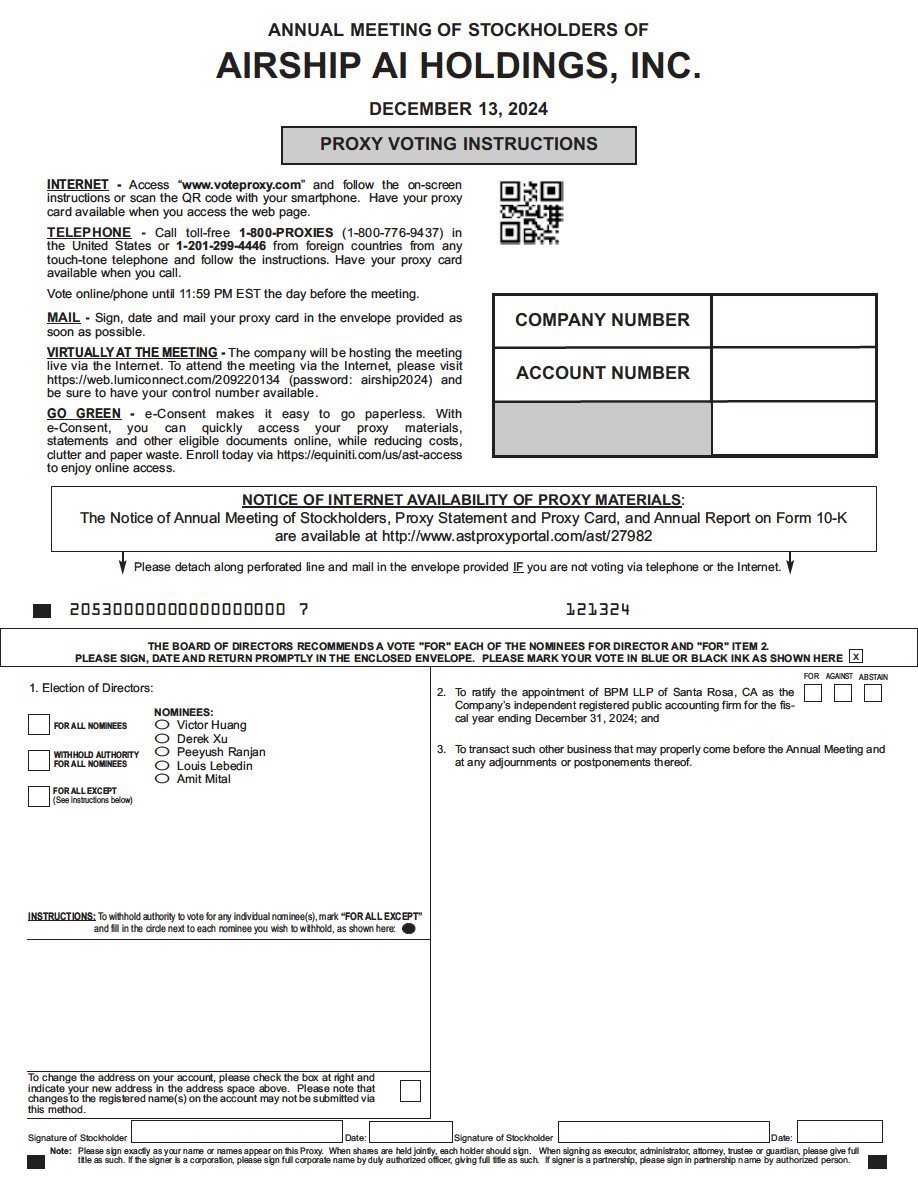

Electronically at the Meeting

This year’s Annual Meeting will be held entirely online to allow greater participation. Stockholders may participate in the Annual Meeting by visiting the following website at the time of the Annual Meeting: https://web.lumiconnect.com/209220134. To participate in the Annual Meeting, you will need the 16-digit control number included in the Notice, on your proxy card or on the instructions that accompanied your proxy materials. Shares held in your name as the stockholder of record may be voted electronically during the Annual Meeting. Shares for which you are the beneficial owner but not the stockholder of record also may be voted electronically during the Annual Meeting. However, even if you plan to attend the Annual Meeting online, the Company recommends that you vote your shares as promptly as possible and in advance over the Internet at www.voteproxy.com or telephone by call toll-free 1-800-PROXIES (1-800-776-9437) in the United States or 1-201-299-4446 from foreign countries and following the instructions. Have your proxy card available when you call.

By Proxy

If you do not wish to vote at the Annual Meeting or will not be participating in the online meeting, you may vote by proxy. You can vote by proxy over the Internet (www.voteproxy.com) or telephone as detailed above and by following the instructions provided in the Notice, or, if you requested printed copies of the proxy materials by mail, you can vote by mailing your proxy as described in the proxy materials. Internet and telephone voting facilities for stockholders of record will close at 11:59 p.m., Eastern time, on December 12, 2024. If you complete and submit your proxy before the meeting, the persons named as proxies will vote the shares represented by your proxy in accordance with your instructions. If you submit a proxy without giving voting instructions, your shares will be voted in the manner recommended by the Board on all matters presented in this Proxy Statement, and as the persons named as proxies may determine in their discretion with respect to any other matters properly presented at the Annual Meeting.

If any other matters are properly presented for consideration at the Annual Meeting, including, among other things, consideration of a motion to adjourn the Annual Meeting to another time or place (including, without limitation, for the purpose of soliciting additional proxies), the persons named in the enclosed proxy card and acting thereunder will have discretion to vote on those matters in accordance with their best judgment. We do not currently anticipate that any other matters will be raised at the Annual Meeting.

| 5 |

| Table of Contents |

Revocability of Proxy

You may revoke your proxy by (1) following the instructions in the Notice and entering a new vote by mail, over the Internet or via telephone before the Annual Meeting or (2) electronically attending the Annual Meeting and voting (although attendance at the Annual Meeting will not in and of itself revoke a proxy). Any written notice of revocation or subsequent proxy card must be received by our Secretary prior to the taking of the vote at the Annual Meeting. Such written notice of revocation or subsequent proxy card should be sent to our Corporate Secretary at Airship AI Holdings, Inc., 8210 154th Ave NE, Redmond, WA 98052, Attention: Corporate Secretary.

If a broker, bank, or other nominee holds your shares, you must contact them for instructions regarding how to change your vote, or you may vote at the Annual Meeting by following the procedures described above.

What are the Board’s recommendations on how I should vote my shares?

The Board recommends that you vote your shares as follows:

| Proposal 1 — | FOR the election of all five nominees to serve on the Board until the 2025 Annual Meeting of Stockholders. |

|

|

|

| Proposal 2 — | FOR ratifying the appointment of BPM LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024. |

Quorum

The presence at the meeting, in person or by proxy, of the holders of a majority of the voting power of the shares of capital stock issued and outstanding and entitled to vote on the record date will constitute a quorum permitting the meeting to conduct its business.

Votes of stockholders of record who are present at the Annual Meeting or by proxy, abstentions, and broker non-votes are counted for purposes of determining whether a quorum exists.

What is a Broker Non-Vote?

If your shares are held in a fiduciary capacity (typically referred to as being held in “street name”), you must instruct the organization that holds your shares how to vote your shares. If you sign your proxy card but do not provide instructions on how your broker should vote on “routine” proposals, your broker will vote your shares as recommended by the Board. If you do not provide voting instructions, your Shares will not be voted on any “non-routine” proposals. This vote is called a “broker non-vote.”

Proposal No. 1 is considered to be “non-routine” such that your broker, bank or other agent may not vote your shares on those proposals in the absence of your voting instructions. Conversely, Proposal No. 2 is considered to be “routine” and thus if you do not return voting instructions to your broker, your shares may be voted by your broker in its discretion on Proposal No. 2.

| 6 |

| Table of Contents |

How many votes are required to approve each proposal?

The table below summarizes the proposals that will be voted on, the vote required to approve each item and how votes are counted:

| Proposal |

| Votes Required |

| Voting Options |

| Impact of “Withhold” or “Abstain” Votes |

| Broker Discretionary Voting Allowed / Impact of Broker Non-Votes |

| Proposal No. 1: To elect five directors to hold office until the next annual meeting of stockholders or until their respective successors are duly elected and qualified, subject to prior death, resignation or removal. |

| A plurality of the voting power present or represented by proxy is required to elect the nominees as directors. |

| “FOR ALL” “WITHHOLD ALL” “FOR ALL EXCEPT” |

| None(1) |

| No(2) / None |

|

|

|

|

|

|

|

|

|

|

| Proposal No. 2: To ratify the appointment of our independent registered public accounting firm. |

| The affirmative vote of the holders of a majority of the voting power of the shares of capital stock present or represented by proxy and entitled to vote on the proposal. |

| “FOR” “AGAINST” “ABSTAIN” |

| Against(4) |

| Yes(3) / N/A (as a routine matter there are no broker non-votes) |

| (1) | Votes that are “withheld” will have the same effect as an abstention and will not count as a vote “FOR” or “AGAINST” a director. |

| (2) | As this proposal is considered a non-routine matter, brokers lack authority to exercise their discretion to vote uninstructed shares on this proposal. Broker non-votes will not be counted as votes cast and, accordingly, will not have an effect on this proposal. |

| (3) | As this proposal is considered a routine matter, brokers are permitted to exercise their discretion to vote uninstructed shares on this proposal, as such we do not expect to receive any “broker-non-votes”; however, if any “broker non-votes” are received they would have the same effect as votes against the proposal. |

| (4) | An “ABSTAIN” vote will have the effect of a vote “AGAINST” this proposal. |

What if I do not specify how my shares are to be voted?

If you submit a proxy but do not indicate any voting instructions, the persons named as proxies will vote in accordance with the recommendations of the Board. The Board’s recommendations are set forth above, as well as with the description of each proposal in this Proxy Statement.

If you are a beneficial owner of shares held in street name and do not provide the organization that holds your shares with specific voting instructions, then your vote would be a broker non-vote and governed under the provisions described above under “What is a Broker Non-Vote?”.

Can I change my vote after I have mailed in my proxy card?

You may revoke your proxy by doing one of the following:

|

| · | By sending a written notice of revocation to the Secretary of the Company that is received prior to the Annual Meeting, stating that you revoke your proxy; |

|

|

|

|

|

| · | By signing a later-dated proxy card and submitting it so that it is received prior to the Annual Meeting in accordance with the instructions included in the proxy card(s); or |

|

|

|

|

|

| · | By attending the Annual Meeting and voting your shares in person. |

Who will count the votes?

Representatives from the Company will count the votes and serve as our Inspector of Election. The Inspector of Election will be present at the Annual Meeting.

Who pays the cost of this proxy solicitation?

Proxies will be solicited by mail, and we will pay all expenses of preparing and soliciting such proxies. We have also arranged for reimbursement, at the rates suggested by brokerage houses, nominees, custodians and fiduciaries, for the forwarding of proxy materials to the beneficial owners of shares held of record.

Is this Proxy Statement the only way that proxies are being solicited?

No. We have also arranged for brokerage houses, nominees, custodians and fiduciaries to forward proxy materials to the beneficial owners of shares held of record. Our directors, officers and employees may also solicit proxies but such persons will not be specifically compensated for such services.

If you have any further questions about voting your shares or attending the Annual Meeting, please call the Company’s Investor Relations department at (877) 462-4250.

| 7 |

| Table of Contents |

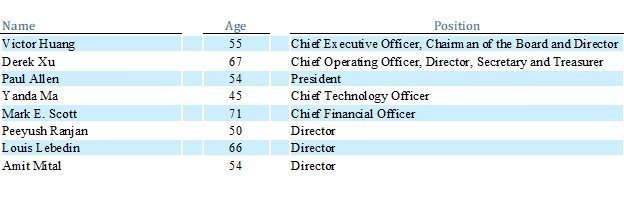

DIRECTORS AND EXECUTIVE OFFICERS

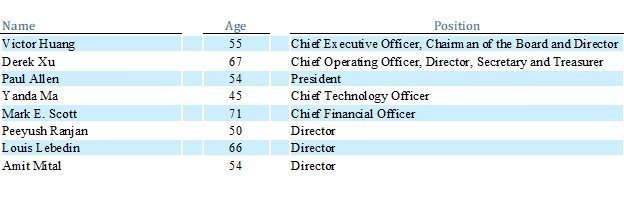

The following sets forth, as of November 4, 2024, the name, age, position and certain information of each executive officer and director and the tenure in office of each director of the Company.

Directors and Executive Officers

The following table sets forth certain information about our current directors and executive officers:

Set forth below is information regarding our directors and executive officers.

Victor Huang joined Airship as its first employee in October 2004. Mr. Huang has served as our Chief Executive Officer and Chairman of the Board since December 2023. He has served as Airship’s Chief Executive Officer since April 2007 and a member of its Board of Directors since March 2005 and as its Chairman of the Board beginning in January 2012. From June 1996 to September 2004, Mr. Huang was an independent trader and investor. From January 1992 to June 1996, Mr. Huang worked at Smith Barney as a financial consultant. Mr. Huang attended University of Washington where he studied business administration. Mr. Huang is our founder and was appointed a director due to the perspective and experience he brings as an investor, Chairman, Chief Executive Officer and one of our largest stockholders.

Derek Xu is a co-founder of Airship. Mr. Xu has served as our Chief Operating Officer, Secretary and Treasurer and a member of the Board since December 2023. He has served as Airship’s Chief Operating Officer, Secretary and Treasurer since March 2022 and as a member of its Board of Directors since the incorporation of Airship in 2003. Mr. Xu also previously served as Airship’s Chief Technology Officer from April 2007. Prior to 2003, Mr. Xu co-founded and sold his Web service company that provided eCommerce solutions for small businesses. Before that, Mr. Xu worked in leadership positions at various tech companies where he helped develop and launch several Web based products for financial institutions. Mr. Xu holds a Ph.D. degree in Geophysics from University of Washington. Mr. Xu is our founder and was appointed a director due to the perspective and experience he brings as an investor, director, Chief Operating Officer and one of our largest stockholders.

Paul Allen has served as our President since December 2023. He has served as Airship’s President since 2019. Mr. Allen joined Airship as the Director of Business Development in 2015 and was promoted to Vice President of Sales in 2017 before being promoted to President in 2019. Prior to joining Airship, Mr. Allen was partner at a boutique firm in Northern Virginia, providing technical goods and services to the U.S. Government and Department of Defense, which he left following a successful private acquisition. Mr. Allen previously spent 14 years with IBM, leaving as a Business Unit Executive in their partner channel organization to pursue a career in direct support of the U.S. Government and Department of Defense. Mr. Allen retired from the U.S. Army 1st Special Forces Command in 2021 with over 28 years of service, the majority of which he spent in the U.S. Army Special Forces as a Green Beret, retiring as the 3rd Battalion 20th Special Forces Group (National Guard) Senior Warrant Officer at the rank of Chief Warrant Officer 3 (CW3). Mr. Allen holds a bachelor’s degree in Strategic Studies & Defense Analysis from Norwich University.

| 8 |

| Table of Contents |

Yanda Ma has served as our Chief Technology Officer since December 2023. He has served as Airship’s Chief Technology Officer since March 2022. Previously, Mr. Ma was Airship’s Vice President Engineering, a position he held from 2005. His primary role is aligning the direction of engineering and product development to the strategic goals of Airship AI. To that end, over the years Mr. Ma has developed multiple evolutions of Airship AI’s product offerings from introducing Airship Enterprise Management, re-focusing with a government specific surveillance solution, delivering innovative edge solutions such as Nexus Outpost and creating value-add through end-to-end solution sets. Mr. Ma holds a bachelor’s degree in EECS from U.C. Berkeley. He has over twenty years of technology leadership experience in the streaming video and security industries and has been awarded multiple patents for key technologies he has helped develop over the course of his career.

Mark E. Scott has served as our Chief Financial Officer since March 2024. Prior to that, he served as Interim Chief Financial Officer of Airship from November 2021 and as a consultant from February 2021 to November 2021. From 2017 to 2024, Mr. Scott served as a consultant and Chief Financial Officer for Valterra Partners LLC, a private equity firm. From January 2021 to November 2021, Mr. Scott served as a consultant and Chief Financial Officer of Valuto, Inc., a bitcoin kiosk company. From August 2014 to December 2020, Mr. Scott served as a consultant and Chief Financial Officer of GrowLife, Inc., an equipment supplier to the cultivation industry. Mr. Scott also served as a member of the Board of Directors and Secretary of GrowLife, Inc. from February 2017 to December 2020. Mr. Scott has operated a wholly owned consulting firm where he advises companies on financial matters. Mr. Scott has significant financial, SEC and merger and acquisition experience in public and private microcap companies. Mr. Scott is a certified public accountant and received a Bachelor of Arts in Accounting from the University of Washington.

Peeyush Ranjan has served as a member of the Board since December 2023. From 2017 to present and from 2006-2015, Mr. Ranjan has served as VP, Director or Manager of Engineering at Google, a technology services firm. From 2015 to 2016, he was CTO of Flipkart, an e-commerce services company based in India, and a VP of Engineering at Airbnb. Previously, he was part of engineering teams at Consera Technologies, Hewlett Packard, Infospace, Inc. and Microsoft. He holds a B.Tech. degree in Computer Science from IIT Kharagpur, an M.S. in Computer Science from Purdue University and an M.B.A. in Technology Management from University of Washington. Mr. Ranjan was appointed a director based on his extensive technology experience.

Louis Lebedin has served as a member of the Board since March 2021. Mr. Lebedin has over 25 years of banking experience with a proven track record of building and leading a world class business. From 2017 to 2019, Mr. Lebedin served as an advisor to Unio Capital LLC, an asset management firm, responsible for product development. From 2006 to 2012, Mr. Lebedin was global head of JP Morgan’s prime brokerage business, a leading provider of clearing and financing services for equity and fixed income hedge funds. He was responsible for defining and executing the strategy for the business, to expand its market share while continuing to meet the evolving needs of its hedge fund clients. From 2008 to 2012, Mr. Lebedin served on JP Morgan Clearing Corp.’s Operations Committee and the Equities Division’s Executive Committee. From 2001 to 2005, Mr. Lebedin was the chief operating officer and chief financial officer of Bear Stearns’s Global Clearing Services division. Mr. Lebedin joined the Clearance Division in 1988 assuming the role of controller before being promoted to chief financial officer in 1996. From 1980 to 1987, he worked at Coopers & Lybrand, rising to the level of audit manager specializing in financial services. Mr. Lebedin holds a B.S. in accounting from Syracuse University, and he earned his CPA license in 1982. Mr. Lebedin was appointed a director based on his extensive banking and business experience.

Amit Mital has served as a member of the Board since December 2023. Mr. Mital has over two decades of experience in the tech field and currently serves as CEO and founder of Kernel Labs, which focuses on machine learning, virtual reality and cybersecurity, a position he also held from 2018 to 2021. From 2021 to 2022, Mr. Mital was on the National Security Council (NSC) as the senior director for cybersecurity strategy and policy and also served in the White House as a special assistant to the President. Before Kernel Labs, Mr. Mital was chief technology officer at Symantec Corporation, where he oversaw technology strategy for the cybersecurity company from 2013-2015. While at Kernel Labs, Mr. Mital was also co-founder and chairman of the blockchain-based distributed identification platform Trusted Key, which was later acquired by Workday. Mr. Mital’s longest-tenured job came at Microsoft, where he worked as a corporate vice president for 20 years, and as a general manager concurrently for seven years. Mr. Mital holds a Master of Science degree in Engineering from Dartmouth College. Mr. Mital was appointed a director based on his executive leadership experience in the technology industry and his senior leadership experience in United States Government, as well as being a cybersecurity industry veteran.

Term of Office

Our directors currently have terms which will end at our next annual meeting of stockholders or until their respective successors are duly elected and qualified, subject to their prior death, resignation or removal. Officers serve at the discretion of the Board.

Family Relationship

There are no family relationships among any of our officers or directors.

Involvement in Certain Legal Proceedings

We are not aware of any of our directors or officers being involved in any legal proceedings in the past ten years relating to any matters in bankruptcy, insolvency, criminal proceedings (other than traffic and other minor offenses) or being subject to any of the items set forth under Item 401(f) of Regulation S-K.

| 9 |

| Table of Contents |

Our Board’s Role in Risk Oversight

Our Board oversees that the assets of our company are properly safeguarded, that the appropriate financial and other controls are maintained, and that our business is conducted wisely and in compliance with applicable laws and regulations and proper governance. Included in these responsibilities is the Board’s oversight of the various risks facing our company. In this regard, our Board seeks to understand and oversee critical business risks. Our Board does not view risk in isolation. Risks are considered in virtually every business decision and as part of our business strategy. Our Board recognizes that it is neither possible nor prudent to eliminate all risk. Indeed, purposeful and appropriate risk-taking is essential for our company to be competitive on a global basis and to achieve our objectives.

While the Board oversees risk management, company management is charged with managing risk. Management communicates routinely with the Board and individual directors on the significant risks identified and how they are being managed. Directors are free to, and indeed often do, communicate directly with senior management.

Our Board administers its risk oversight function as a whole by making risk oversight a matter of collective consideration; however, much of the work is delegated to committees, which will meet regularly and report back to the full Board. The audit committee oversees risks related to our financial statements, the financial reporting process, accounting and legal matters, the compensation committee evaluates the risks and rewards associated with our compensation philosophy and programs, and the nominating and corporate governance committee evaluates risks associated with management decisions and strategic direction.

Attendance at Annual Meetings of Stockholders

We expect that all of our Board members will attend our annual meetings of stockholders in the absence of a showing of good cause for failure to do so.

Board Meetings and Committees

During our last fiscal year, each of our directors attended at least 75% of the aggregate of (i) the total number of Board meetings and (ii) the total number of meetings of the committees on which the director served.

Independent Directors

Nasdaq rules generally require that a majority of an issuer’s board of directors must consist of independent directors. Our Board currently consists of five (5) directors, three (3) of whom, namely Amit Mital, Peeyush Ranjan and Louis Lebedin, are independent within the meaning of the Nasdaq listing standards and applicable SEC rules.

Controlled Company Exemption

Victor Huang, our c-founder and Chief Executive Officer, and Derek Xu, our co-founder and Chief Operating Officer, beneficially own (including shares underlying warrants, stock options and SARs) approximately 54.9% of the combined voting power for the election of directors to the Board, and, as a result, the Company is considered a “controlled company” for the purposes of Nasdaq listing rules. For so long as the Company remains as a controlled company under that definition, it is permitted to elect to rely on certain exemptions from certain corporate governance requirements, including that a majority of the Company consist of “independent directors,” as defined under Nasdaq listing rules. In addition, the Company is not required to have a nominating and corporate governance committee or compensation committee that is composed entirely of independent directors with written charters addressing the committees’ purposes and responsibilities and an annual performance evaluation of these committees.

If at any time the Company ceases to be a “controlled company” under Nasdaq listing rules, the Board intends to take any action that may be necessary to comply with Nasdaq listing rules, subject to a permitted “phase-in” period.

| 10 |

| Table of Contents |

Committees of the Board of Directors

Our Board has established an audit committee, a compensation committee and a nominating and corporate governance committee, each comprised only of members who meet the independence requirements of the Exchange Act and Nasdaq rules and each with its own charter approved by the Board. Each committee’s charter is available on our website at www.airship.ai. In addition, our Board may, from time to time, designate one or more additional committees, which shall have the duties and powers granted to it by our Board.

Audit Committee

Amit Mital, Peeyush Ranjan and Louis Lebedin serve on our audit committee, with Mr. Mital serving as the chairperson. Our Board has determined that Mr. Lebedin qualifies as an “audit committee financial expert” as defined by applicable SEC rules.

The audit committee oversees our accounting and financial reporting processes and the audits of our financial statements. The audit committee is generally responsible for, among other things:

|

| · | appointing the independent auditors and pre-approving all auditing and non-auditing services permitted to be performed by the independent auditors; |

|

|

|

|

|

| · | reviewing with the independent auditors any audit problems or difficulties and management’s response; |

|

|

|

|

|

| · | discussing the annual audited financial statements with management and the independent auditors; |

|

|

|

|

|

| · | reviewing the adequacy and effectiveness of our accounting and internal control policies and procedures and any steps taken to monitor and control major financial risk exposures; |

|

|

|

|

|

| · | reviewing and approving all proposed related party transactions as defined by applicable law or Nasdaq listing requirements; |

|

|

|

|

|

| · | meeting separately and periodically with management and the independent auditors; and |

|

|

|

|

|

| · | monitoring compliance with our code of business conduct and ethics, including reviewing the adequacy and effectiveness of our procedures to ensure proper compliance. |

Compensation Committee

Peeyush Ranjan and Amit Mital serve on our compensation committee, with Mr. Ranjan serving as the chairperson. The members of the compensation committee are also “non-employee directors” within the meaning of Section 16 of the Exchange Act.

The compensation committee is generally responsible for overseeing and making recommendations to the Board regarding the salaries and other compensation of our executive officers and general employees and providing assistance and recommendations with respect to our compensation policies and practices. The compensation committee is generally responsible for, among other things:

|

| · | reviewing and approving the corporate goals and objectives applicable to the compensation of the chief executive officer, evaluating the chief executive officer’s performance, and determining and approving the chief executive officer’s compensation level based on this evaluation; |

|

|

|

|

|

| · | reviewing and approving the compensation of all other executive officers; |

|

|

|

|

|

| · | reviewing, approving and recommending incentive compensation plans and equity-based plans to the Board and stockholders of the Company for approval, and administering the Company’s incentive compensation plans, equity-based plans and the clawback policy; |

|

|

|

|

|

| · | reviewing, approving and recommending employment agreements and severance arrangements or plans to the Board for approval; |

|

|

|

|

|

| · | reviewing all director compensation and benefits for service on the Board and Board committees, and recommending any changes to the Board as necessary; and |

|

|

|

|

|

| · | overseeing, in conjunction with the nominating and corporate governance committee, engagement with stockholders and proxy advisory firms on executive compensation matters. |

| 11 |

| Table of Contents |

Nominating and Corporate Governance Committee

Peeyush Ranjan and Amit Mital serve on our nominating and corporate governance committee, with Mr. Ranjan serving as the chairperson.

The nominating and corporate governance committee is generally responsible for identifying and proposing new potential director nominees to the Board for consideration and for reviewing our corporate governance policies. The nominating and corporate governance committee is generally responsible for, among other things:

|

| · | determining the qualifications, qualities, skills, and other expertise required to be a director, and developing and recommending to the Board the criteria to be considered in selecting director nominees for the Board’s approval; |

|

|

|

|

|

| · | identifying and screening individuals qualified to become members of the Board, and considering any director candidates recommended by the Company’s stockholders; |

|

|

|

|

|

| · | selecting and approving the director nominees to be submitted to a stockholder vote at the stockholders’ annual meeting, subject to approval by the Board; |

|

|

|

|

|

| · | developing and recommending to the Board a set of corporate governance guidelines applicable to the Company, reviewing these principles and recommending any changes to the Board; |

|

|

|

|

|

| · | overseeing the Company’s corporate governance practices and procedures, including identifying best practices, and reviewing and recommending to the Board for approval any changes to the documents, policies and procedures in the Company’s corporate governance framework; |

|

|

|

|

|

| · | reviewing the Board’s committee structure and composition and to make recommendations to the Board annually regarding the appointment of directors to serve as members of each committee and committee chairpersons; |

|

|

|

|

|

| · | if a vacancy on the Board and/or any Board committee occurs, identifying and making recommendations to the Board regarding the selection and approval of candidates to fill such vacancy either by election by stockholders or appointment by the Board; |

|

|

|

|

|

| · | developing and overseeing a Company orientation program for new directors and a continuing education program for current directors, periodically reviewing these programs and updating them as necessary; |

|

|

|

|

|

| · | reviewing and discussing with management disclosure of the Company’s corporate governance practices; |

|

|

|

|

|

| · | developing and recommending to the Board for approval an officer succession plan, to review such succession plan periodically with the chief executive officer, developing and evaluating potential candidates for executive positions, and recommending to the Board any changes to and any candidates for succession under the succession plan. |

A stockholder may nominate one or more persons for election as a director at an annual meeting of stockholders if the stockholder complies with the notice and information provisions contained in our Bylaws. Such notice must be received in writing to our Company not later than the close of business ninety (90) days nor earlier than the close of business one hundred twenty (120) days prior to the first anniversary of the preceding year’s annual meeting; provided, however, that if the date of the annual meeting is more than thirty (30) days before or more than seventy (70) days after such anniversary date, such writing shall be received by the Secretary of the Corporation not later than the 90th day prior to such annual meeting or, if later, the 10th day following the day on which public disclosure of the date of such annual meeting was first made by the Company. In addition, a stockholder furnishing such notice must be a holder of record on both the date of delivering such notice and at the time of the meeting and is entitled to vote at such meeting.

| 12 |

| Table of Contents |

Code of Ethics

We have adopted a code of ethics that applies to all of our directors, officers and employees, including our principal executive officer, principal financial officer and principal accounting officer. Such code of ethics addresses, among other things, honesty and ethical conduct, conflicts of interest, compliance with laws, regulations and policies, including disclosure requirements under the federal securities laws, and reporting of violations of the code.

A copy of the code of ethics is available on our website as www.airship.ai. We are required to disclose any amendment to, or waiver from, a provision of our code of ethics applicable to our principal executive officer, principal financial officer, principal accounting officer, controller, or persons performing similar functions. We intend to use our website as a method of disseminating this disclosure as well as by SEC filings, as permitted or required by applicable SEC rules.

Compensation Committee Interlocks and Insider Participation

None of the members of our compensation committee was at any time one of the Company’s officers or employees. None of the Company’s executive officers currently serves, or has served during the last completed fiscal year, on the compensation committee or board of directors of any other entity, one of whose executive officers served as a member of our board of directors or compensation committee.

Communication with Our Board of Directors

Our stockholders and other interested parties may communicate with our Board by sending written communication in an envelope addressed to “Board of Directors” in care of the Secretary, 8210 154th Ave NE, Redmond, WA 98052.

Section 16(a) Beneficial Ownership Reporting Compliance

Our executive officers, directors and 10% stockholders are required under Section 16(a) of the Exchange Act to file reports of ownership and changes in ownership with the SEC. Copies of these reports must also be furnished to us.

Based solely on a review of copies of reports furnished to us, as of December 31, 2023 our executive officers, directors and 10% holders complied with all filing requirements.

Insider Trading Policy; Anti-Hedging and Anti-Pledging

In 2023, we adopted an insider trading policy governing the purchase, sale, and/or other dispositions of the Company’s securities by directors, officers and employees that includes restrictions and limitations on the ability of the Company’s directors, officers and other employees to engage in transactions involving the hedging and pledging of Company stock. Under the policy, hedging or monetization transactions, such as collars, forward sale contracts, equity swaps, puts, calls, collars, forwards and other derivative instruments, which allow an employee to lock in much of the value of his or her stock holdings, often in exchange for all or part of the potential for upside appreciation in the stock, and thus to continue to own Company stock without the full risks and rewards of ownership, are prohibited. In addition, the policy addresses the practices of holding Company stock in a margin account, under which the securities may be sold by the broker without the customer’s consent if the customer fails to meet a margin call, and of pledging Company stock as collateral for a loan, in which event the securities may be sold in foreclosure if the borrower defaults on the loan. Securities held in a margin account or pledged as collateral may not exceed 25% of the total number of shares owned by the employee or director.

| 13 |

| Table of Contents |

On December 21, 2023, Airship AI, Inc., a Washington corporation (“Airship”), completed a business combination (the “Merger”) with BYTE Acquisition Corp. (“BYTS”). Effective December 21, 2023, Airship merged with and into a subsidiary of BYTS, with Airship as the surviving corporation. Airship became a wholly-owned subsidiary of the Company. In connection with the Merger, BYTS changes its name to “Airship AI Holdings, Inc.”

Unless the context requires otherwise, references to “Airship AI,” “we,” “us,” “our” and “the Company” in this section are to the business and operations of Airship prior to the Merger and the business and operations of the Company as directly or indirectly affected by Airship by virtue of the Company’s ownership of the business of Airship following the Merger.

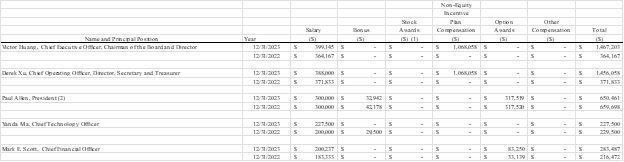

The following table sets forth information concerning all cash and non-cash compensation awarded to, earned by or paid to our Chief Executive Officer and our next two other most highly compensated executive officers who earned more than $100,000 and were serving as executive officers as of December 31, 2023 or 2022 (our “named executive officers”) for services rendered in all capacities during the fiscal years ended December 31, 2023 and 2022, respectively.

Summary Compensation Table – Years Ended December 31, 2023 and 2022

The following table sets forth information concerning the compensation of our named executive officers for the years ended December 31, 2023 and 2022:

| (1) | These amounts reflect the grant date market value as required by Regulation S-K Item 402(n)(2), computed in accordance with FASB ASC Topic 718. |

|

|

|

| (2) | Mr. Allen was paid a discretionary annual bonus of $42,178 during the year ended December 31, 2022. See “Outstanding Equity Awards as of the Year Ended December 31, 2022” for a discussion of option award compensation. |

| 14 |

| Table of Contents |

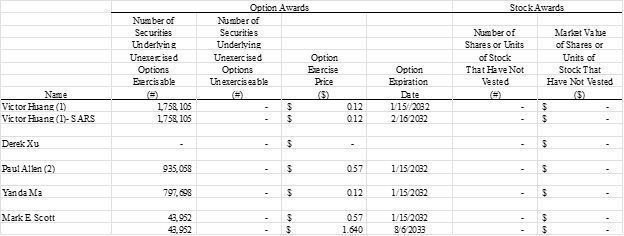

Outstanding Equity Awards as of the Years Ended December 31, 2023 and 2022

The following table summarizes the number of shares of common stock underlying outstanding equity incentive plan awards for each named executive officer as of December 31, 2023 and 2022. The number of shares subject to Airship AI options outstanding at the effective time of the Merger, and the exercise price of such Airship AI options, have been adjusted to reflect the Merger.

| (1) | On January 16, 2018, Mr. Huang received a stock option grant to purchase 1,758,105 shares of common stock, with an exercise price of $0.12 per share. As of December 31, 2023, 1,758,105 shares were vested. These shares were valued at $0.11 per share, or $190,000, as of the date of grant. On January 16, 2018, Mr. Huang received 1,758,105 stock appreciation rights for past service. The stock appreciation rights each has a base value of $0.12 per share. |

|

|

|

| (2) | On January 16, 2022, Mr. Allen received a stock option grant to purchase 935,058 shares of common stock, with an exercise price of $0.57 per share. Of these options, 467,528 vested immediately, 233,765 vested on December 31, 2022 and 233,765 vested on December 31, 2023. These options were valued at grant date Black-Scholes value of $1.35 per share, or $1,270,078. |

Executive Compensation Arrangements

Other than the annual compensation, bonus and equity incentive awards described above and below, the Company has no other executive compensation, change in control or similar agreements or arrangements.

On March 1, 2024, the Company entered into an employment agreement with Mark E. Scott, the Company’s Chief Financial Officer, which provides for a base salary of $250,000 annually. Mr. Scott is also eligible to participate in annual performance-based bonus programs established by the Board or Compensation Committee, subject to the achievement of applicable performance criteria established by the Board or Compensation Committee, which shall be determined in good faith by the Board or Compensation Committee. Mr. Scott was also granted options to purchase up to twenty-five thousand (25,000) shares of common stock with an exercise price equal to $1.49, which options vested in full on the date of issuance.

2022 Combined Incentive and Non-Qualified Stock Option Plan

Related to the Share Exchange Agreement with Supersimple AI, Inc., on February 17, 2022, our board of directors approved the 2022 Combined Incentive and Non-Qualified Stock Option Plan (the “2022 Plan”) to issue options to acquire a maximum of 3,000,000 common stock shares. Effective upon the closing of the Merger, the 2022 Plan will no longer be available for use for the grant of future awards. The 2022 Plan will continue to govern the terms of awards that have been granted under the 2022 Plan before, and that are still outstanding following, the Merger.

The 2022 Plan provides for the grant of stock options, including options that are intended to qualify as “incentive stock options” under Section 422 of the Code, as well as non-qualified stock options. Each award is set forth in a separate agreement with the person who received the award which indicates the type, terms and conditions of the award.

| 15 |

| Table of Contents |

Certain Transactions

If as a result of any reorganization, recapitalization, stock dividend, stock split, reverse stock split or other similar change in our capital stock, the outstanding shares of common stock are increased or decreased or are exchanged for a different number or kind of shares or other securities of the Company without the receipt of consideration by the Company, or, if, as a result of any merger or consolidation, or sale of all or substantially all of the assets of the Company, the outstanding shares are converted into or exchanged for other securities of the Company. Or any successor entity, the administrator shall make an appropriate and proportionate adjustment in (i) the maximum number of shares reserved for issuance under the 2022 Plan, (ii) the number and kind of shares or other securities subject to any then outstanding awards under the 2022 Plan, (iii) the repurchase price, if any, per share subject to each outstanding award, and (iv) the exercise price for each share subject to any then outstanding options under the 2022 Plan.

Amendment and Termination

Our board of directors may terminate or amend the 2022 Plan at any time, but no such action shall adversely affect rights under any outstanding award without the holder’s consent. However, we must generally obtain stockholder approval for any such amendments to the extent required by applicable law. The administrator may exercise its discretion to reduce the exercise price of outstanding stock options to the then current fair market value if the fair market value of the common stock covered by such option has declined since the date the option was granted, without the approval of the Company’s stockholders.

Upon consummation of the Merger, each outstanding option under the 2022 Plan that was outstanding as of immediately prior to the effective time of the Merger (the “Effective Time”) converted into (i) an option (each, a “Converted Stock Option”), on substantially the same terms and conditions as are in effect with respect to such award immediately prior to the Effective Time, to purchase the number of shares of common stock, determined by multiplying the number of shares of Airship AI common stock subject to such award as of immediately prior to the Effective Time by the Merger conversion ratio, at an exercise price per share of common stock equal to (A) the exercise price per share of common stock of such award divided by (B) the Merger conversion ratio, and (ii) the right to receive a number of earnout shares in accordance with, and subject to, the contingencies set forth in the Merger Agreement.

Stock Appreciation Rights Plan

Related to the Share Exchange Agreement with Supersimple AI, Inc., on February 17, 2022, our board of directors approved the 2022 Stock Appreciation Rights Plan (the “SAR Plan”) to issue a maximum of 1,500,000, which was later adjusted to 2,637,150 stock appreciation rights (“SAR”) after the Merger.

As of December 31, 2023, after adjusting for the Merger, there were 1,758,105 SARs outstanding with a base value of $0.12 and January 2028 expiration.

Payment of Appreciation Amount

The appreciation distribution in respect to a SAR may be paid in cash, in common stock of the Company, in any combination of the two or in any other form of consideration, as determined by the Board and contained in the stock appreciation rights agreement evidencing such SAR.

Amendment and Termination

Our board of directors may terminate or amend the SAR Plan at any time, but no such action shall adversely affect rights under any outstanding award without the holder’s consent.

Upon consummation of the Merger, each SAR granted under the SAR Plan that was outstanding immediately prior to the Effective Time converted into a stock appreciation right denominated in shares of common stock (each, a “Converted SAR”). Each Converted SAR will continue to have and be subject to substantially the same terms and conditions as were applicable to such SAR immediately prior to the Effective Time, except that (i) each Converted SAR will cover that number of shares of common stock equal to (A) the product of (1) the number of shares of Airship AI common stock subject to such SAR immediately prior to the Effective Time and (2) the Merger conversion ratio and (B) a number of earnout shares in accordance with, and subject to, the contingencies set forth in the Merger Agreement, and (ii) the per share base value for each share of common stock covered by the Converted SAR will be equal to the quotient obtained by dividing (A) the base value per share of common stock of such SAR immediately prior to the Effective Time by (B) the Merger conversion ratio.

| 16 |

| Table of Contents |

2023 Equity Incentive Plan

In connection with the consummation of the Merger, the Company has adopted the Airship AI Holdings, Inc. 2023 Equity Incentive Plan (the “Equity Incentive Plan”), which plan was approved by stockholders at the extraordinary general meeting. This section summarizes certain principal features of the Equity Incentive Plan.

The Equity Incentive Plan is a comprehensive incentive compensation plan under which the Company can grant equity-based and other incentive awards to its officers, employees, directors, consultants and advisers. The purpose of the Equity Incentive Plan is to help the Company attract, motivate and retain such persons with awards under the Equity Incentive Plan and thereby enhance shareholder value.

Administration. The Equity Incentive Plan is administered by the compensation committee of the Board, which consists of three members of the Board, each of whom is a “non-employee director” within the meaning of Rule 16b-3 promulgated under the Exchange Act and “independent” for purposes of any applicable listing requirements. If a member of the compensation committee is eligible to receive an award under the Equity Incentive Plan, such compensation committee member shall have no authority under the plan with respect to his or her own award. Among other things, the compensation committee has complete discretion, subject to the express limits of the Equity Incentive Plan, to determine the directors, employees and nonemployee consultants to be granted an award, the type of award to be granted the terms and conditions of the award, the form of payment to be made and/or the number of shares of common stock subject to each award, the exercise price of each option and base price of each stock appreciation right (“SAR”), the term of each award, the vesting schedule for an award, whether to accelerate vesting, the value of the common stock underlying the award, and the required withholding, if any. The compensation committee may amend, modify or terminate any outstanding award, provided that the participant’s consent to such action is required if the action would impair the participant’s rights or entitlements with respect to that award. The compensation committee is also authorized to construe the award agreements, and may prescribe rules relating to the Equity Incentive Plan. Notwithstanding the foregoing, the compensation committee does not have any authority to grant or modify an award under the Equity Incentive Plan with terms or conditions that would cause the grant, vesting or exercise thereof to be considered nonqualified “deferred compensation” subject to Code Section 409A, unless such award is structured to be exempt from or comply with all requirements of Code Section 409A.

Grant of Awards; Shares Available for Awards. The Equity Incentive Plan provides for the grant of stock options, SARs, performance share awards, performance unit awards, distribution equivalent right awards, restricted stock awards, restricted stock unit awards and unrestricted stock awards to non-employee directors, officers, employees and nonemployee consultants of the Company or its affiliates. The aggregate number of shares of common stock initially reserved and available for grant and issuance under the Equity Incentive Plan is 4,000,000. Such aggregate number of shares of stock will automatically increase on January 1 of each year for a period of ten years commencing on January 1, 2024 and ending on (and including) January 1, 2033, in an amount equal to 2.0% of the total number of shares of common stock outstanding on December 31 of the preceding year; provided, however, that the Board may act prior to January 1 of a given year to provide that the increase for such year will be a lesser number of shares of common stock. No more than 4,000,000 shares of common stock in the aggregate may be issued under the Equity Incentive Plan in connection with incentive stock options. Shares shall be deemed to have been issued under the Equity Incentive Plan solely to the extent actually issued and delivered pursuant to an award. If any award granted under the Equity Incentive Plan expires, is cancelled, or terminates unexercised or is forfeited, the number of shares subject thereto is again available for grant under the Equity Incentive Plan, other than any shares tendered or withheld in order to exercise or satisfy withholding obligation in respect of any award. The Equity Incentive Plan shall continue in effect, unless sooner terminated, until the tenth (10th) anniversary of the date on which it is adopted by the Board.

It is expected that all of our employees, consultants, advisors and service providers and all of our non-executive officer directors will be eligible to participate in the Equity Incentive Plan. Future new hires and additional non-employee directors and/or consultants would be eligible to participate in the Equity Incentive Plan as well. The number of stock options and/or shares of restricted stock to be granted to executives and directors cannot be determined at this time as the grant of stock options and/or shares of restricted stock is dependent upon various factors such as hiring requirements and job performance.

| 17 |

| Table of Contents |

Non-Employee Director Compensation Limit. The Equity Incentive Plan provides for a limit on non-employee director compensation. The maximum number of shares of stock that may be subject to an award granted under the Equity Incentive Plan during any single fiscal year to any non-employee director, when taken together with any cash fees paid to such non-employee director during such year in respect of his or her service as a non-employee director (including service as a member or chair of any committee of the board), shall not exceed $250,000 in total value (calculating the value of any such award based on the fair market value on the date of grant of such award for financial reporting purposes).

Stock Options. The Equity Incentive Plan provides for the grant of either “incentive stock options” (“ISOs”), which are intended to meet the requirements for special federal income tax treatment under Section 422 of the Code, or “nonqualified stock options” (“NQSOs”). Stock options may be granted on such terms and conditions as the compensation committee may determine, which shall be specified in the option agreement; provided, however, that the per share exercise price under a stock option may not be less than the fair market value of a share of common stock on the date of grant and the term of the stock option may not exceed 10 years (110% of such value and five years in the case of an ISO granted to an employee who owns (or is deemed to own) more than 10% of the total combined voting power of all classes of capital stock of our company or a parent or subsidiary of our company). ISOs may only be granted to employees. In addition, the aggregate fair market value of common stock covered by one or more ISOs (determined at the time of grant), which are exercisable for the first time by an employee during any calendar year may not exceed $100,000. Any excess is treated as an NQSO.

Stock Appreciation Rights. A SAR entitles the participant, upon exercise, to receive an amount, in cash or stock or a combination thereof, equal to the increase in the fair market value of the underlying common stock between the date of grant and the date of exercise. The compensation committee shall set forth in the applicable SAR award agreement the terms and conditions of the SAR, including the base value for the SAR (which shall not be less than the fair market value of a share on the date of grant), the number of shares subject to the SAR and the period during which the SAR may be exercised and any other special rules and/or requirements which the compensation committee imposes on the SAR. No SAR shall be exercisable after the expiration of ten (10) years from the date of grant. SARs may be granted in tandem with, or independently of, stock options granted under the Equity Incentive Plan. A SAR granted in tandem with a stock option (i) is exercisable only at such times, and to the extent, that the related stock option is exercisable in accordance with the procedure for exercise of the related stock option; (ii) terminates upon termination or exercise of the related stock option (likewise, the common stock option granted in tandem with a SAR terminates upon exercise of the SAR); (iii) is transferable only with the related stock option; and (iv) if the related stock option is an ISO, may be exercised only when the value of the stock subject to the stock option exceeds the exercise price of the stock option. A SAR that is not granted in tandem with a stock option is exercisable at such times as the compensation committee may specify.

Performance Shares and Performance Unit Awards. Performance share and performance unit awards entitle the participant to receive cash or shares of common stock upon the attainment of specified performance goals. In the case of performance units, the right to acquire the units is denominated in cash values. The compensation committee shall set forth in the applicable award agreement the performance goals and objectives and the period of time to which such goals and objectives shall apply. If such goals and objectives are achieved, such distribution of shares, or payment in cash, as the case may be, shall be made no later than by the fifteenth (15th) day of the third (3rd) calendar month next following the end of the company’s fiscal year to which such performance goals and objectives relate, unless otherwise structured to comply with Code Section 409A.

Distribution Equivalent Right Awards. A distribution equivalent right award entitles the participant to receive bookkeeping credits, cash payments and/or common stock distributions equal in amount to the distributions that would have been made to the participant had the participant held a specified number of shares of common stock during the period the participant held the distribution equivalent right. A distribution equivalent right may be awarded as a component of another award (but not an option or SAR award) under the Equity Incentive Plan, where, if so awarded, such distribution equivalent right will expire or be forfeited by the participant under the same conditions as under such other award. The compensation committee shall set forth in the applicable distribution equivalent rights award agreement the terms and conditions, if any, including whether the holder is to receive credits currently in cash, is to have such credits reinvested (at fair market value determined as of the date of reinvestment) in additional shares of common stock, or is to be entitled to choose among such alternatives.

| 18 |

| Table of Contents |

Restricted Stock Awards. A restricted stock award is a grant or sale of common stock to the holder, subject to such restrictions on transferability, risk of forfeiture and other restrictions, if any, as the compensation committee or the board of directors may impose, which restrictions may lapse separately or in combination at such times, under such circumstances (including based on achievement of performance goals and/or future service requirements), in such instalments or otherwise, as the compensation committee or the board of directors may determine at the date of grant or purchase or thereafter. If provided for under the restricted stock award agreement, a participant who is granted or has purchased restricted stock shall have all of the rights of a shareholder, including the right to vote the restricted stock and the right to receive dividends thereon (subject to any mandatory reinvestment or other requirement imposed by the compensation committee or the board of directors or in the award agreement). During the restricted period applicable to the restricted stock, subject to certain exceptions, the restricted stock may not be sold, transferred, pledged, exchanged, hypothecated, or otherwise disposed of by the participant.

Restricted Stock Unit Awards. A restricted stock unit award provides for a grant of shares or a cash payment to be made to the holder upon the satisfaction of predetermined individual service-related vesting requirements, based on the number of units awarded to the holder. The compensation committee shall set forth in the applicable restricted stock unit award agreement the individual service-based vesting requirements which the holder would be required to satisfy before the holder would become entitled to payment and the number of units awarded to the holder. The holder of a restricted stock unit shall be entitled to receive a cash payment equal to the fair market value of a share of common stock, or one share of common stock, as determined in the sole discretion of the compensation committee and as set forth in the restricted stock unit award agreement, for each restricted stock unit subject to such restricted stock unit award, if and to the extent the holder satisfies the applicable vesting requirements. Such payment or distribution shall be made no later than by the fifteenth (15th) day of the third (3rd) calendar month next following the end of the calendar year in which the restricted stock unit first becomes vested, unless otherwise structured to comply with Code Section 409A. A restricted stock unit shall not constitute an equity interest in the company and shall not entitle the holder to voting rights, dividends or any other rights associated with ownership of shares prior to the time the holder shall receive a distribution of shares.

Unrestricted Stock Awards. An unrestricted stock award is a grant or sale of shares of common stock to the employees, non-employee directors or non-employee consultants that are not subject to transfer, forfeiture or other restrictions, in consideration for past services rendered to the company or an affiliate or for other valid consideration.

Adjustment to Shares. Subject to any required action by shareholders of the company, the number of shares of common stock covered by each outstanding award shall be proportionately adjusted for any increase or decrease in the number of issued shares resulting from a subdivision or consolidation of shares, including, but not limited to, a stock split, reverse stock split, recapitalization, continuation or reclassification, or the payment of a stock dividend (but only on the stock) or any other increase or decrease in the number of such shares effected without receipt of consideration by the company.

Change-in-Control Provisions. The compensation committee may, in its sole discretion, at the time an award is granted or at any time prior to, coincident with or after the time of a change in control, cause any award either (i) to be cancelled in consideration of a payment in cash or other consideration in amount per share equal to the excess, if any, of the price or implied price per share of common stock in the change in control over the per share exercise, base or purchase price of such award, which may be paid immediately or over the vesting schedule of the award; (ii) to be assumed, or new rights substituted therefore, by the surviving corporation or a parent or subsidiary of such surviving corporation following such change in control; (iii) accelerate any time periods, or waive any other conditions, relating to the vesting, exercise, payment or distribution of an award so that any award to a holder whose employment has been terminated as a result of a change in control may be vested, exercised, paid or distributed in full on or before a date fixed by the compensation committee; (iv) to be purchased from a holder whose employment has been terminated as a result of a change of control, upon the holder’s request, for an amount of cash equal to the amount that could have been obtained upon the exercise, payment or distribution of such rights had such award been currently exercisable or payable; or (v) terminate any then outstanding award or make any other adjustment to the awards then outstanding as the compensation committee deems necessary or appropriate to reflect such transaction or change. The number of shares subject to any award shall be rounded to the nearest whole number.

Transferability. No award may be assigned, transferred, sold, exchanged, encumbered, pledged or otherwise hypothecated or disposed of by a holder except by will or by the laws of descent and distribution, or by gift to any immediate family member of the holder, subject to compliance with applicable laws.

| 19 |

| Table of Contents |

Amendment and Termination. The compensation committee may adopt, amend and rescind rules relating to the administration of the Equity Incentive Plan, and amend, suspend or terminate the Equity Incentive Plan, but no such amendment or termination will be made that materially and adversely impairs the rights of any participant with respect to any award received thereby under the Equity Incentive Plan without the participant’s consent, other than amendments that are necessary to permit the granting of awards in compliance with applicable laws. In addition, no amendment that results (directly or indirectly) in the reduction of the exercise price of an option or SAR or that otherwise requires shareholder approval under applicable law will be made without shareholder approval.

Additional Narrative Disclosure

Retirement Benefits

We have not maintained, and do not currently maintain, a defined benefit pension plan, nonqualified deferred compensation plan or other retirement benefits.

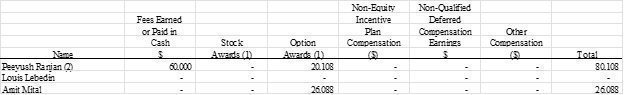

We maintain a 401(k) plan and/or other health and welfare benefit plans in which our named executive officers are eligible to participate.